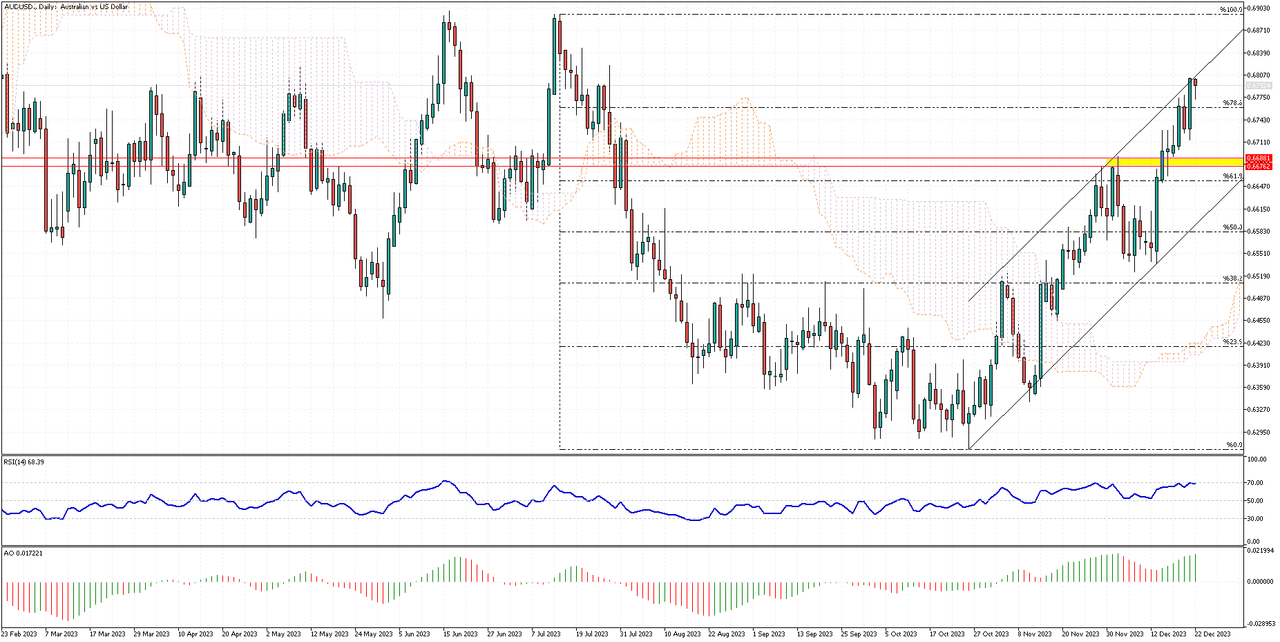

AUDUSD: Buy or Wait?

The AUDUSD's rise is still going strong, moving near the top of its bullish trend. Yet, in today's market, the pair approached the 78.6% Fibonacci level, with the RSI near 70. This means the pair isn't overvalued despite the ongoing uptrend.

For those with smaller budgets, buying now may not be the best move. It's better to wait for a slight price drop. If the price dips below 78.6%, it could fall to the support zone between 0.6681 and 0.6676, a better buy-in point for those bullish on AUDUSD.

However, buying the Australian dollar now isn't advisable, strong trend or not. The market looks overbought, and AUDUSD is likely to lose some value. A smarter strategy is to wait for a drop before joining the upward trend.

With its upward momentum, the pair might reach its June 2023 high.

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- Market Update by Solidecn.com

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,171

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 8 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (8)

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,171

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

UK Pound Rises Amid Economic Shifts

Solid ECN – The UK pound recently surged past $1.27, driven by investor reactions to fresh economic data and predictions about future monetary policies. Recent reports have painted a mixed picture of the UK's economic health. The third quarter showed a shrinkage in the economy, a downturn further emphasized by revised figures from the second quarter, signaling a looming recession risk. On a brighter note, retail sales in November surpassed expectations.

Inflation trends are also shifting. The latest Consumer Price Index (CPI) report indicates a drop in UK inflation to 3.8%, significantly lower than the anticipated 4.4%. Additionally, core inflation has fallen to 5.1%, which is below the forecasted 5.6%. These changes have led traders to strongly anticipate interest rate cuts by the Bank of England (BOE) in the coming year. Market expectations suggest a total decrease of 143 basis points, translating to five quarter-point reductions and a 70% likelihood of a sixth cut. However, this contrasts with BOE Governor Andrew Bailey's insistence on keeping rates higher for a longer duration.

