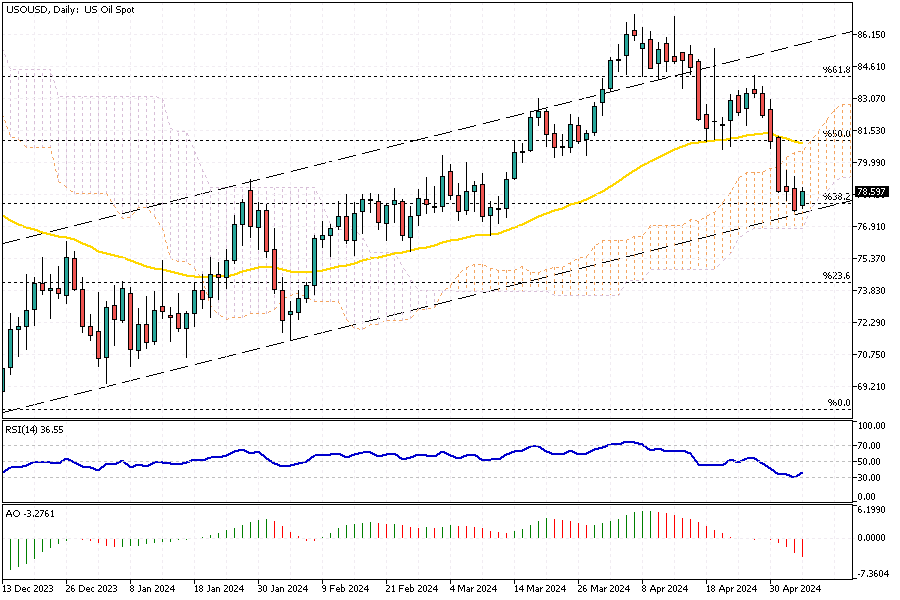

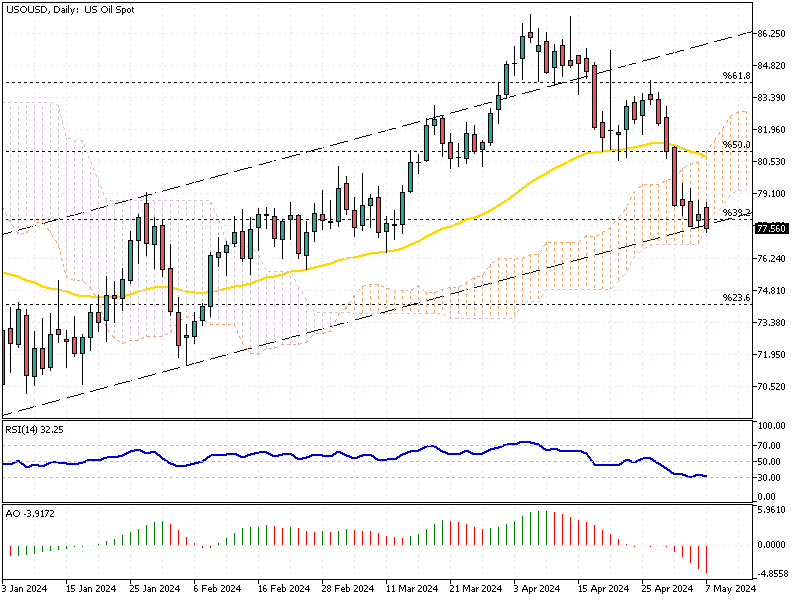

Oil Prices Stabilize Amid Geopolitical Tensions

Solid ECN – WTI crude futures remained steady, trading at approximately $77 per barrel as of Tuesday. This stability comes despite the market being close to its nearly two-month low of $78.1, recorded on May 3rd. The current price balances ongoing geopolitical concerns and the global perception of an ample oil supply.

Impact of Middle East Tensions on Oil Prices

Despite escalating tensions in the Middle East, where the Israeli military cabinet has unanimously rejected a ceasefire agreement with Hamas, the situation has not severely disrupted oil shipments.

Notably, the absence of significant military escalations involving Iran has ensured that oil tanker movements through the critical Strait of Hormuz continue unimpeded. This situation has helped alleviate fears of potential new U.S. sanctions or disruptions in oil supply.

