Wall Street Braces for Fed Meeting and CPI Data

On Monday, Wall Street's primary indexes displayed a muted demeanor as investors' focus turned to significant upcoming events: the Federal Reserve's interest rate meeting and the U.S. inflation report, both due later in the week. The general market sentiment suggests that a halt in rate hikes is already factored into current prices. However, investors are vigilantly looking for clues about when the Fed might adjust interest rates in the upcoming year.

Inflation Data and Its Impact

The Consumer Price Index (CPI) report, scheduled for release just before the Fed meeting, is crucial as it provides insights into inflation trends. For November, it is anticipated that the headline inflation figures will show no significant change. Such data is vital as it influences the Federal Reserve's decision-making regarding monetary policy, which in turn affects the economy's overall health.

Individual Stock Movements

In the realm of individual stocks, Macy's witnessed a 16% surge after an investor group proposed a $5.8 billion bid to privatize the department store chain. In parallel, health insurer Cigna's shares climbed 14%. This increase came after the company decided against acquiring its competitor Humana and instead announced a massive $10 billion share repurchase program.

Index Performance and Economic Outlook

As for the broader market indices, the S&P 500 slightly declined by 0.1%, settling at 4,600 points. Meanwhile, the Dow Jones Industrial Average and the Nasdaq Composite showed minimal changes. This subdued activity follows a recent surge that had driven these indices to their highest points since early 2022.

Assessment of the Market Scenario

This cautious approach in the stock market reflects investor sensitivity to macroeconomic indicators and policy decisions. While individual stock movements like Macy's and Cigna's provide short-term trading opportunities, the broader market's performance is more indicative of economic confidence. A stable or declining inflation rate can signal a healthier economic environment, potentially leading to more robust stock market performance in the long term.

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- Market Update by Solidecn.com

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to Solid ECN For This Useful Post:

Unregistered (1)

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

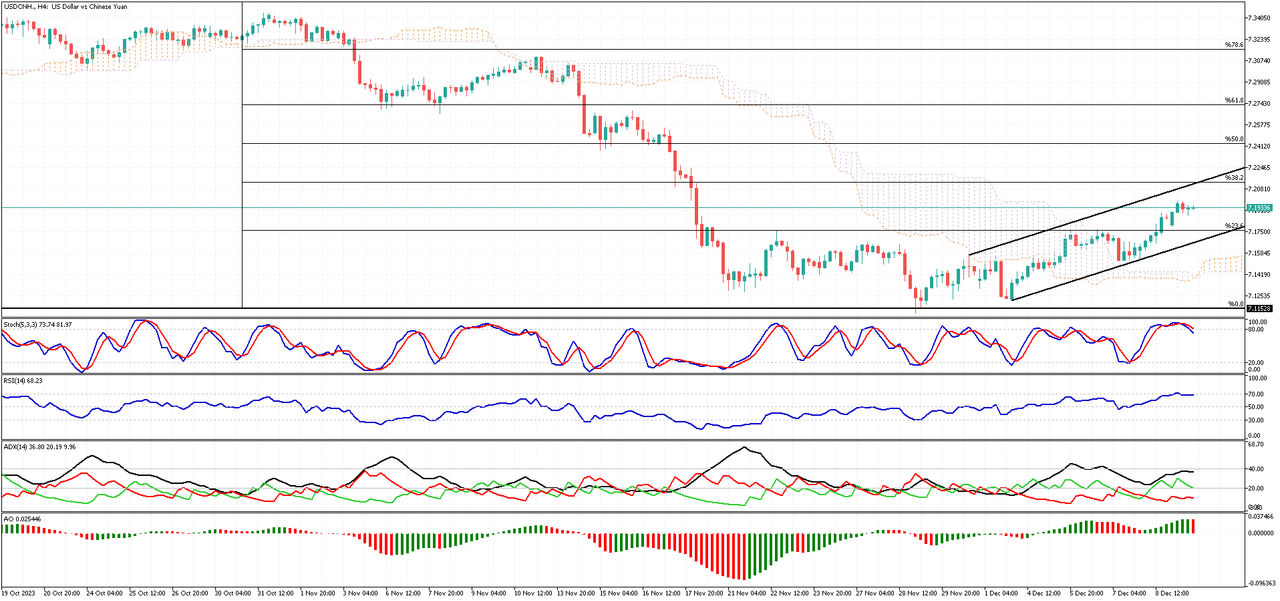

Analyzing the Recent Drop in Offshore Yuan Against the Dollar

Solid ECN - The offshore yuan has recently experienced a notable decline, reaching around 7.20 against the US dollar. This represents its lowest level in three weeks. The primary reason for this drop is the ongoing deflationary pressures in China, indicating that the country's economy is grappling with reduced domestic demand.

