Franc Strengthens, Dollar Weakens Post-Fed

Solid ECN—The Swiss franc has remarkably recovered, climbing to 0.91 against the US dollar from a seven-month low of 0.92 on May 1st. This rebound was sparked by unexpectedly high inflation data, which reduced the market's expectation that the Swiss National Bank (SNB) would further relax monetary policy.

In April, inflation surged to 1.4% from a low of 1% the previous month, significantly exceeding forecasts of 1.1%.

Inflation Concerns Shape Policy

The recent jump in inflation rates is noteworthy, especially since the SNB had warned that prices could be unstable due to global tensions and a relaxed stance on the franc. Although foreign currency reserves have increased, the rapid inflation has fueled worries about potential ongoing price rises.

These concerns have led to speculation about whether the SNB will reduce interest rates again in June.

Dollar's Influence on the Franc

A weakening US dollar bolstered the franc's strength after the Federal Reserve avoided strong indications of future rate hikes. This backdrop provides a complex landscape for forex traders and investors, suggesting a cautious strategy approach.

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- Market Update by Solidecn.com

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,191

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,191

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

WTI Crude Drops Below $78, Eyes on OPEC

Solid ECN – WTI crude futures experienced a significant decline, dropping below $78 per barrel this Monday. This downward trend extended from last week when oil prices fell sharply by more than 1%. The drop is largely attributed to growing concerns about demand, influenced by economic indicators and policy signals from the U.S.

Economic Signals Affect Oil Demand

Recent statements by U.S. Federal Reserve officials suggest that high interest rates might persist, potentially slowing economic growth and reducing oil demand. This speculation is supported by a notable decrease in U.S. consumer confidence reported last Friday, signaling an economic slowdown. Additionally, increases in U.S. gasoline and distillate inventories ahead of the summer imply weaker-than-expected demand.

Looking Ahead: OPEC's Next Moves

Investors are now focusing on OPEC's policy meeting scheduled for early June. There is widespread anticipation that OPEC may continue its supply cuts into the latter half of the year, potentially influencing future market dynamics.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,191

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

EURUSD Technical Analysis

Solid ECN – EUR/USD rose from the 61.8% Fibonacci retracement level yesterday and is now testing the descending trendline near 1.07.

The technical indicators are bullish, but for the uptrend to resume, the price must close and stabilize above the trendline. If this happens, the euro will strengthen against the dollar, with the next milestone likely at 1.088.

We recommend closely monitoring price movements near the bearish trendline and checking lower timeframes, such as the 4-hour chart, for bearish candlestick patterns. If the bulls fail to close above the trendline, EUR/USD could face renewed selling pressure, potentially pushing the price down to the 50% Fibonacci support level.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,191

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Key Reports to Influence Gold Prices

Solid ECN – Gold prices soared to $2,350 per ounce this past Friday, reacting to traders' expectations of a Federal Reserve rate cut. The anticipation grew after Thursday’s economic report showed a surprising increase in Americans filing for unemployment benefits, hinting at a potential cooling of the labor market.

Such economic indicators often lead to a softer approach to interest rates, benefiting assets like gold, which thrives in lower-rate environments.

Monitoring Future Economic Indicators

Investors and traders are now poised to closely analyze the upcoming Consumer Price Index (CPI) and Producer Price Index (PPI) reports. These indicators will provide further clarity on the Federal Reserve's stance.

Despite some Federal officials expressing caution about easing policies too quickly, the general sentiment leans towards reducing rates, especially with pressures from global economic uncertainties and market demand.

Influences on Gold’s Market Performance

Significant factors such as increased over-the-counter market investments, ongoing central bank acquisitions, and rising demand in Asian markets continue to push gold prices upward.

Additionally, geopolitical tensions in the Middle East and Ukraine are escalating, further increasing gold's appeal as a safe-haven asset. With these dynamics, gold is on track for a 2.2% weekly gain.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,191

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

AUDUSD Analysis

Solid ECN – The AUD/USD pair has resumed its uptrend from 0.655 after testing the 50-day EMA. Currently, the Australian dollar is trading around 0.660 against the U.S. dollar, with bulls aiming to stabilize above the 23.6% Fibonacci retracement level.

The RSI is above 50, indicating momentum in favor of the upward move. Technically, 0.6557 serves as the primary support for the bullish trend. If the price holds above this level, the next target is likely around 0.664.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,191

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Bitcoin Dips Below Key $61.9K Level

Solid ECN – Bitcoin dipped below $61,896 in today's trading session. The technical indicators are bearish, with the RSI hovering below 50 and the Awesome Oscillator bars in red.