Despite the recent slowdown, inflation in the UK remains nearly double the BOE’s 2% target and is the highest among the Group of Seven nations. This situation poses a delicate balance for policymakers, who must navigate between supporting growth and controlling inflation.

Economic Implication

In a fundamental analysis, the future of the UK economy hinges on several factors. The anticipated interest rate cuts could stimulate spending and investments, potentially aiding in recession recovery. However, persistent high inflation remains a challenge. If inflation continues to outpace targets, the BOE may need to reconsider its stance on rate cuts to prevent further devaluation of the pound and manage cost-of-living increases. The economic outlook will largely depend on the BOE’s ability to balance these competing priorities and the government's measures to support economic growth.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,171

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Yen Holds Firm as Japan Sees Inflation Ease

Solid ECN – In a recent update, the value of the Japanese yen remained stable at approximately 142.2 against the US dollar. This steadiness occurred despite new data indicating a decrease in Japan's inflation rates. November saw both the main and core inflation rates drop to the lowest they've been in 16 months, recording figures of 2.8% and 2.5%, respectively. Notably, the core inflation rate has been over the Bank of Japan's target of 2% for twenty consecutive months.

Earlier in the week, the yen faced some downward pressure. This was largely due to the Bank of Japan's decision to continue its very accommodative monetary policy. The bank did not hint at any potential shifts towards more standard policies in the upcoming year. The Bank's Governor, Kazuo Ueda, emphasized in a press conference that the bank is prepared to implement further easing measures if they become necessary.

In contrast, recent economic data from the United States has led to speculation that the Federal Reserve might begin to reduce interest rates next year. This expectation has lent some support to the yen.

Economic Implication

From an analytical perspective, the economic future appears to hinge on several factors. Japan's persistent core inflation above the target suggests an underlying economic resilience, possibly influencing the Bank of Japan's monetary policy decisions in the future. However, the bank's readiness to introduce further easing measures could signal a cautious approach towards economic uncertainties. Internationally, the US Federal Reserve's potential interest rate adjustments could impact the yen, either stabilizing or fluctuating its value against the dollar.

Overall, careful monitoring of these domestic and international economic indicators will be crucial in forecasting the yen's trajectory and Japan's economic health.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,171

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Ibovespa Hits Record High

Solid ECN – On Thursday, the Ibovespa index climbed 0.8%. It reached over 131,800, a new high. This rise followed a loss in the previous session. The upbeat mood in Wall Street influenced this. Investors think the Federal Reserve will soon lower interest rates. This hope caused a drop in future interest rate expectations in Brazil. It also supports a positive view of Brazil's central bank. This mood is good for stocks in emerging markets.

Vale, a big company, saw its shares rise almost 3%. This was due to higher iron ore prices. In other news, Braskem, despite a police probe into its mining in Maceio, saw its shares go up.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,171

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Gold Nears $2,040 Amid Rate Cut Hopes

Solid ECN – Gold climbed to near $2,040 per ounce on Thursday. It recovered from earlier losses, driven by strong beliefs that the US Federal Reserve will reduce interest rates next year. Also, a big drop in stocks created a demand for safe investments like gold.

Even though Federal Reserve officials opposed the idea of many rate cuts next year, the market still thinks there's a 70% chance of a rate cut in March. Investors are now waiting for US economic growth data on Thursday and the core personal consumption expenditures (PCE) index on Friday for more clues. In the UK, inflation in November fell to its lowest in over two years, suggesting a possible worldwide trend of rate cuts. In other news, the Bank of Japan kept its very relaxed monetary policy, and the People’s Bank of China did not change its main lending rates.

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,171

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Offshore Yuan Slips to 7.15

Solid ECN – The offshore yuan dropped to around 7.15 per dollar, moving down from its six-month high. This happened because China's central bank did not change its main lending rates, even though there was pressure to loosen monetary policy due to a weak economic recovery.

The People’s Bank of China kept its one-year rate at 3.45% and its five-year rate at 4.2%, as many had expected. Now, markets are looking forward to possible rate cuts next year and maybe a lower reserve requirement ratio to keep enough money in circulation. Experts believe that China’s low inflation and slow economic growth justify this expectation. However, the yuan is still strong because the US Federal Reserve might start to cut interest rates next year. Also, the Bank of Japan has not said anything about changing its policies in 2024.

