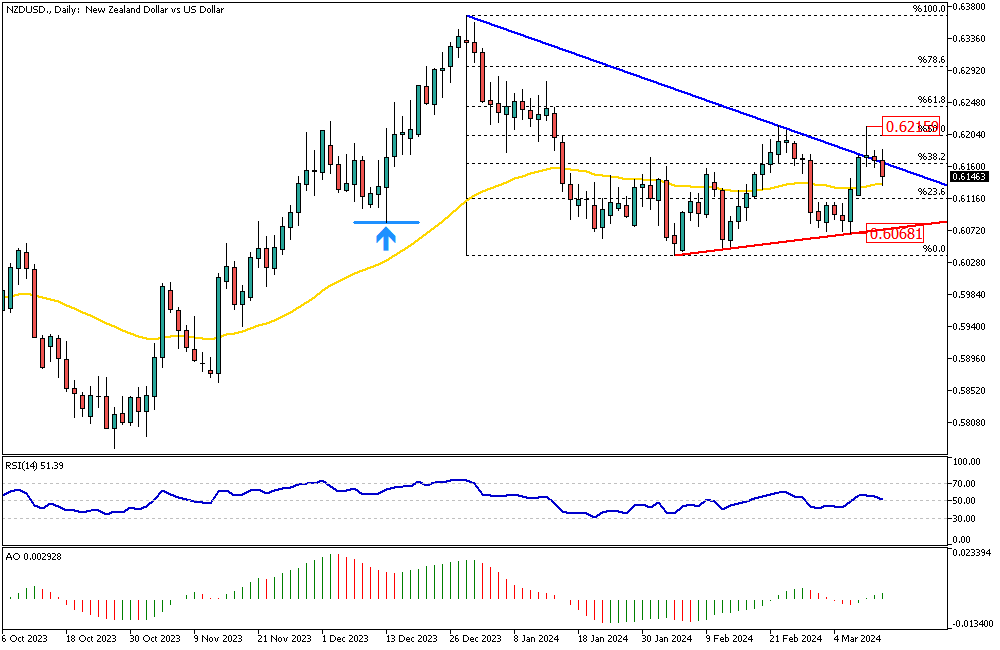

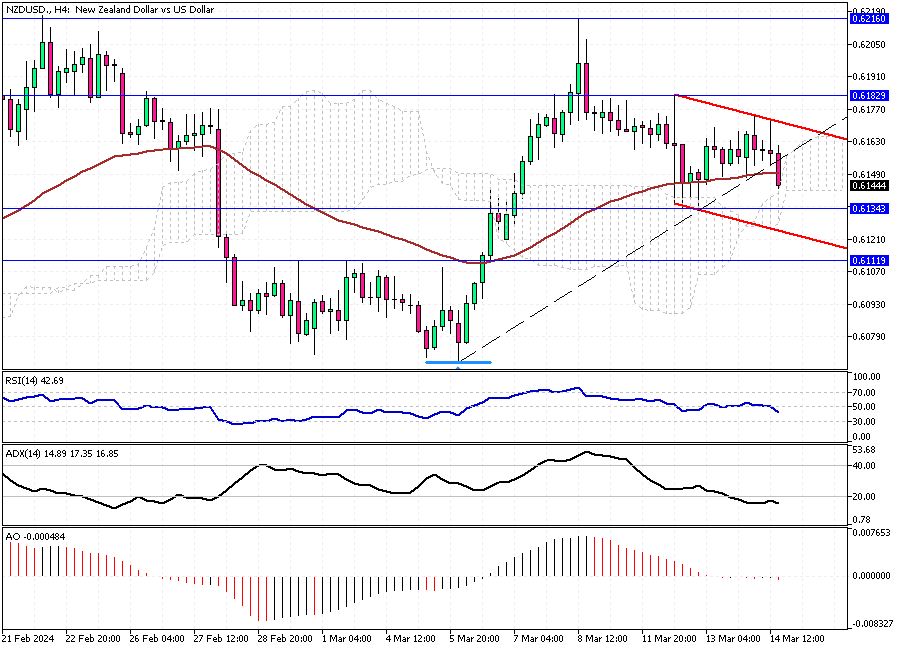

Analyzing NZDUSD: The Battle within the Bearish Channel

In this evening's trading session, the U.S. Dollar is pushing the price in its favor against New Zealand's currency. The technical indicators give mixed signals; therefore, we rely on the price action and the support and resistance areas.