Economic Data and Its Implications

Recent statistics released over the weekend have highlighted this economic challenge. Consumer prices in China fell by 0.5% year-on-year in November, a more significant decrease than October's 0.2% drop and below the expected 0.1% decline. Additionally, producer prices witnessed a 3% fall last month. This marks the 14th consecutive month of decline in the Producer Price Index (PPI) and is the most rapid drop since August.

These figures are critical as they reflect the purchasing trends and production costs within the economy. Persistent deflationary pressures can indicate an economic slowdown, as falling prices often lead to decreased consumer spending and business investment.

Future Economic Indicators and External Influences

Investors are now turning their attention to upcoming economic data and the loan prime rate decisions from China's central bank, which will provide further insights into the economic trajectory. Externally, the yuan is also feeling the impact of a globally strong US dollar. This strength is partly due to unexpectedly robust US jobs data, which suggests that the Federal Reserve might not reduce interest rates as soon as previously thought, in March 2024.

Impact on the Economy

This situation presents a mixed bag for China's economy. On one hand, a weaker yuan can make Chinese exports more competitive on the global market. However, persistent deflation and reduced domestic demand can hinder economic growth and stability. Moreover, the interplay between domestic economic challenges and external pressures like the strong US dollar creates a complex environment for monetary policy decisions.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to Solid ECN For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Yen Falls as Dollar Strengthens, BOJ Policy in Focus

The value of the Japanese yen has recently seen a significant decline, falling beyond 145 against the US dollar. This change comes after a period of strength for the yen, which had reached a four-month peak. The shift is primarily due to the robustness of the US dollar, bolstered by unexpectedly strong job data from the United States. This information has altered perceptions, with many now doubting that the US Federal Reserve will reduce interest rates in the early part of 2024.

Furthermore, there's been a decrease in expectations for interest rate increases by the Bank of Japan, especially as the bank's monetary policy decision looms on the horizon. Just a week ago, the yen had experienced a surge, jumping by 3.5% to reach about 141.7 against the dollar. This increase was fueled by remarks from Bank of Japan Governor Kazuo Ueda, who hinted that the bank might end its negative interest-rate policy sooner than expected.

In a recent statement to the parliament, Governor Ueda mentioned the potential adjustments in short-term rates, dependent on the prevailing economic and financial circumstances. He indicated that the rates could shift from zero to 0.1%, and eventually to 0.25% or 0.50%. However, he also made it clear that Japan is yet to witness a sustainable increase in inflation that is driven by growth in wages.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to Solid ECN For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Impact of US Jobs Report on Australian Currency

Soldi ECN – The value of the Australian dollar recently dropped to approximately $0.655. This change was largely influenced by a strong jobs report from the United States. In November, the US reported an increase in nonfarm payrolls by 199,000 jobs, which was more than the expected 180,000. Additionally, the unemployment rate in the US decreased slightly to 3.7%, and wages grew unexpectedly. This combination of factors has led to a boost in the US dollar (USD).

Why the Aussie Dollar Weakened

This weakening of the Australian dollar, often referred to as the "Aussie," was also affected by decisions made by the Reserve Bank of Australia (RBA). The RBA decided to keep its policy rate steady at 4.35%. This decision was anticipated and is seen as a way for the RBA to take time and evaluate how previous interest rate increases are influencing the economy, particularly in terms of demand, inflation, and employment.

The RBA has expressed some uncertainty about future household spending. However, it has also noted that inflation is becoming more moderate and that there are signs of the job market becoming less tight.

Australia's Economic Growth

Regarding Australia's economic performance, there was a slight increase of 0.2% in the economy in the third quarter. This growth was less than the forecasted 0.4%, marking it as the slowest growth Australia has seen in a year.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to Solid ECN For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Exploring the Best in Trading Platforms: A Look at Solid ECN MetaTrader 5

There's a common misconception that MetaTrader 5 is merely an updated version of MT4. However, this isn't the case. While MT4 was specifically designed for the Forex market, MetaTrader 5 takes it a step further. It's engineered for trading in CFDs, Stocks, and Futures. Essentially, MetaTrader 5 caters to those who are more experienced in the trading arena.