From a technical standpoint, the downtrend momentum that started earlier this week will likely continue, with the median line of the Bollinger Band acting as resistance. If BTC/USD remains below this line, the next milestone for sellers will likely be $59,559.

Conversely, the bearish outlook could be invalidated if the price crosses and stabilizes above $62,702.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,191

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

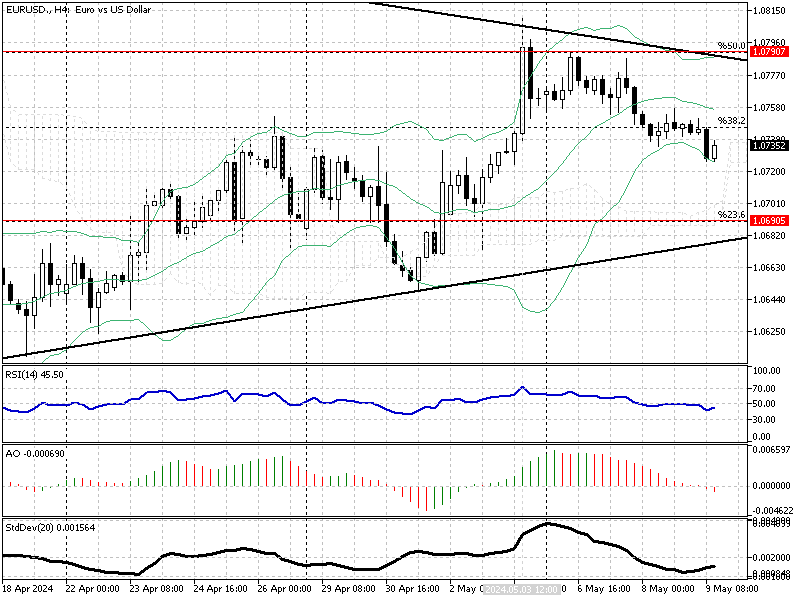

EURUSD Bearish Outlook

Solid ECN – As of the latest trading session, the Euro continues to decline, trading at approximately 1.07 against the U.S. dollar, notably below the 38.2% Fibonacci retracement level. The current technical indicators support the bearish outlook; the Awesome Oscillator (AO) has dipped below zero, while the Relative Strength Index (RSI) remains under the median line, suggesting weakened momentum.

The EUR/USD downtrend appears poised to continue as it trades below a significant descending trendline. The primary resistance level is at the 50% Fibonacci level of 1.079.

If this resistance holds, the downtrend initiated on May 3rd will likely extend, potentially reaching a target of 1.069. This target aligns with the ascending trendline and the 23.6% Fibonacci level, providing a technical confluence that supports the bearish scenario.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,191

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

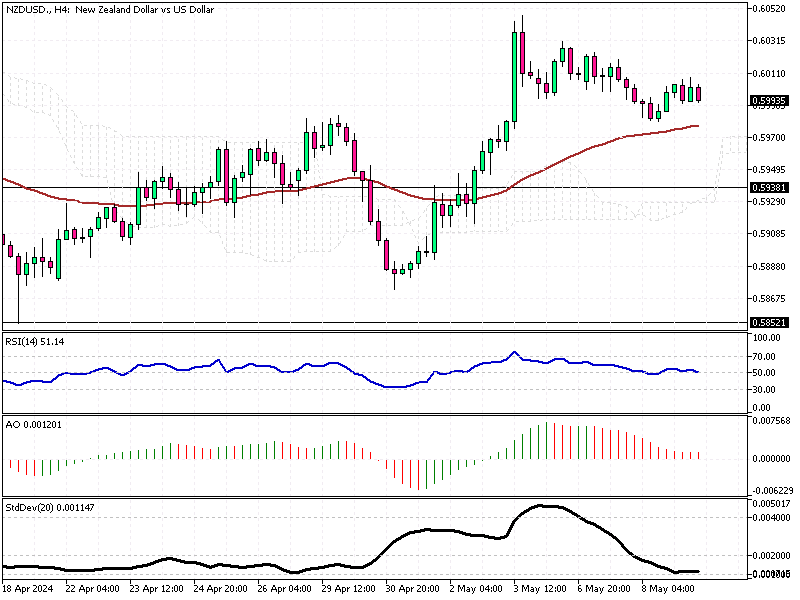

NZDUSD: Fed Officials Hint at Prolonged Rates

The New Zealand dollar (NZD) has shown a minor decline to $0.59, influenced by a slight rise in the US dollar. This movement comes as traders anticipate crucial US economic data that might hint at the Federal Reserve's timing for interest rate reductions. The US will soon disclose figures on jobless claims and consumer sentiment, with significant inflation data on the horizon.

