British Pound Falls Amid Economic Challenges in the UK

Solid ECN – The British pound dropped to about $1.26, marking its lowest point since February 19th. This happened because people in the UK stopped spending more in February, and the head of the Bank of England, Andrew Bailey, suggested there might be cuts in interest rates later this year. The Office for National Statistics reported that shopping numbers in the UK didn't change last month.

This was a significant change from January's 3.6% increase and was different from what people thought would happen; they expected a 0.3% drop. At the same time, Bailey did say there were signs that prices were going up less quickly, but he also said it's essential to be sure before making decisions about how to handle the situation.

The Bank of England decided to keep the cost of borrowing money very high, at 5.25%, the highest it's been in 16 years. They made this decision with almost everyone agreeing, even though two people changed their minds about wanting to increase it. This choice was made after seeing that prices weren't rising as fast as before, which hasn't happened in over two years, but prices are still higher than the bank wants.

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- Market Update by Solidecn.com

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,185

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,185

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Explore New Ways to Fund Your Trades!

At Solid ECN Securities, funding your account has become more accessible and diverse! Now, you can manage your funds using over 50 cryptocurrencies, from Bitcoin to Zilliqa. It's all accessible right from the Dashboard> Account funding.

Why the new options?

We want to make your trading as cost-effective as possible. With rising blockchain transfer fees, traders are looking for better alternatives. That's why we've expanded our payment methods to include a vast selection of cryptos.

Choose Solid ECN for your trading needs and enjoy the benefits of our cryptocurrency payment options:

- Secure Transactions

- Private and Confidential

- Completely Decentralized

Join US, EU, and worldwide traders already enjoying these benefits. With Solid ECN, experience unparalleled market transparency – ensuring fair and manipulation-free trading. Dive into the future of forex trading with Solid ECN!

https://solidecn.com >>> %15 Bonus | Swap Free | Raw Spread | RegulatedThough trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,185

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

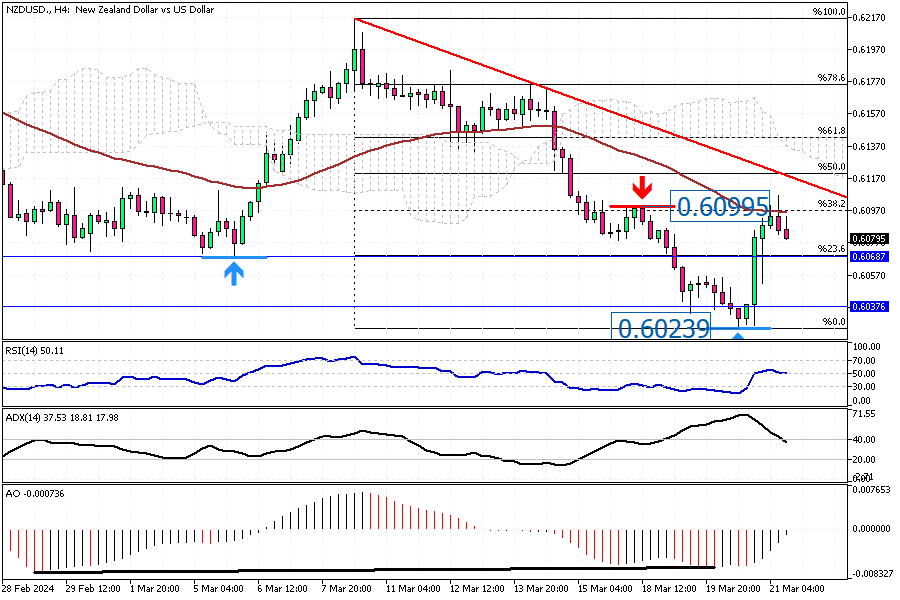

NZDUSD Struggles at the Key 0.609 Mark

Solid ECN – In today’s trading session, the NZDUSD currency pair has risen from the 0.602 resistance area and is currently testing the 50-day EMA at the 0.609 mark.