From a technical standpoint, the pair trades within a narrow, bearish channel, which can be interpreted as a sideways market. The level at 0.613 acts as support; if this level is breached, the NZDUSD will likely dip to the next support, which is located at about 0.6111.

Conversely, the price must surpass 0.6182 for the uptrend to continue. In this case, March's higher high would be retested.

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- Market Update by Solidecn.com

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

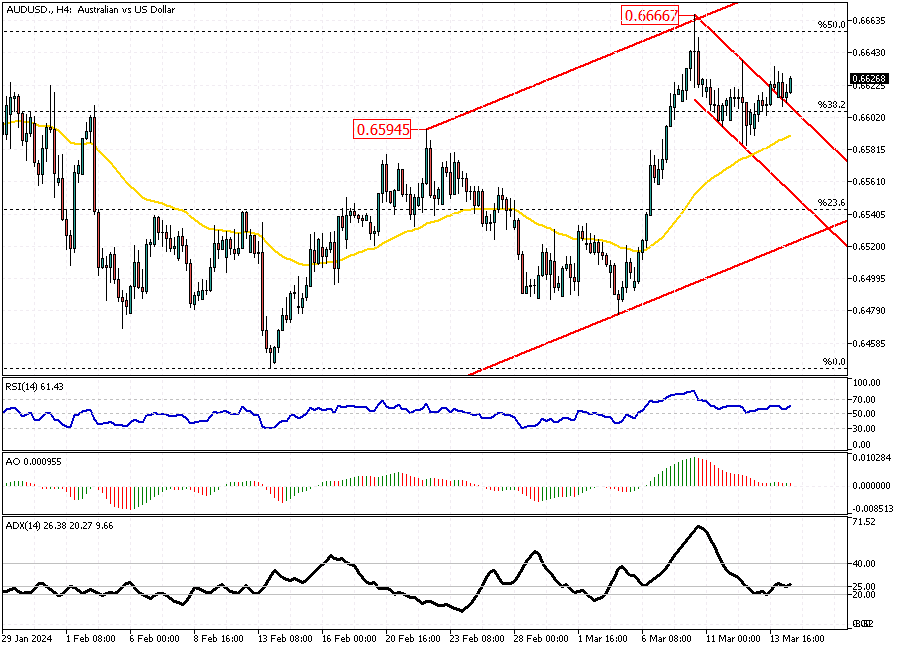

Australian Dollar Outlook: Bullish Trends and EMA 50 Support

Solid ECN – The Australian dollar has stabilized above the 38.2% Fibonacci support level and the previously broken descending channel. Interestingly, the ADX indicator is making a return above the 25 level, interpreted as a sign that a new trend is on the horizon. This signal from the ADX aligns with the RSI, where it hovers above the 50 level.

From a technical standpoint, the EMA 50 supports the bullish bias on the currency pair. If the price stays above it, the next target for buyers would be the upper band of the bullish channel, which coincides with the 61.8% Fibonacci resistance level.

Conversely, the EMA 50 acts as the critical pivot between the bull and bear markets. The uptrend should be considered invalidated if the U.S. Dollar pushes the Australian dollar below the mentioned moving average.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

GBPUSD's Next Move: A Crucial Phase Beyond Fibonacci Resistance

Solid ECN – As anticipated, the pound sterling is on an upward trajectory against the U.S. Dollar, and this uptrend persists. The RSI indicator remains above 50, while the ADX signal, hovering around the 20 level, does not indicate significant volatility. Apparently, the market awaits for the price to surpass 50% Fibonacci resistance before adding new bets on the current trend.

From a technical perspective, the bulls have already disregarded the previous day's high, and momentum is likely to continue rising after a minor struggle with the aforementioned Fibonacci level. If this scenario comes into play, the 78.6% level would be the next target.