OPEC's Strategy and Global Oil Supply

In response to the current market conditions, Saudi Arabia has increased the official selling price of its Arab Light crude by 90 cents per barrel for June, exceeding market expectations by 30 cents.

This adjustment suggests that OPEC’s largest producer is likely to advocate for extending production cuts into the next quarter, aiming to stabilize prices and address the relatively loose supply on the global stage.

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- Market Update by Solidecn.com

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,179

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,179

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

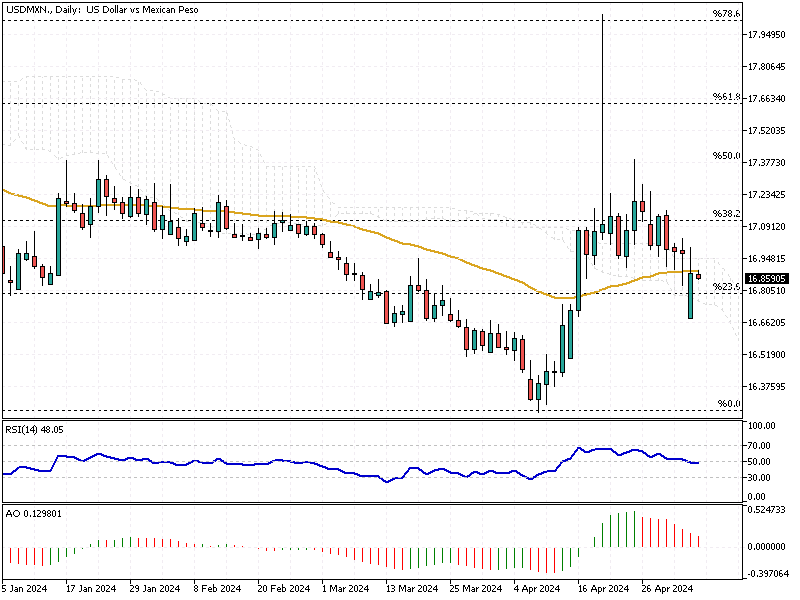

USDMXN - Banxico Rate Decision Looms

Solid ECN—The Mexican peso has shown remarkable resilience. It is trading at approximately 16.8 per USD, a significant recovery from its five-month low of 17.2 recorded on April 25th. This improvement is largely due to a weakened U.S. dollar, spurred by increasing indications that the Federal Reserve might implement two rate cuts later this year.

Contributing factors include moderated job growth and a rise in the U.S. unemployment rate in April, alongside Federal Reserve Chair Powell’s recent dismissal of potential rate hikes.

Economic Indicators and Policy Outlook

Amidst these currency shifts, Mexico’s central bank, Banxico, is expected to maintain its interest rate at 11% on May 9th, holding steady after a reduction in March. However, emerging economic data could spark discussions among Banxico’s Governing Council members about possible policy changes.

The Mexican economy showed signs of acceleration, expanding by 0.2% in the first quarter of 2024, outpacing the previous quarter’s growth and surpassing market expectations. Additionally, business confidence in Mexico is robust, remaining near an 11-year high, although inflation exceeds 4%.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,179

