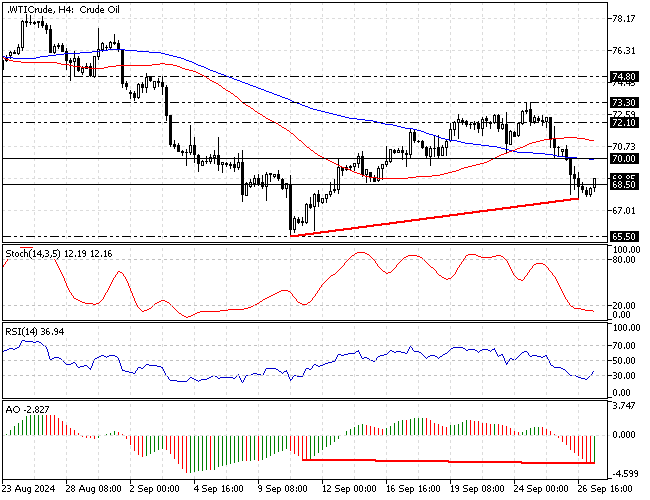

Crude Oil Signals Consolidation Phase Ahead

FxNews—Crude Oil crossed below the $68.5 support, but the market is still oversold, as the Stochastic oscillator hovers below 20. Additionally, the Awesome oscillator also signals divergence, meaning the Oil price can consolidate near the upper resistance levels.

Forecast

It is not advisable to go short when a market is oversold. Hence, we suggest traders and investors wait patiently for the price to complete the consolidation phase.

That said, the $70 resistance provides a decent ask price to join the bear market. Therefore, traders and investors should monitor this level for bearish signals, such as a shooting star candlestick or a bearish engulfing pattern.

Please note that the Oil market will remain bearish as long as the price is below the 100-period simple moving average.

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- FxNews.me — Latest Technical & Fundamental Analysis

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to FxNews For This Useful Post:

Unregistered (1)

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

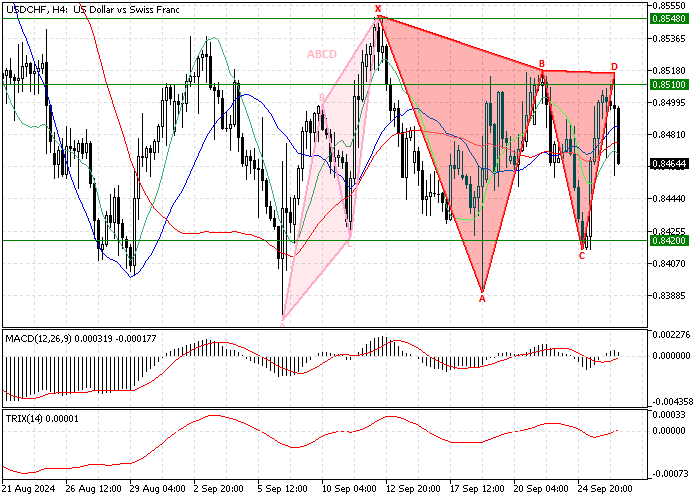

USD/CHF Signals Sell Amid Gartley Pattern

FxNews—The USD/CHF currency pair has formed a Gartley harmonic pattern on the 4-hour chart, signaling a sell. Immediate resistance lies at 0.851.

The downtrend is likely to resume, targeting 0.842, provided that the bears hold their position firmly below 0.851.

Conversely, the bearish outlook will be invalidated if the USD/CHF price exceeds 0.851. In this scenario, the bullish wave that began from 0.842 has the potential to target 0.854.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to FxNews For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

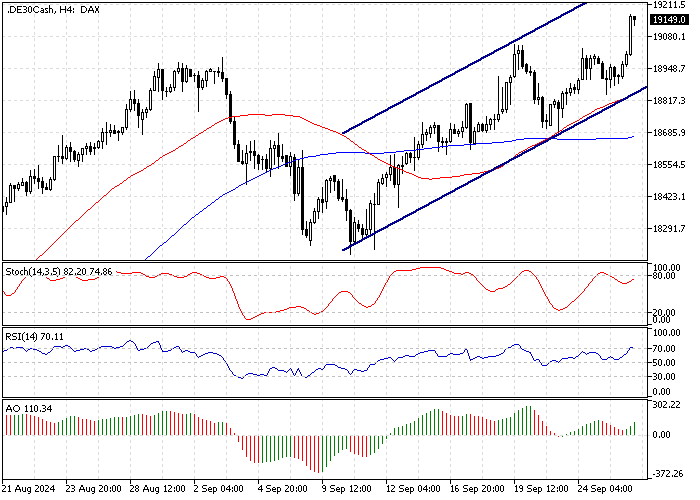

DAX Hits New Heights

FxNews—The DAX gained 1.2%, rising above 19,130, and is set to close at a new record high on Thursday, following the positive trend seen in global markets.

