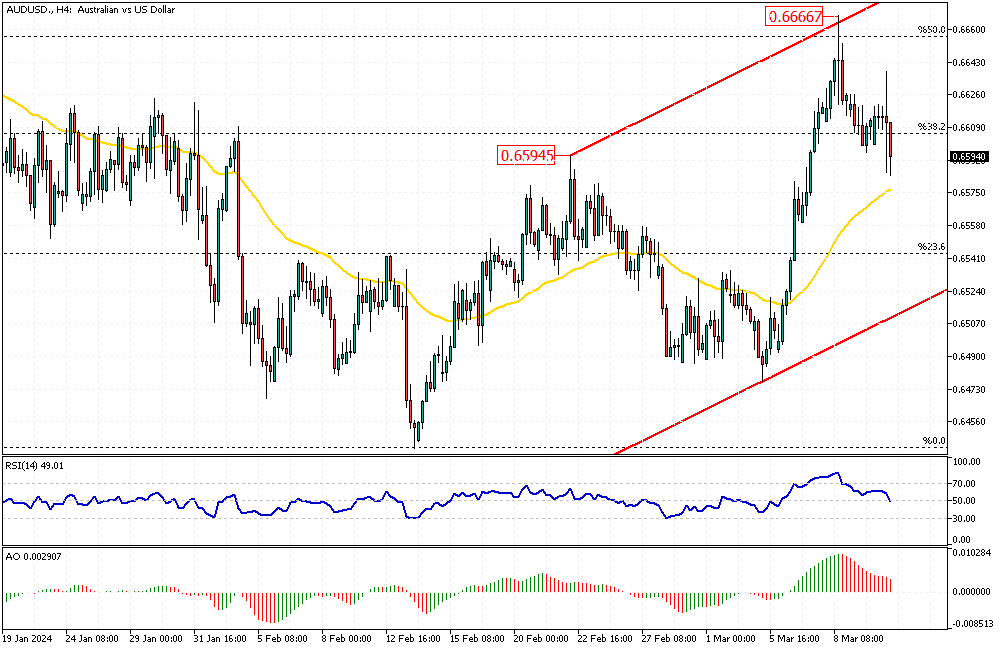

Bearish Signals: AUDUSD Technical Indicators Review

Solid ECN – The seller of the AUDUSD pair formed a long wick candlestick pattern on the 4-hour chart, close to the 50% Fibonacci resistance at the 0.666 mark. Consequently, the pair dipped below 38.2% and is testing the EMA 50 as of writing.

The technical indicators signal a bear market, with the RSI closing below 50 and the Awesome Oscillator bars being red and declining.

From a technical standpoint, the AUDUSD pair has created a new higher high since the beginning of the year, and this is the first time the value went as high as 0.666. Therefore, the Australian currency is bullish against the U.S. dollar. That said, if the EMA 50 can withstand today's selling pressure, the market will likely aim for the upper band of the rising flag, which is close to the 61.8% resistance level.

Conversely, if the AUDUSD dips below the EMA 50, the next support level is 23.6%. Traders should watch the EMA 50 closely and adjust their strategy accordingly.

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- Market Update by Solidecn.com