Please note, dear traders, the bull market is robust, and for it to be invalidated, the price must dip below the Ichimoku cloud.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

Discover Easy Trading with Solid ECN Account Types!

At Solid ECN, we're all about allowing you to trade your way on the MetaTrader 5 platform. Whether you're just starting or selling for a business, we've got the perfect setup for everyone. Dive into trading with options that suit everyone—from solo adventurers to big-time players. With our top-notch platforms, you can experience different spreads and lightning-fast trades.

Pick the perfect account that fits and is tailored just for you. And don't worry; we've got your back with fantastic trading conditions and super-speedy executions to help you hit your trading targets.

Are you new to the market or a seasoned pro? It doesn't matter at Solid ECN! Enjoy tight spreads starting from 0 pips and super-fast trades that match you with the best prices. Plus, our world-class support is here for you every step of the way.

Step into the world of Solid ECN – where trading is made simple for everyone.

https://solidecn.com >>> %15 Bonus | Swap Free | Raw Spread | RegulatedThough trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

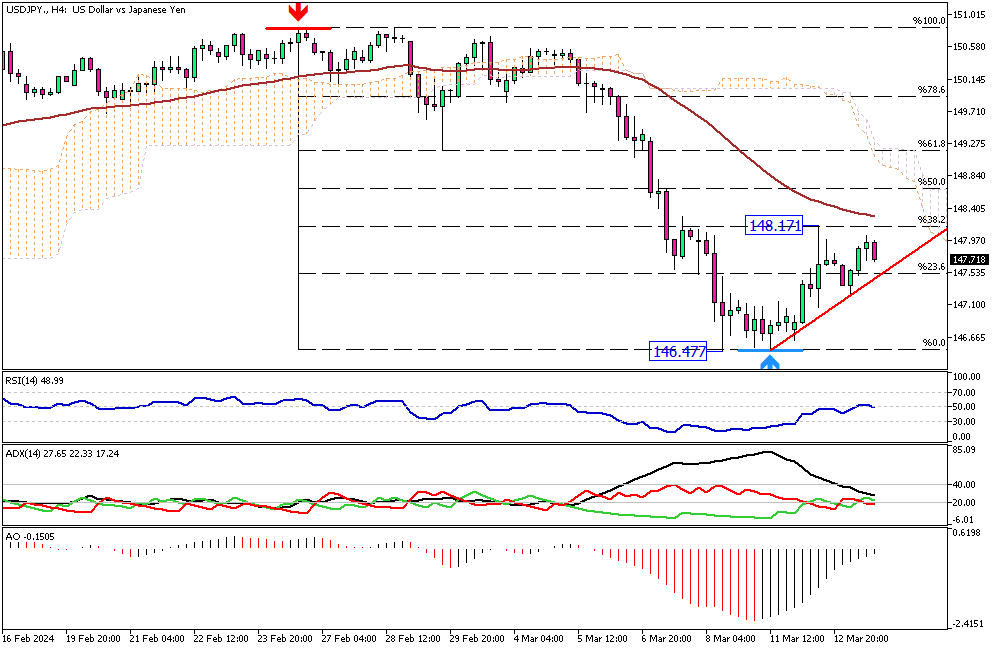

Mixed Indicators for the USDJPY

The U.S. dollar recovered from 146.4 and tested the 38.2% Fibonacci resistance at 148.1. The EMA 50 and the Ichimoku cloud reinforce this resistance level, making it more robust.

The RSI and the AO indicators signal a bull market; however, the ADX indicates a slowdown in market momentum, which could be interpreted as a halt in the recent uptick bias.

From a technical standpoint, we are in a bear market, and the current bullish wave could be a consolidation phase. Therefore, the market will likely decline if the price remains below the EMA 50. A break below the ascending trendline, depicted in red, can trigger selling pressures.