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

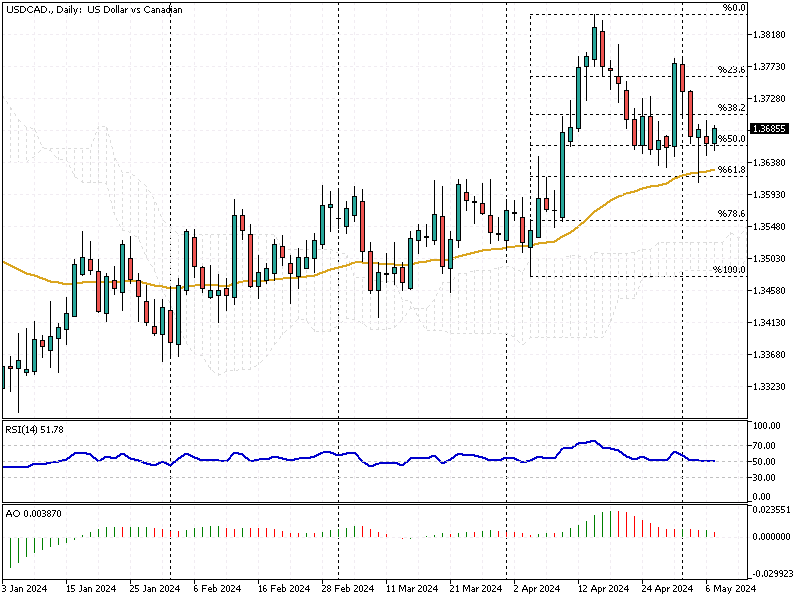

USDCAD - Canadian Dollar Surge

Solid ECN – The Canadian dollar recently hit a high of 1.36 USD, marking its strongest position since early April. This rise comes amid a widespread weakening of the U.S. dollar, driven by disappointing labor statistics from the U.S. The data showed only 175,000 new jobs created in April, well below the anticipated 243,000.

This underperformance, coupled with slower wage growth and a slight increase in unemployment, suggests that the Federal Reserve may cut rates as early as September.

Economic Indicators in Canada

In contrast, economic signals from Canada also hint at an upcoming rate adjustment, with several key indicators underscoring potential economic challenges. The Manufacturing PMI fell to 49.4, indicating continued contraction in factory activity for the twelfth consecutive month.

Furthermore, the Canadian economy's growth was a modest 0.2% in February, with expectations of stagnation in March, signaling a possible earlier rate cut by the Bank of Canada.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,179

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

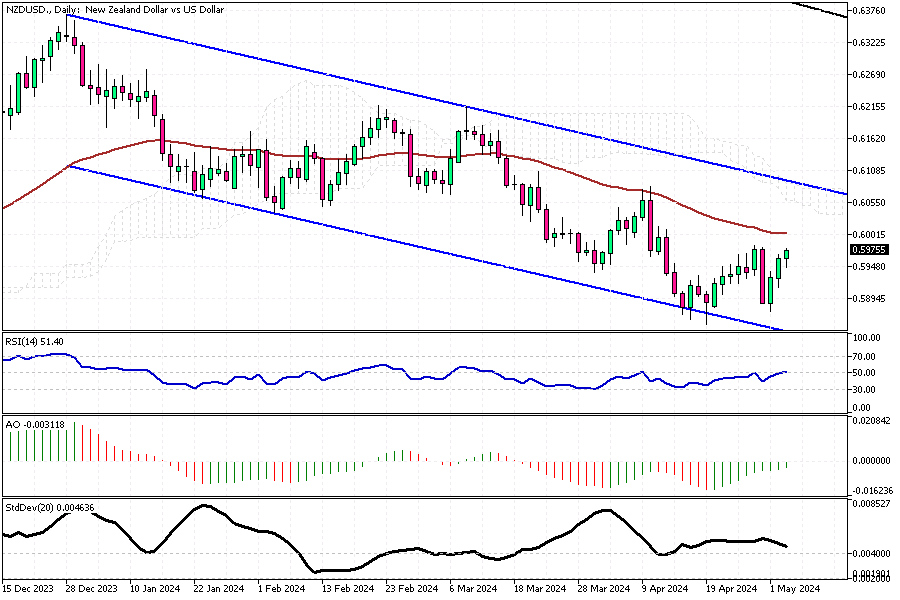

NZ Dollar Dips Amid US Stability

Solid ECN – The New Zealand dollar recently fell to $0.6 against a stabilizing US dollar. This shift came as fresh economic indicators suggested a potential cut in US interest rates later this year. Concurrently, the Kiwi mirrored the Australian dollar's downturn after the Reserve Bank of Australia opted to maintain its current interest rates, adopting a less aggressive stance than many anticipated.

Geopolitical Influences

Investors closely monitor the Middle East, where recent developments could impact global markets. Following Hamas's acceptance of a ceasefire in Gaza proposed by mediators, tensions remain as Israel did not agree to the terms, continuing military operations in Rafah and planning further negotiations.