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

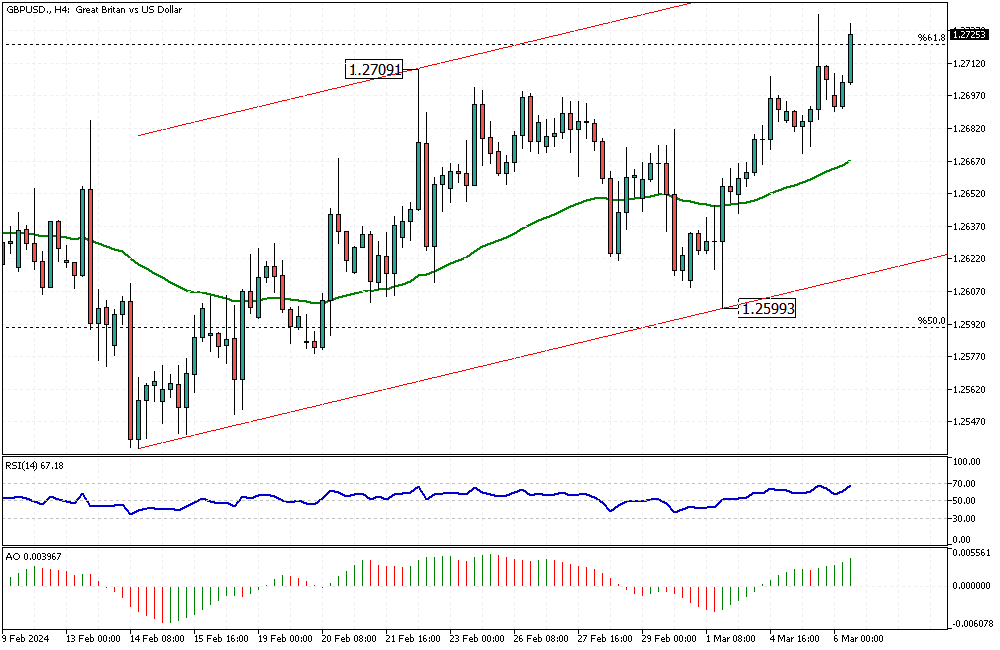

GBPUSD's Potential Downshift and Support Levels

Solid ECN – The pound sterling has pulled back from a significant level, the 78.6% Fibonacci resistance against the U.S. Dollar, resulting in the pair trading below 1.2827. Concurrently, the RSI indicator has retreated from the overbought area and is heading toward the 50 level.

This downshift could extend to the EMA 50, which aligns with the rising trendline.

Traders should pay close attention to the 61.8% Fibonacci support, which could present buying opportunities. If this level holds, the GBPUSD price will likely rise and retest the 1.2893 resistance.

However, if the rising trendline breaks, it's a clear sign that the bullish scenario should be invalidated. In this case, the consolidation phase will likely extend to the 1.2599 mark, the 50% Fibonacci support.

Therefore, we suggest observing the market's behavior around the EMA 50.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 4 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (4)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Protect Your Trades with Solid ECN's Solid-Shield Feature

At Solid ECN, we prioritize the peace of mind of our traders, especially in times of market volatility. We are committed to upholding the highest standards of trading safety and have introduced the Solid-Shield feature to enhance your trading experience.

Solid-Shield is an innovative tool designed to protect traders from the risk of negative balances. This means that even in highly volatile market conditions, where margin calls and stop-outs might typically lead to a negative balance, traders with Solid ECN are wholly safeguarded against this risk.

The feature automatically resets a trader's balance to zero if it turns negative after a stop-out, ensuring that our traders are not liable for any negative balance. This fully automated process provides an extra layer of financial security and allows our traders to focus on their trading strategies without unnecessary stress.

Trade with confidence and security with Solid ECN's Solid-Shield feature.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 6 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (6)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