Investor sentiment improved due to renewed hope in China's stimulus plan and news that additional actions are being considered by the government, such as injecting up to CNY 1 trillion into major state-owned banks.

The technology sector also received a lift, driven by strong sales and profit outlooks from Micron Technology.

SAP rose 1.3% after dropping around 2.4% in the previous trading session. Among the best performers were Adidas (up 5.4%), Commerzbank (up 4.1%), and Porsche AG (up 3.9%), while BASF experienced the largest drop, falling 2.9%.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to FxNews For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

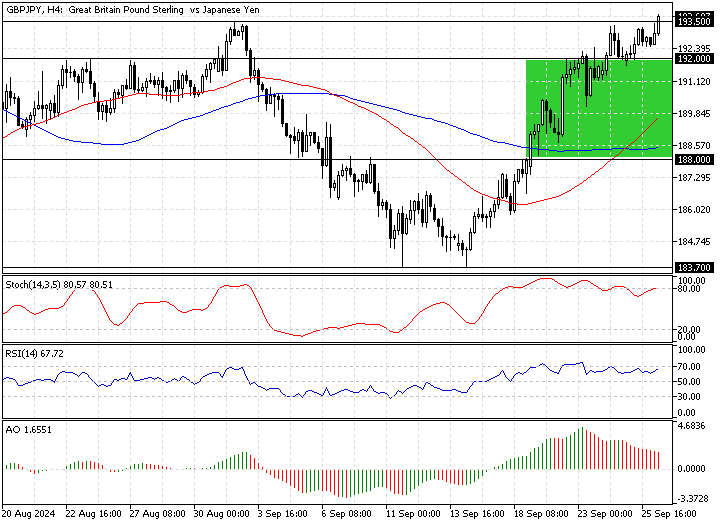

GBP/JPY Eyes 195.5 After Resistance Test

FxNews—The GBP/JPY currency pair closed and is now stabilizing above the 192.0 resistance, currently testing the 193.5 resistance. Meanwhile, the Awesome Oscillator and RSI signal divergence as the British pound gains against the Japanese yen. Therefore, a consolidation phase or trend reversal could be on the horizon.

Forecast

The pair is trading above the 50- and 100-period simple moving averages on the 4-hour chart. If the GBP/JPY price exceeds 193.5, the next bullish target could be 195.5.

Please note, the currency pair in discussion has the potential to consolidate near the 50-period simple moving average before heading toward the target.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to FxNews For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

European Stocks Rise: Boost from China’s Economic Moves

Fxnews—European stock markets rose on Thursday, driven by a worldwide increase in enthusiasm. This boost came mainly from China's announcement of new economic incentives and possible additional support, including plans to pour up to 1 trillion yuan into the biggest government-owned banks.

The technology sector also benefited from strong sales and earnings predictions from Micron Technology. Companies with a big stake in the Chinese market, like LVMH and Kering, also saw significant increases, rising 4.6% and 5.1% respectively.

Other companies that performed well included Adidas, L'Oréal, and ASML Holding, with their stocks going up 3.8%, 3.4%, and 4.7%.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to FxNews For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