The Awesome Oscillator has predicted the uptick in the momentum of the New Zealand dollar, as evidenced by the divergence shown in the 4-hour chart. At the time of writing, the U.S. dollar drives the price towards the 0.606 resistance, which aligns with the lower high of March 4 and the 23.6% Fibonacci resistance.

From a technical perspective, the primary trend remains bearish as long as the pair continues to trade below the descending red trendline. In this scenario, the bear market is likely to persist, and a break below the 23.6% Fibonacci support could accelerate the downtrend.

However, if the NZDUSD stabilizes above the 50% Fibonacci resistance, it would invalidate the bear market.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,185

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Bitcoin's March 2024 Rebound: Analyzing the Latest Price Movements

Solid ECN – Bitcoin bounced from its March 2024 low, the $60,700 mark, in yesterday's trading session, Tuesday.

As of this writing, the BTCUSD pair trades at about $67,700, slightly below the Ichimoku Cloud. The 4-hour chart shows that digital gold is trying to stabilize the price above the EMA 50, while the Awesome Oscillator and the RSI have flipped above their signal lines. Therefore, the technical indicators are bullish, but the Bitcoin bulls face the $68,900 barrier to overcome if they wish the price to surge higher.

From a technical standpoint, the downtrend will likely extend if the price stabilizes itself below the EMA 50. This attempt hasn't been achieved so far in today's trading session. Therefore, watch the EMA 50 on the BTCUSD 4-hour chart.

Conversely, the uptrend would continue if bullish traders break the aforementioned barrier. In this scenario, the March higher high, $73,700, would be the initial target for the bull market.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,185

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Euro Rises as Central Banks Discuss Future Rate Cuts

Solid ECN – On Wednesday, the euro climbed to $1.09, bouncing back from its lowest point in two weeks after the Federal Reserve decided not to change its plans for interest rate reductions in 2024. The Fed did not alter interest rates in March, meeting expectations, and hinted at three possible decreases later in the year. Also, the ECB's President Lagarde emphasized in an earlier meeting that they would look at reducing rates in June.

She added a note of caution, stating that the European Central Bank wouldn't lock itself into a set number of cuts, as future decisions will be based on the latest data. Central bank leaders from five countries—Spain, the Netherlands, Ireland, Greece, and Slovakia—have expressed their support for action in June.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,185

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Recent Trends in NZDUSD

Solid ECN – The New Zealand dollar fell below $0.605, reaching close to its four-month low following the Australian dollar's downturn. This happened after the Reserve Bank of Australia decided not to change interest rates, a decision many anticipated. They also removed their previous caution against ruling out future rate hikes. Meanwhile, the Kiwi dollar faced additional pressure due to the upcoming policy meeting of the US Federal Reserve. There's the worry that persistently high inflation in the US might postpone any cuts in Fed rates.

Furthermore, within New Zealand, the expectation is growing that the Reserve Bank of New Zealand may reduce its policy rates starting in August as the rise in prices begins to slow down. As investors wait, they are particularly interested in the upcoming report on the country's economic growth, hoping it will offer more clarity.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,185