Conversely, if the USDJPY bulls can cross the EMA 50 and stabilize the price above it, the bear market should be invalidated, and traders should reevaluate the market.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

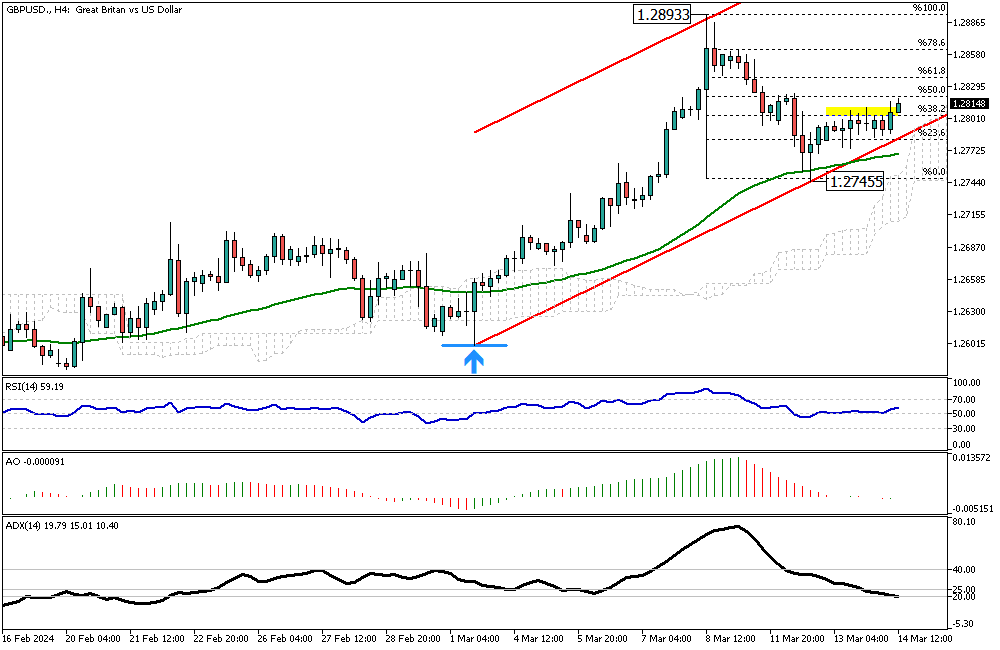

GBPUSD Uptrend Signals: RSI Indicator's Positive Shift

Solid ECN – The pound sterling is coming back from the 50 EMA, and as of writing, it is trading at about 1.279. The ascending trendline depicted in red provides support alongside the EMA 50. Interestingly, The RSI indicator has returned above the signal line, indicating that the uptrend will likely resume.

From a technical standpoint, as long as GBPUSD trades above the 1.2745 mark, the bull market will remain valid and will likely aim for the 50% Fibonacci resistance, followed by the 61.8%.

Conversely, a dip below the EMA 50 would invalidate the bullish market.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