Fed's Strategy on Interest Rates

Comments from Federal Reserve officials, particularly Fed Bank of Boston President Susan Collins, suggest a cautious approach to monetary policy. Collins indicated that high interest rates might persist longer than expected to mitigate inflation, affecting forex market dynamics.

Anticipation of NZ Central Bank

In New Zealand, the focus shifts to the upcoming central bank meeting scheduled for May 22nd. With inflation exceeding initial forecasts, the bank is poised to maintain the interest rate at 5.50%. This decision could shape the short-term trajectory of the NZD in forex markets.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,191

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

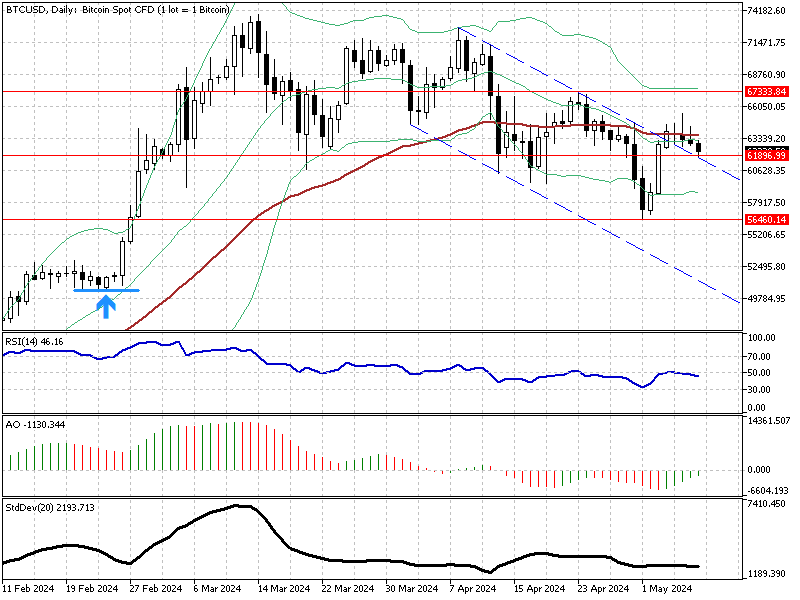

BTC Bulls Eye Higher Targets Despite Price Dip

Solid ECN – Bitcoin broke out of the descending trendline (in blue), but the bulls failed to stabilize the price above the EMA 50 and the middle line of the Bollinger Band. Consequently, the pair formed a long-wick bearish candle on the daily chart. As of this writing, the BTC/USD pair has dipped and is currently testing the broken resistance at $61,896.

The technical indicators provide mixed signals. RSI hovers below 50, but AO is bullish, showing a green line.

From a technical perspective, the bullish outlook remains valid if the BTC/USD price remains above $61,896. In this case, the next target could be $67,333.

On the flip side, the downtrend will resume if the price falls below the support level, with $56,460 as the next support level.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,191

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Economic Indicators Show Growth and Stability in Mexico

Solid ECN – The Mexican peso has rallied to approximately 16.8 per USD, marking a significant rebound from its five-month trough of 17.2 on April 25th. This upturn is primarily attributed to a widespread weakening of the U.S. dollar, spurred by indications that the Federal Reserve might implement two rate cuts within the year.

These speculations were fueled by a moderated growth in U.S. job numbers for April and a surprising increase in the unemployment rate, compounded by Federal Reserve Chair Powell's earlier dismissal of any forthcoming rate hikes.

Stable Monetary Outlook as Mexican Economy Grows

On the domestic front, Mexico's central bank, Banxico, is expected to maintain its interest rates at 11% in its upcoming May 9th meeting, consistent with its rate cut in March. However, emerging data might spark discussions among Banxico's Governing Council members about potential policy adjustments.

Additionally, Mexico's economic growth has accelerated, with a 0.2% expansion in Q1 of 2024 compared to 0.1% in the previous quarter, surpassing market expectations. Business confidence remains robust, near an 11-year peak, even as inflation persists above 4%.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Thread: Market Update by Solidecn.com

Thread: Market Update by Solidecn.com

Copyright © 2024 vBulletin Solutions, Inc. All rights reserved.

Reply With Quote

Reply With Quote