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

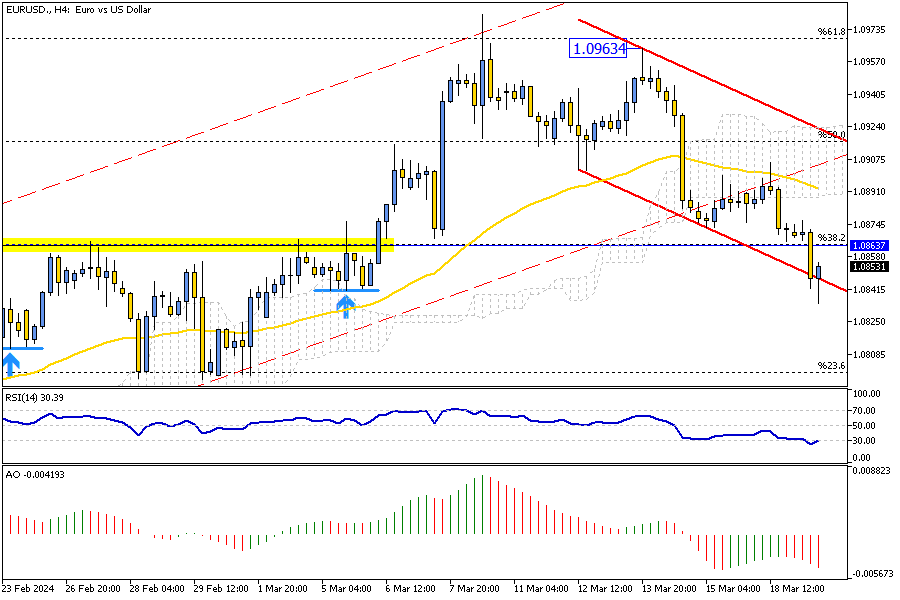

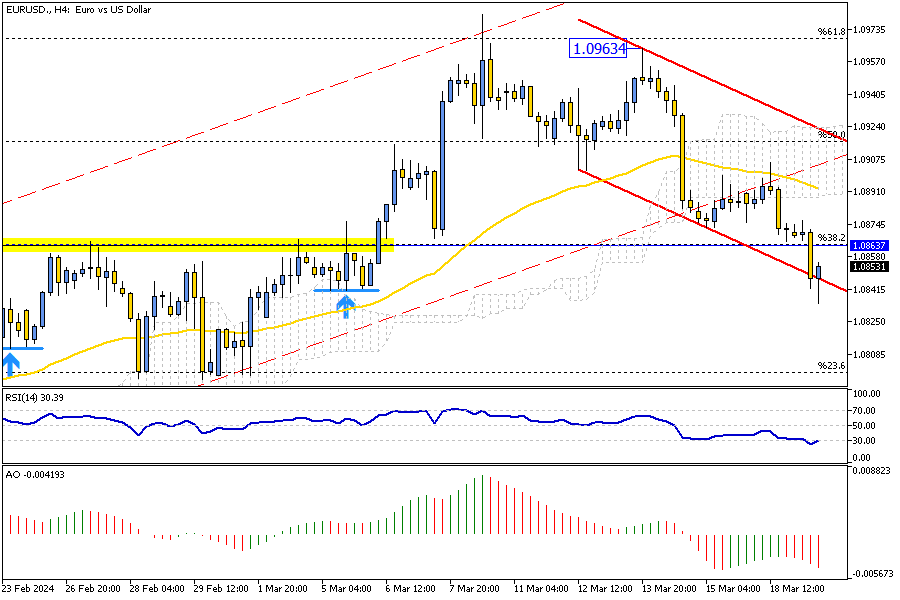

EURUSD Hits New Low: Analyzing the Latest Bearish Wave

Solid ECN – In today's trading session, the European currency dipped toward the 1.08 mark, its lowest since March 1st, against the U.S. Dollar. The drop was expected from a technical perspective because the bears formed an inverted hammer clinging to the EMA 50 yesterday. The failed attempt to cross above the moving average has led the EURUSD price to experience a new bearish wave.

As of this writing, the pair is testing the lower band of the bearish flag. The RSI indicator hovers in the oversold area; therefore, the market might make corrections below the EMA 50 before a new wave emerges.

From a technical standpoint, the primary market is dominated by bears if the price is kept below the cloud. Due to the RSI being in the oversold zone, we suggest waiting for the price to show some correction before joining the bear market. With the price below the mentioned resistance areas, the 23.6% Fibonacci support could be the next target.

The price must flip and stabilize itself above the cloud for the bear market to be deemed invalid.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,185

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Euro Drops as ECB Considers June Rate Cut Amid Slow Growth

Solid ECN – The euro fell toward the $1.08 mark, its lowest since March 1st, as investors processed reports of slower wage increases and cautious remarks from some European Central Bank (ECB) officials. They also looked forward to the Federal Reserve's policy meeting on Wednesday. ECB Vice President Luis de Guindos stated on Tuesday that the bank might consider lowering interest rates in June, highlighting the need for more information before changing policies.