New Zealand's Economic Outlook

In New Zealand, despite market expectations leaning towards an interest rate cut by October, fueled by recent weaker employment figures, the central bank has indicated it might hold off on easing monetary policy until 2025. This decision is based on persistently high inflation rates in the year's first quarter.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,179

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

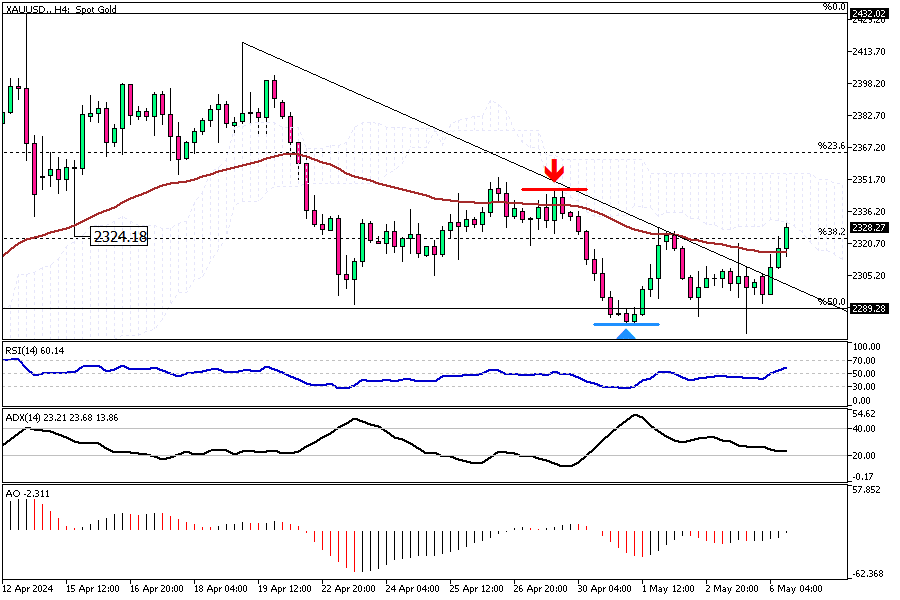

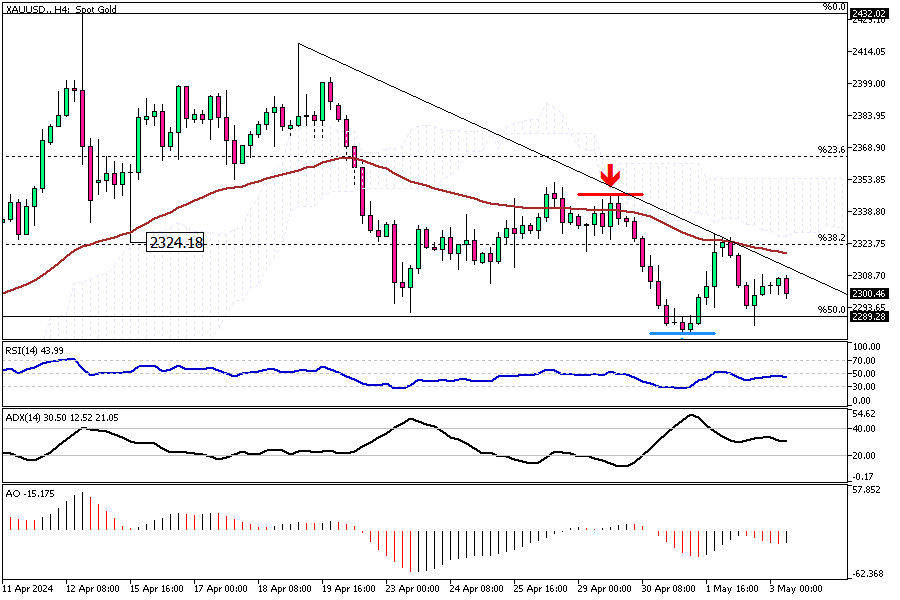

Gold Prices Rise Amid Fed Speculations

Solid ECN – Gold prices climbed to $2,310 per ounce on Monday, rebounding from a near one-month low. This surge is influenced by anticipation of upcoming remarks from Federal Reserve officials, which traders are eyeing for hints about potential interest rate cuts.

This keen interest stems from recent U.S. labor data that indicated a slowdown in job growth last April, suggesting that the Fed might start reducing rates later in the year.