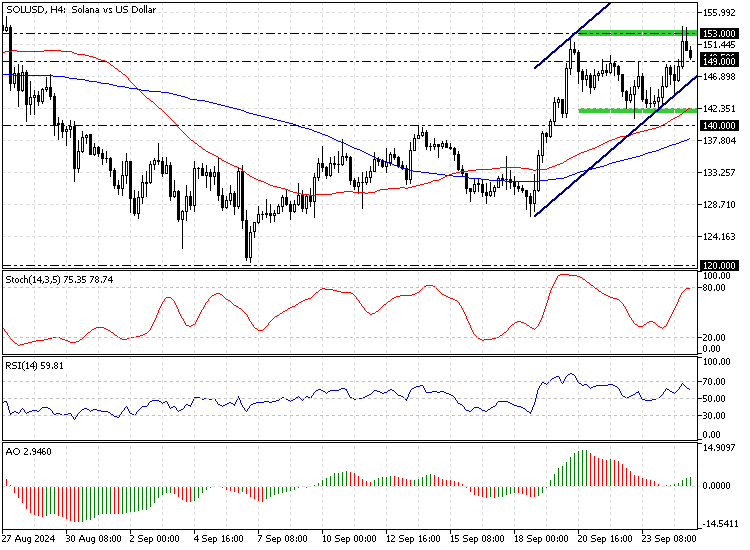

Solana Consolidates After Breaking Resistance

FxNews—Solana is in a bull market, trading above the 50-period simple moving average and the $149 immediate resistance. Meanwhile, the Awesome oscillator signals divergence, meaning the Solana price can potentially consolidate near the lower support levels.

Forecast

Today's decline in the Solana price can expand to $140 if the bears (sellers) close below the ascending trendline in the 4-hour chart. If this scenario unfolds, the $140 mark, which coincides with the 50-SMA, can provide a decent bid for retail traders to join the bull market.

The outlook for the ADA/USD trend remains bullish as long as the price is above $140. That said, the next bullish target will likely be the August 2024 high at $162.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to FxNews For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

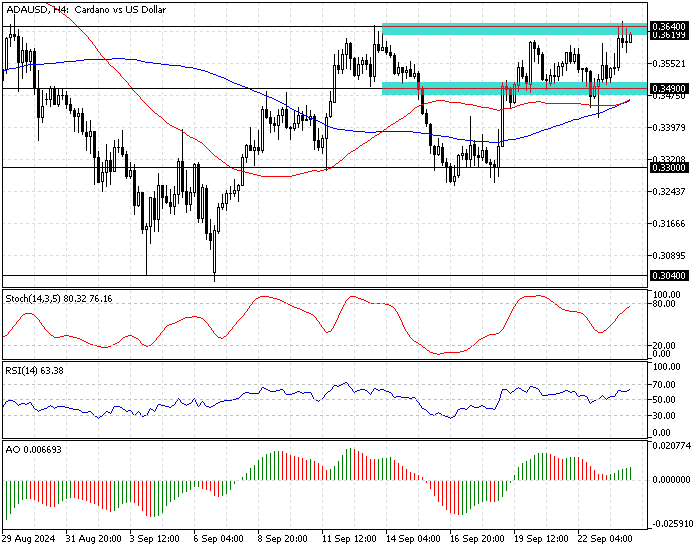

Cardano Eyes Bullish Breakout at $0.364

FxNews—Cardano stabilized above the $0.349 support, testing the immediate resistance at $0.364. Meanwhile, the Awesome Oscillator signals divergence, indicating that the trend has the potential to consolidate or reverse. Adding to the divergence signal, the 4-hour chart formed a bearish long-wick candlestick pattern, signaling a potential market reversal.

Forecast

The primary trend is bullish because the ADA/USD price is above the 50- and 100-period simple moving averages. That said, the uptrend will likely resume if the Cardano price exceeds $0.364. In this scenario, the next bullish target could be the $0.376 mark.

Bearish Scenario

If the Cardano price fails to surpass the immediate resistance, it could potentially dip to the critical support level of $0.349, a supply zone backed by the 100-period simple moving average.

Furthermore, the bullish outlook should be invalidated if the price crosses below the 100-SMA.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to FxNews For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

Investors Eye More Fed Cuts After Yield Rise

FxNews—The interest rate on the US 10-year Treasury bond rose to 3.74%, reaching its highest point in nearly three weeks. This increase comes as market participants consider the future of interest rates following the Federal Reserve's recent actions, which included a significant rate decrease of 0.50%.

The Federal Reserve has also indicated plans to lower rates by another 0.50% later this year and by 1.00% the following year. Investors are now awaiting the upcoming PCE report and comments from various Federal Reserve leaders to determine the central bank’s forthcoming decisions.