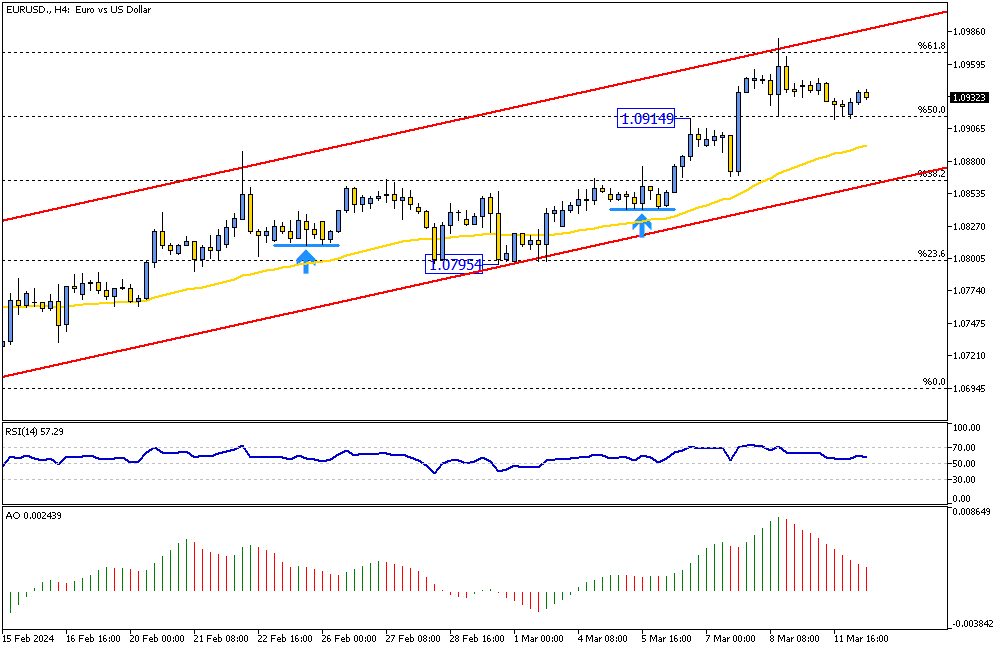

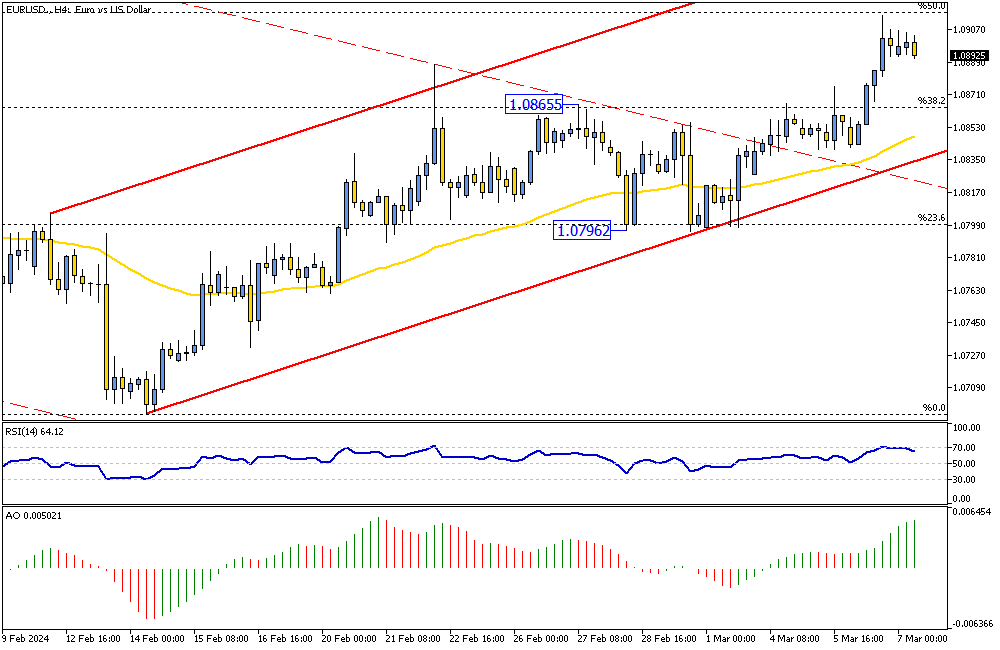

EURUSD's Next Move: Navigating Above 1.091 Key Support

Solid ECN – The EURUSD formed a hammer candlestick pattern on the 4-hour chart, clinging to the 50% Fibonacci support level at the 1.0914 mark. As of writing, the pair is trading at about 1.093, slightly above the resistance. While the European currency gains ground against the U.S. dollar within the bullish channel, the technical indicators do not offer significant insights.