Interest Rate Expectations and Gold's Appeal

The possibility of reduced interest rates, which decrease the opportunity cost of holding gold, has bolstered the metal's attractiveness. According to the CME's FedWatch Tool, there's a 67% likelihood of a rate cut by September.

Furthermore, geopolitical tensions, such as the fading hopes for a Gaza ceasefire reported on Sunday, have heightened gold's status as a safe-haven asset.

Global Gold Demand Fluctuates

Despite the price drop, gold demand in India remained subdued last week, with buyers waiting for further price declines. In China, gold premiums decreased for the second consecutive week, reflecting reduced demand during the holiday period.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,179

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Oil Prices Rebound on Supply Cuts

Solid ECN—WTI crude oil futures rose above $78.5 per barrel on Monday, rebounding from a near two-month low of $78.1. This uptick is attributed to new developments suggesting a decrease in supply. Notably, Saudi Aramco increased the official selling price of its Arab Light crude by 90 cents per barrel for June deliveries. This adjustment exceeds the market’s anticipation of a 60-cent hike, underscoring a robust outlook from OPEC+ on sustained supply cuts.

Geopolitical Tensions Affect Oil Markets

Further influencing oil prices, geopolitical tensions have escalated. Following a series of rocket attacks by Hamas over the weekend, Israel responded by closing the Kerem Shalom crossing into Gaza and advised civilians in Rafah to evacuate. This move jeopardizes the recent hopes for a ceasefire and stirs concerns about regional stability, impacting global oil markets.

Guidance for Traders and Investors

These developments suggest a cautious approach to oil-linked currencies and investments for forex traders and investors. Monitoring the evolving geopolitical landscape and OPEC+ decisions will be crucial to effectively navigating the volatile oil market.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,179

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Pound Hits $1.26 as U.S. Jobs Disappoint

Solid ECN – The British pound has risen to its highest value since early April, reaching $1.26, as U.S. employment data fell below expectations, prompting a shift in interest rate forecasts for 2024. This surge comes as traders adjust their expectations for the Federal Reserve's rate cuts, now anticipated in September rather than November. The change in sentiment follows the April jobs report, which showed that the U.S. economy added 175,000 jobs, which was markedly lower than the 243,000 jobs economists had forecasted.

Impact on U.S. Economic Performance

The disappointing job growth has been accompanied by underwhelming wage increases and a surprise uptick in the unemployment rate. These indicators suggest a cooling in the U.S. labor market, affecting Federal Reserve policies. Originally, rate cuts were expected later in the year, but the new data has brought these expectations forward, reflecting concerns about economic momentum.

British Economic Outlook

In contrast, the Bank of England maintains a steady stance, with no changes expected in the upcoming rate decision. However, investors anticipate the first rate cut to occur in August, a slight advancement from previous estimates. Governor Andrew Bailey remains optimistic, citing a decrease in inflation to 3.2% in March, aligning closely with the target. This is Britain's lowest inflation rate since September 2021, signaling a potentially stabilizing economic environment.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,179