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,171

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

EURUSD Trades Below $1.1

Solid ECN – The EURUSD currency pair is currently trading at less than $1.1. The participants are forecasting a potential dip in the Euro zone interest rates. Francois Villeroy de Galhau from France hinted on Tuesday that a rate cut might be on the horizon next year. The goal would be stabilizing inflation at 2% no later than 2025.

However, Yannis Stournaras of Greece has a more conservative approach, insisting that inflation should be kept under 3% by the middle of the following year before considering a reduction in borrowing costs. Despite inflation falling to 2.4% in November, economic analysts are predicting a possible surge in the latter part of the year.

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 4 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (4)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,171

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

France's Manufacturing Sector: A Mixed Outlook for 2024

Solid ECN – In December 2023, France's manufacturing sector showed signs of positive change. The manufacturing climate indicator, a measure of the health of the industry, reached 100, the highest level since July. This increase, up from 99 in November, surpassed expectations of 98. Key factors behind this rise included a more positive view from industrialists about recent production, moving from a negative perception (-9) in the past to a neutral stance (0). Additionally, there was a slight improvement in the inventory of finished goods, with the index moving from 13 to 14.

However, not all aspects were upbeat. The overall order books didn't show any change, remaining at a low level (-17), though foreign orders saw a marginal improvement. Concerns emerged regarding the future, as manufacturers' expectations for their own production dropped slightly, and their outlook on selling prices also deteriorated.

An encouraging sign was the decrease in perceived economic uncertainty, which fell to 25 in December from 28 in November. This suggests that manufacturers are becoming slightly more confident about the economic environment.

France Manufacturing Sector: Economic Implication

Looking ahead, these mixed signals in France's manufacturing sector offer a nuanced view of the economic future. The improvement in the manufacturing climate indicator and the reduction in uncertainty are positive signs, indicating potential growth and stability in the industry. However, the stagnant order books and cautious outlook on production and pricing point to ongoing challenges. The sector might experience moderate growth but will likely continue facing hurdles, such as fluctuating demand and pricing pressures.

Overall, while the immediate future seems cautiously optimistic, the long-term outlook remains uncertain, dependent on both domestic and global economic conditions.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 3 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (3)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,171

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Solid ECN: Fast, Transparent Forex and Crypto Trading

Solid ECN stands as a broker that doesn't rely on market makers to process orders. Instead, it pairs up trading parties electronically and forwards orders to those who provide liquidity. As a genuine ECN broker, it aids investors in utilizing the ECN for their trades.

The system powering Solid ECN ensures faster trade executions and more competitive spreads. This comes along with the benefits of increased leverage and enhanced transparency.

We prioritize the security of your investments. For this reason, we separate traders' funds from our assets, keeping them in distinct accounts at leading international banks.

Our approach delivers swift access to liquid markets, ensuring prompt and efficient order fulfillment. We maintain transparency with no hidden fees or manipulative practices. Trading is available around the clock on commodities, Forex, and cryptocurrencies via the MetaTrader 5 platform. Flexible leverage options range from 1:1 to 1:1000, allowing for controlled risk management. The platform is ideal for scalping strategies due to its quick order processing and narrow spreads. Furthermore, hedging options are available to counter inflation or minimize losses.

Solid ECN offers substantial benefits to forex traders globally. The high level of market transparency ensures fair pricing, free from manipulation.

%15 Bonus | Swap Free | Raw Spread | RegulatedThough trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 4 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (4)

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,171

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Fed's Rate Cut Speculation Keeps Gold Near $2,040

On Wednesday, gold's price remained steady at about $2,040 per ounce. This stability is close to the highest it's been in more than two weeks. Despite comments from US Federal Reserve officials, expectations for interest rate reductions next year haven't changed much. Atlanta Fed President Raphael Bostic, echoing other US policymakers, mentioned on Tuesday that there's no immediate need to lower US interest rates, considering the economy's current robustness.

However, the market still anticipates a high likelihood, roughly 75%, of an interest rate cut by March. Looking forward, investors are waiting for the Fed's preferred core PCE price index, set to be released later this week, for more direction. In other news, the Bank of Japan has decided to maintain its very accommodative monetary policy and hasn't hinted at any changes for the coming year. Similarly, the People’s Bank of China kept its key lending rates steady, resisting the push to relax monetary policy further despite a struggling economic recovery.

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 4 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (4)

Thread: Market Update by Solidecn.com

Thread: Market Update by Solidecn.com

Copyright © 2024 vBulletin Solutions, Inc. All rights reserved.

Reply With Quote

Reply With Quote