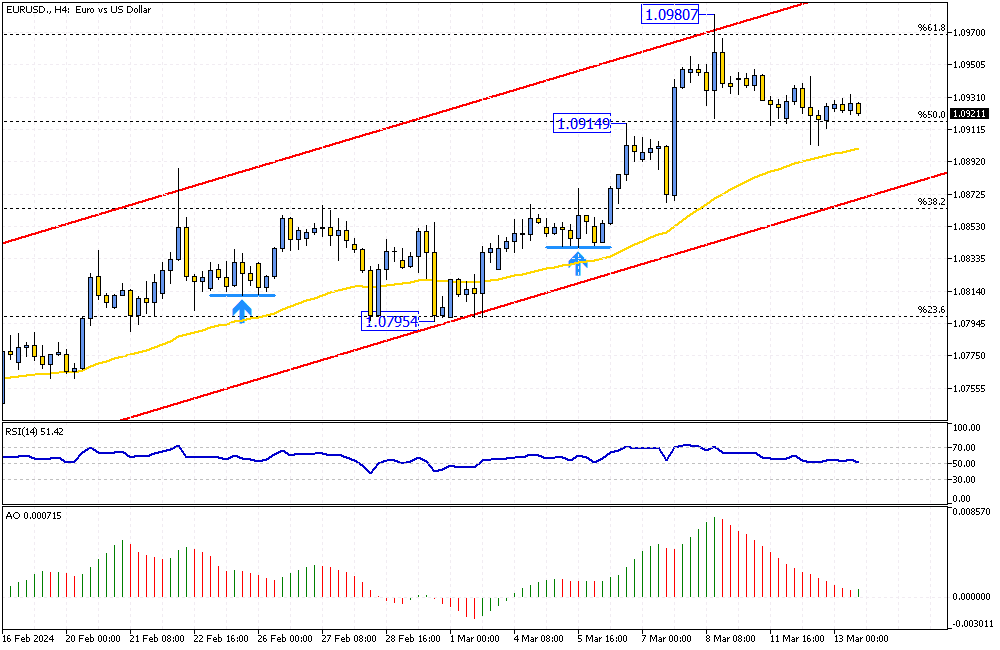

EURUSD's Bullish Momentum: Indicators and Support Levels

The EURUSD currency pair consolidates its recent gains above the 50% Fibonacci support level, the 1.091 mark, where it formed a hammer candlestick pattern.

As of writing, the Euro trades at about 1.092, with the RSI indicator hovering above 50, which can be interpreted as a signal for the continuation of the uptrend. The EMA 50 and the lower band of the bullish channel support the current uptick momentum. That said, the bull market is likely to extend and test 1.098 as its first barrier.

Conversely, the 38.2% level divides the bull market from the bear market. Therefore, if the price dips below this level, the bull market should be invalidated.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

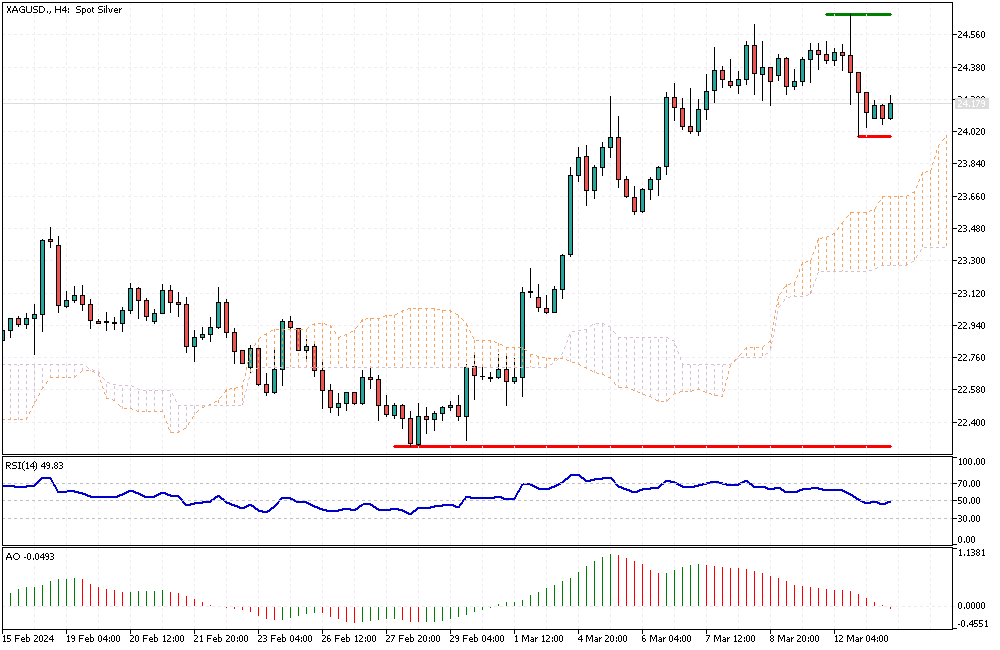

Significant Silver Price Dip from Three-Year High

Solid ECN – Silver's price fell to approximately $24 per ounce, a slight decrease from the three-year peak of $24.4 per ounce in the prior session. This change occurred as investors closely monitored the possibility of the Federal Reserve lowering interest rates following the latest U.S. CPI (Consumer Price Index) figures.