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

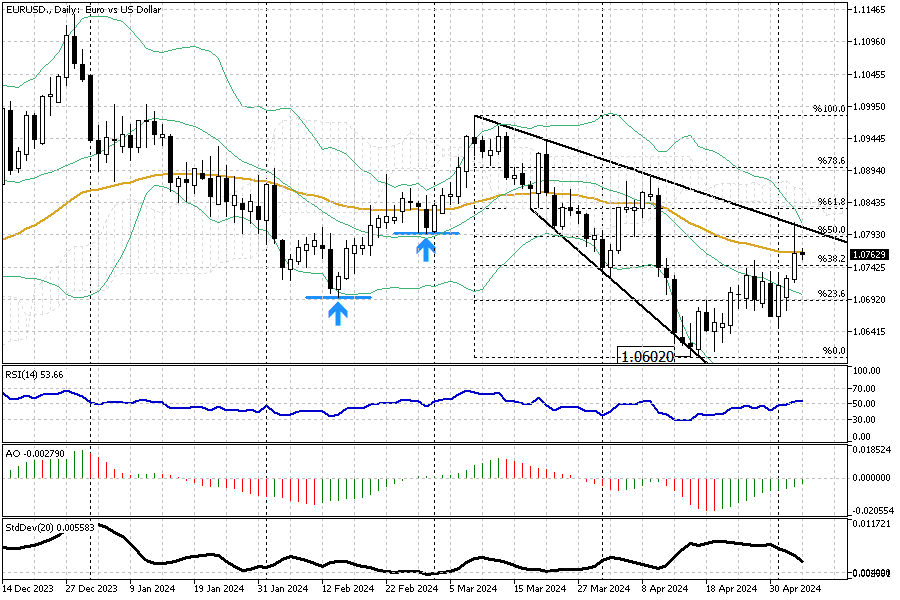

US Jobs Data Weakens Dollar

Solid ECN – The euro recently climbed towards $1.08, reaching its highest since April 9th. This rise comes as traders adjusted their forecasts for potential cuts in interest rates, influenced by a surprisingly weak US jobs report. The latest figures showed that the US economy added only 175,000 jobs last month, falling short of expectations. This underperformance has led investors to anticipate that the Federal Reserve might reduce interest rates earlier than previously thought, possibly as soon as September.

Impact of US Economic Data

The jobs report showed fewer jobs created and indicated that annual wage growth has slowed to 3.9%. Additionally, the jobless rate unexpectedly increased to 3.9%. These factors contribute to a growing belief among traders that the US economy might need stimulus sooner rather than later, influencing currency values.

European Economic Stability

Contrastingly, in Europe, economic indicators have been more stable. Recent data revealed steady inflation rates and moderate GDP growth within the Eurozone. These factors strengthen the argument for the European Central Bank (ECB) to consider reducing interest rates by June. As a result, the euro has gained strength against the dollar, reflecting differing economic forecasts between the US and Europe.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,179

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

NZDUSD - Awaiting RBA's Impact on NZ Policy

Solid ECN – The New Zealand dollar, commonly referred to as the NZD, has seen a notable increase, surpassing the $0.59 mark. This resurgence comes after a period of losses earlier in the week. The uplift was triggered by a retreat in the US dollar, which occurred following the Federal Reserve's decision to maintain current interest rates.

Adding to the momentum, Fed Chair Jerome Powell indicated that further rate hikes were unlikely, reinforcing the central bank’s current stance towards easing monetary policy.

Economic Signals in New Zealand

Recent economic data from New Zealand has shown some concerning trends, with the unemployment rate climbing to 4.3% in the first quarter of the year. This is the highest it has been in three years and surpassed economists' forecasts. Such figures hint at a possible shift in monetary strategy, potentially prompting the Reserve Bank of New Zealand (RBNZ) to lower interest rates earlier than the US Federal Reserve.

Anticipation for RBA’s Decision

As the market digests New Zealand's unfolding economic indicators, attention is now turning towards the Reserve Bank of Australia’s (RBA) upcoming policy announcement.

The decision is keenly awaited as it could have significant implications for New Zealand's monetary policy direction. Investors and economists alike are closely watching, with many predicting a rate cut by the fourth quarter. However, opinions vary, with some forecasts suggesting stable rates until 2025.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,179

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Gold Prices Steady as Investors Wait

Solid ECN – Gold prices remained stable at around $2,300 per ounce this Friday, marking the lowest level in four weeks. Investors are maintaining caution as they await the release of the US non-farm payroll data later today. This significant economic indicator is expected to provide insights into the Federal Reserve's future monetary policy decisions.

Federal Reserve and Economic Indicators

The Federal Reserve opted to keep interest rates unchanged last Wednesday, indicating a possible inclination toward future rate reductions. However, concerns over recent disappointing inflation figures might delay these cuts. Moreover, the stable number of new unemployment claims last week suggests a tight labor market, which is likely to bolster the economy throughout the second quarter.

Geopolitical Developments Impacting Gold

Easing geopolitical tensions in the Middle East, particularly the growing optimism for a ceasefire agreement between Israel and Hamas brokered by Egypt, has also influenced gold prices. As a result, the precious metal is set to register a 1.6% decline this week, marking its second consecutive weekly drop.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Thread: Market Update by Solidecn.com

Thread: Market Update by Solidecn.com

Copyright © 2024 vBulletin Solutions, Inc. All rights reserved.

Reply With Quote

Reply With Quote