ECB President Christine Lagarde mentioned possibly lowering rates earlier in the month due to falling inflation. The ECB's chief economist, Philip Lane, suggested a rate cut could come in the second quarter. Significantly, central bank leaders from Spain, the Netherlands, Ireland, Greece, and Slovakia, among the ECB's 26 Governing Council members, supported a decision in June.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,185

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

BTCUSD Hits April Low: What's Next for Bitcoin Prices?

Solid ECN – Bitcoin flipped below the Ichimoku cloud in last week's trading session. The decline continued this week, and today BTCUSD hit a new low for April, trading below the $64,400 mark. Interestingly, the RSI and the Awesome Oscillator also point to a bear market. In addition to RSI and Ao, the ADX climbs to 40, signifying that the downtrend is strengthening.

From a technical standpoint, the EMA 50 and the upper band of the bearish channel, marked in red, act as resistance levels. If Bitcoin's price remains below $67,000, the next target is likely the $60,000 mark.

Conversely, for the uptrend to resume, the price must cross above the EMA 50 and maintain its position above it.

Noteworthy

It's important to note that the primary market is bullish, and the current downward momentum is considered a consolidation phase. During this phase, major players collect profits by sweeping the floor from retail traders.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,185

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

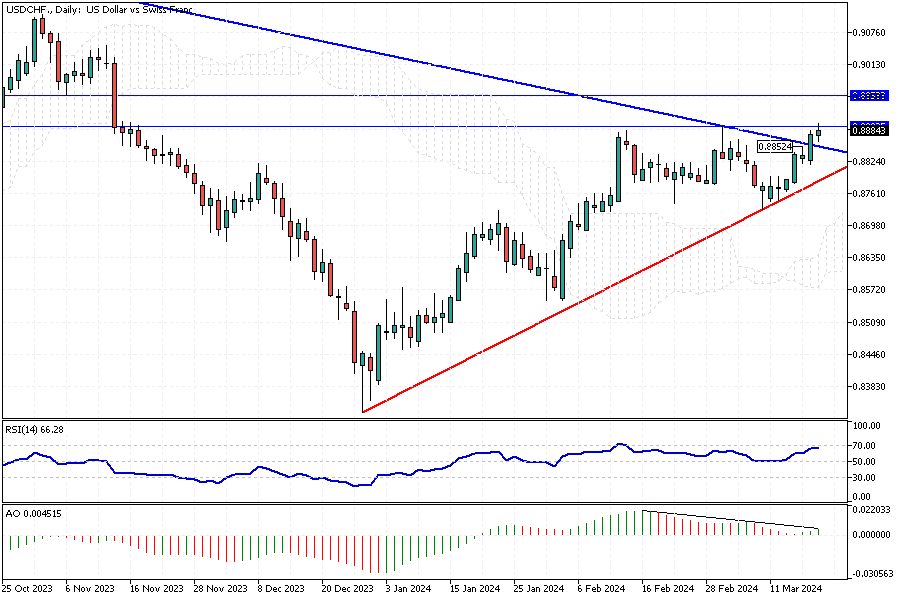

USDCHF Hits New Heights Post-Wedge Breakout

Solid ECN – The U.S. Dollar broke out from the wedge pattern in today's trading session against the Swiss franc and is testing the 0.889 barrier as of writing.

The Awesome Oscillator signals divergence, which could be interpreted as a sign that a consolidation phase is likely on the way. Therefore, the price might dip to 0.885 before a new bullish wave begins. Interestingly, the RSI indicator is nearing the overbought zone, signaling the same as the AO.

From a technical standpoint, the ascending trendline in red supports the bull market. As long as the pair trades above this level, the primary trend will remain an uptrend. In this scenario, the market will likely surpass the 0.889 resistance and aim for the next target, the 0.895 mark.

P.S. For the uptrend to resume, the market must pass and stabilize the price above the 0.889 mark.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Thread: Market Update by Solidecn.com

Thread: Market Update by Solidecn.com

Copyright © 2024 vBulletin Solutions, Inc. All rights reserved.

Reply With Quote

Reply With Quote