From a technical standpoint, the next target would be 1.1 if the price maintains its position above 50%.

Conversely, if the price dips below the 50% level, it will likely decline to the 38.2% level, coinciding with the lower band of the channel.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 4 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (4)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

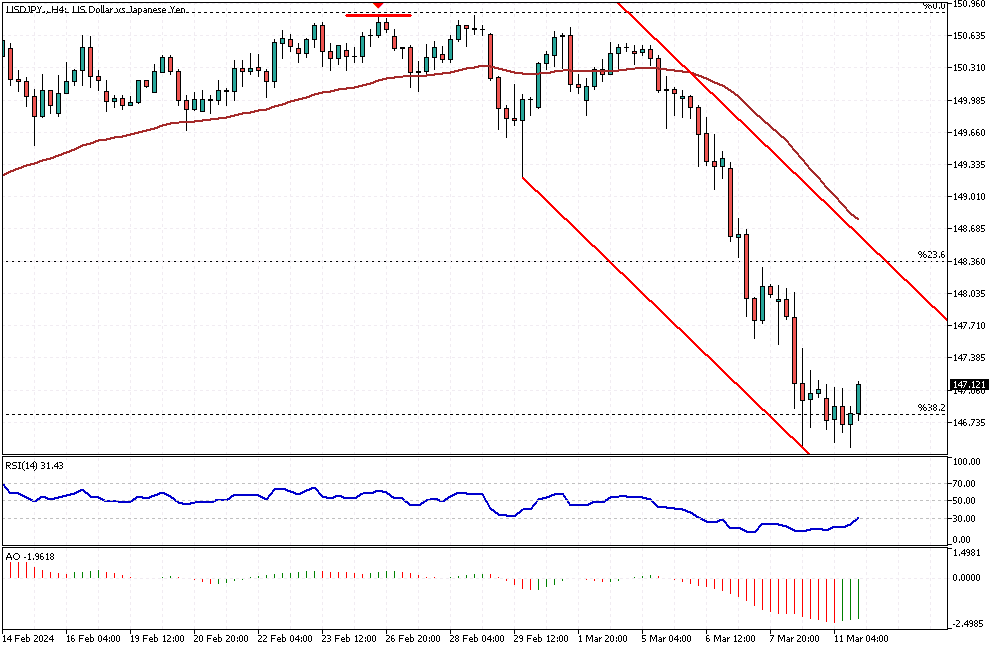

Navigating the USDJPY Oversold Market: Strategy for Professional Trader

Solid ECN – The RSI has been deep in the oversold area since March 8th. Despite the bulls resisting the extreme selling pressure, the uptick momentum seems weak, even with the RSI's position below 30.

Professional traders typically avoid short positions in an oversold market; therefore, waiting for the market to consolidate and stabilize itself is recommended. If the consolidation phase reaches the upper band of the bearish flag, this level, which coincides with the 23.6% Fibonacci retracement, can offer a better price for joining the bear market.

Fortunately, the Awesome Oscillator bars have turned green, which could be interpreted as the start of the consolidation phase. At the moment, wise traders are waiting for USDJPY to form new higher lows and are adjusting their next moves accordingly.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