Currently, there's a 50% chance that rates will be cut by another 0.50% in November.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to FxNews For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

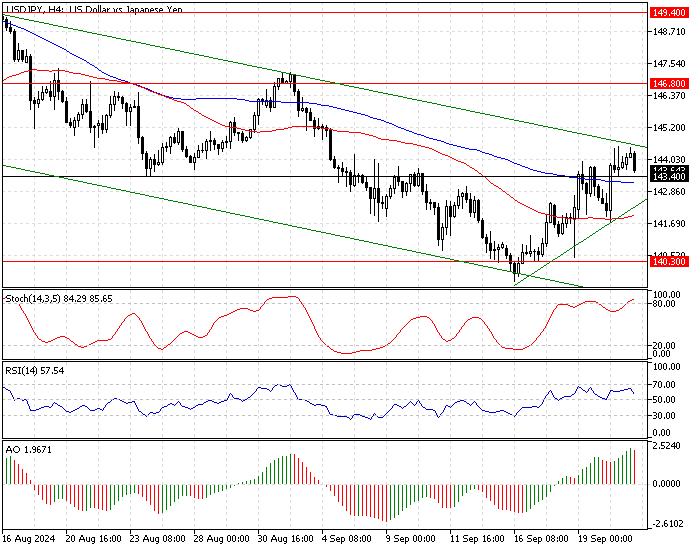

USD/JPY Recent SMA Golden Cross Signal Explained

FxNews—The USD/JPY consolidation phase eased near the upper line of the bearish flag and is currently testing the immediate support at 143.4. Meanwhile, the Stochastic oscillator has entered the overbought territory, signaling an overbought condition. Additionally, the Awesome Oscillator histogram has turned red, indicating that the bear market is strengthening.

Price Forecast

If the bears (sellers) close and cross below the 143.4 support, the downtrend will likely be triggered. In this scenario, the next bearish target could be the 50-period simple moving average, followed by 140.3.

Bullish Scenario

Despite the AO indicator's recent bar turning red and the Stochastic's overbought signal, the USD/JPY price remains above the 50- and 100-period simple moving averages. However, for the bull market to resume, the price must stabilize above the descending trendline.

If this scenario unfolds, the consolidation phase could extend to 146.8, followed by 149.4.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to FxNews For This Useful Post:

Unregistered (1)

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

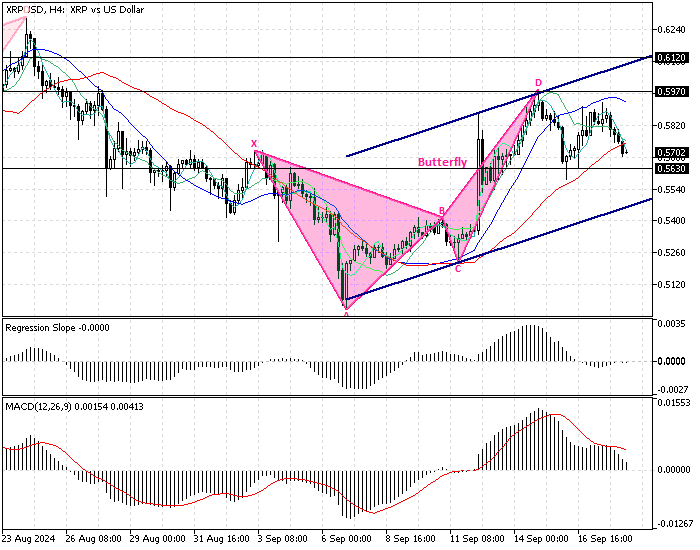

XRP Faces Bearish Threat Despite Bullish Momentum

FxNews—Ripple (XRP) trades in a bullish channel, but the 4-hour chart has formed a bearish butterfly pattern, which is a sell signal. The MACD value is declining, and the indicator is about to flip below the signal line, meaning the bear market is strengthening.

Additionally, we notice that the recent candle is bearish and closed below the 100-period regression line, meaning the bear market could potentially resume.

Overall, the technical indicators suggest that despite the bullish momentum, XRP/USD could dip to lower support levels.

Forecast

The immediate resistance is at $0.563. The XRP/USD downtrend will likely be triggered if the price closes and stabilizes below $0.563. If this scenario unfolds, the downtrend could extend to the lower band of the bullish channel.

Bullish Scenario

If bulls (buyers) maintain their position above the $0.563 mark, and if they can close beyond the 100-period regression line, the uptrend will likely be triggered. In this scenario, the next bullish target could be retesting $0.597, followed by $0.612.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to FxNews For This Useful Post:

Unregistered (1)

Copyright © 2026 vBulletin Solutions, Inc. All rights reserved.

Thread:

Thread:

Reply With Quote

Reply With Quote