These figures, which showed that the annual and core consumer inflation rates were slightly higher than expected, have significantly influenced the market's anticipation of the Federal Reserve cutting interest rates by June. Earlier, officials from the Federal Reserve and the European Central Bank hinted at potential rate decreases in 2024, which further increased the attractiveness of safe-haven assets like silver.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

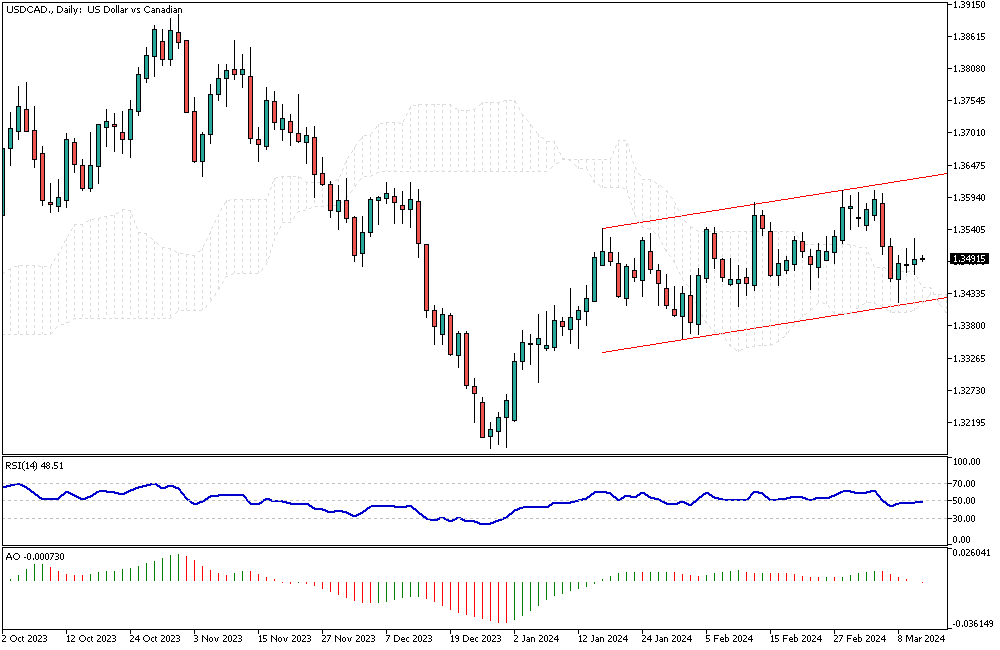

Canadian Dollar Dynamics: Economic Insights and Monetary Policy Updates

Solid ECN – The Canadian dollar is currently valued at around 1.35 per USD, returning from a one-month peak of 1.345 USD recorded on March 7. This drop is primarily due to the stability and strength of the US dollar. Meanwhile, the Federal Reserve is expected to hold interest rates steady at its upcoming March 19-20 meeting, with predictions leaning towards a rate cut in June. This decision comes after the consumer price index indicated a slight increase beyond expectations. Specifically, the overall inflation rate went up to 3.2%, surpassing forecasts, while the core inflation rate decreased slightly to 3.8% from 3.9%, still over the expected 3.7%.

In February, the unemployment rate in Canada increased to 5.8%, aligning with analysts' predictions. The country also witnessed an addition of 42,000 jobs, exceeding the anticipated numbers and showcasing a solid job market. Consequently, this strength allows the Bank of Canada to keep its monetary policy tight, helping curb further drops in the value of the Canadian dollar, also known as the loonie.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,166

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

NZDUSD's Critical Levels: EMA 50 as the Decisive Barrier

Solid ECN – The NZDUSD currency pair failed to stabilize the price above the 38.2% Fibonacci support level, and consequently, it dipped below the descending trendline depicted in blue. The EMA 50 is currently preventing the price from dipping further. If this price breaches the 50-exponential moving average, the next target will likely be 0.6068, followed by the February low.

The 0.6215 mark is the pivotal point between a bull and bear market. If the New Zealand dollar breaks this resistance against the U.S. Dollar, the previously mentioned forecast should be invalidated, and traders must reevaluate the market accordingly.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Thread: Market Update by Solidecn.com

Thread: Market Update by Solidecn.com

Copyright © 2024 vBulletin Solutions, Inc. All rights reserved.

Reply With Quote

Reply With Quote