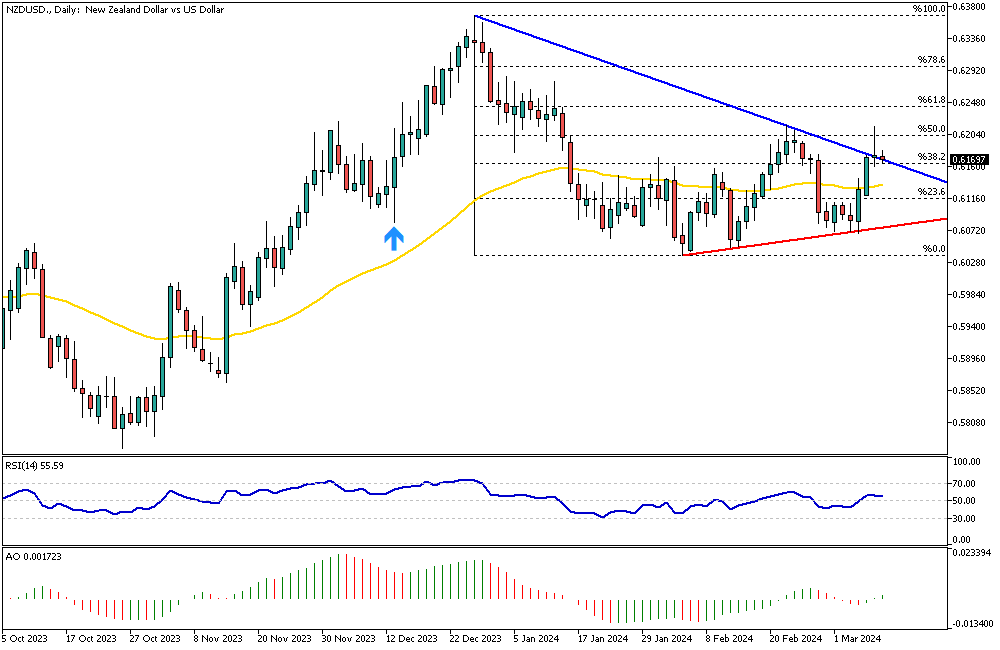

NZDUSD Outlook: Technical Indicators Suggest Ongoing Bullish Trend

Solid ECN – The NZDUSD currency pair formed a long-wick candlestick pattern in Friday's trading session, which suggests a possible trend reversal from an uptrend to a downtrend. The technical indicators still signal a bull market; as we know, all technical indicators are inherently lagging.

From a technical standpoint, if the price stabilizes below the 38.2% Fibonacci support following Friday's wick, it could extend to 23.6%. Otherwise, the bull market will continue, and the next target could be the 61.8% Fibonacci level.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

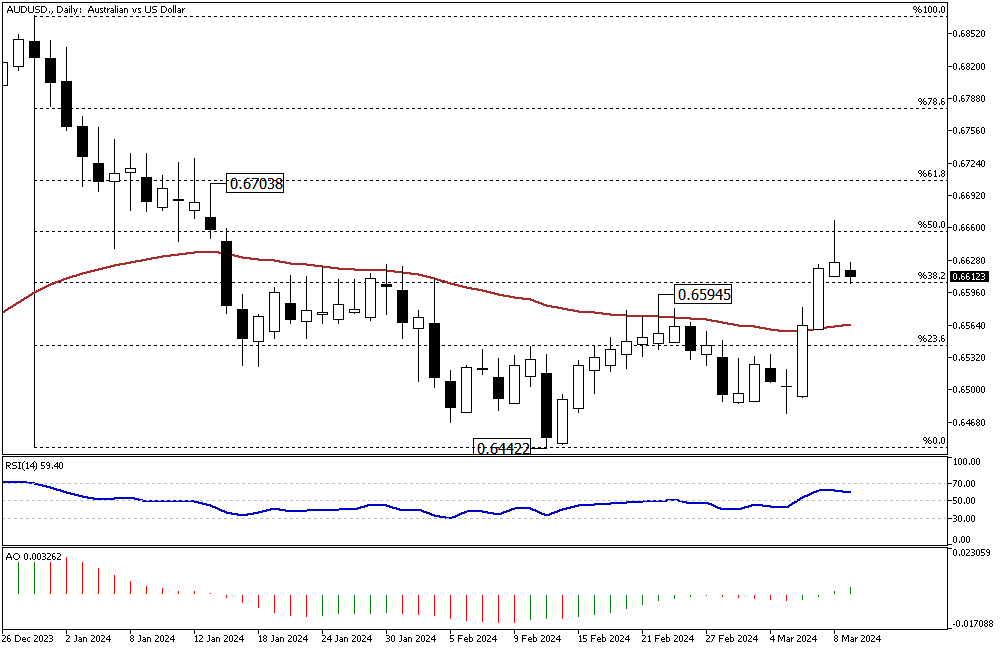

AUDUSD Analysis: Signs of Bullish Resurgence

Solid ECN Blog — The AUDUSD formed a long-wick candlestick pattern during Friday's trading session. As of this writing, the price tested the 38.2% Fibonacci support and is trading at about 0.661. Interestingly, the Awesome Oscillator has flipped above the signal line on the daily chart, which can be interpreted as a sign that the bull market may resume.

From a technical standpoint, the 0.6594 level supports the bull market. As long as the price remains above it, the next bullish target could be the 61.8% Fibonacci resistance at the 0.6703 mark.

Conversely, if the price dips below the 38.2% level, the decline could extend to the EMA 50, followed by the 23.6% level.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Experience Transparent and Efficient Forex Trading with Solid ECN

At Solid ECN, we redefine your trading experience by eliminating reliance on market makers. Our system directly pairs trading parties and forwards orders to liquidity providers, establishing ourselves as an actual ECN broker to optimize your trading strategies.

Our platform is engineered for speed, delivering faster trade executions alongside competitive spreads, further complemented by increased leverage and unparalleled transparency.

We value the security of your investments. To ensure this, we segregate client funds from our company assets and house them safely in leading international banks.

Solid ECN grants rapid access to the most liquid markets, enabling efficient and timely order execution. Our commitment is full transparency; we have no hidden fees or unfair practices. Enjoy 24/7 trading on various assets, including commodities, Forex, and cryptocurrencies, through the advanced MetaTrader 5 platform. Our flexible leverage options, ranging from 1:1 to 1:1000, facilitate meticulous risk management. Additionally, the platform supports scalping strategies with its quick order processing and tight spreads. We also offer hedging solutions to protect against inflation or to help reduce potential losses.

Join Solid ECN for an enhanced trading journey where market transparency and fair pricing stand at the forefront, ensuring a trading environment free from manipulation tailored for forex traders worldwide.

https://solidecn.com >>> %15 Bonus | Swap Free | Raw Spread | RegulatedThough trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Euro Hits New High Amid ECB Meeting Anticipation and Inflation Data Insights

Solid ECN – The euro rose sharply to $1.085, reaching its highest point since February 1. This spike was due to investors focusing on the European Central Bank's (ECB) next meeting about monetary policy later this week. They are looking for new information on the ECB's plans. Although the bank is expected to keep interest rates high, market participants are eager to hear any updates to economic forecasts and hints from ECB President Christine Lagarde about when borrowing costs might start to decrease.

Recent data showed that inflation in the Eurozone dropped again last month, making it the second month of decline, with a rate of 2.6% in February—a bit higher than the predicted 2.5%. The fundamental inflation rate also fell to 3.1%, above the expected 2.9%. This information suggests that the ECB is careful before reducing monetary policy measures.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

RSI Indicator Predicts GBPUSD Bullish Trend Continuation

Solid ECN – The GBPUSD currency pair has climbed above 1.2709, exceeding the 61.8% Fibonacci resistance level. RSI and Awesome Oscillator support this rise, which suggests continuing the trend. The RSI has room to reach the 70 level, which can be interpreted as the market not being overbought yet. This indicates that the pound sterling will likely target the bullish channel's upper band against the U.S. dollar.

Please note that the bull market will remain valid if the pair trades above the 50% Fibonacci retracement level.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Thread: Market Update by Solidecn.com

Thread: Market Update by Solidecn.com

Copyright © 2024 vBulletin Solutions, Inc. All rights reserved.

Reply With Quote

Reply With Quote