At Solid ECN, we conducted a survey among traders and discovered an intriguing trend: even beginners and less experienced traders are increasingly opting for MetaTrader 5, overtaking MT4 in popularity!

Why MetaTrader 5 Stands Out

The superiority of MetaTrader 5 is evident in its features:

- Time Frames Galore: MT4 offers 9 time frames, but MT5 expands this to 21, giving technical analysts a more nuanced view of market trends.

- More Pending Order Types: With 6 types of pending orders compared to MT4's 4, MT5 provides greater flexibility.

- In-Chart Market Depth: Unlike MT4, MT5 allows users to access market depth directly within the chart.

- Built-in Economic Calendar: Stay ahead with the economic calendar integrated into MT5.

- Advanced Trading Options: MT5 supports both hedging and netting, while MT4 is limited to hedging.

- Enhanced Analytical Tools: Offering 38 technical indicators, 44 analytical objects, and unlimited charting capabilities, MT5 is a powerhouse for detailed analysis.

- Flexible Order Filling Policies: Catering to advanced traders, MT5 includes options like fill/kill or cancel return.

- uperior Strategy Tester: MT5's multi-threaded strategy tester far outpaces MT4's single-threaded tool.

Given the MetaQuote corporation's announcements about ceasing updates for MT4, it seemed prudent for Solid ECN to adopt the more advanced and future-proof MetaTrader 5 platform.

We're curious about your preferences in trading platforms. Are you using MetaTrader 5, or do you prefer a different platform? Share your reasons with us in the comments below!

%15 Bonus | Swap Free | Raw Spread | RegulatedThough trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to Solid ECN For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Turkey Sees Lowest Unemployment Rate in 11 Years

Turkey’s unemployment rate fell to 8.5 percent in October 2023, the lowest level in 11 years. It was 9.1 percent in September 2023. More people found jobs in October 2023, as the number of employed people increased by 246 thousand to 31.835 million. At the same time, the number of people without jobs decreased by 163 thousand to 2.961 million. The jobless rate was lower for men (7.0 percent) than for women (11.3 percent). More people also joined the labor force, as the labor force participation rate rose slightly to 53.1 percent from 53.0 percent in September 2023. The employment rate also improved to 48.5 percent from 48.2 percent. Moreover, the unemployment rate for young people aged 15-24 years went down to 16.3 percent from 16.7 percent.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to Solid ECN For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Egypt's Inflation Eases, Food Prices Slow Down

In November 2023, Egypt saw its annual urban inflation rate decline for the second consecutive month, reaching a six-month low at 34.60%. This decrease from October's 35.8% rate follows a record peak in September of 38.0%. The current rate remains well above the Egyptian central bank's target range of 5-9%, yet it still surpasses the anticipated market forecast of 34.8%. A contributing factor to this development is the reduced pace of food inflation, which fell to 64.5% from 71.3% in October. On a monthly basis, consumer prices experienced a 1.3% increase, a slight acceleration compared to October's 1.0% rise, which was the most modest in over a year.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 3 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (3)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

China Experiences Steepest Food Price Fall Since 2021

In November 2023, the cost of food in China experienced a notable decrease, dropping by 4.2% compared to the same time last year. This decrease in food prices was more significant than the 4.0% drop observed in the previous month. In fact, this trend of falling food prices has been ongoing for five consecutive months, marking the most rapid decline since September 2021.

A key factor in this decline was the dramatic fall in pork prices, which went down by 31.8%, surpassing the 30.1% decrease seen in October. This larger drop in pork prices was unexpected and is thought to be due to a combination of unusually warm winter weather and a continued adequate supply following the Golden Week holiday in early October. In addition to pork, other food items also saw price reductions, including cooking oils (down by 4.1%), eggs (decreasing by 8.8%), and milk (a slight decrease of 0.3%).

However, not all food categories followed this downward trend. Fresh vegetables, for example, saw a slight increase in price (0.6%), reversing the previous month's decline of 3.8%. Similarly, the cost of fresh fruit accelerated, with prices rising by 2.7% compared to a 2.2% increase in the previous month.

In terms of the economic impact, this trend of falling food prices can have mixed effects. On one hand, lower food prices can benefit consumers by reducing their living expenses, potentially increasing their disposable income and encouraging spending in other sectors. On the other hand, for producers and farmers, falling prices can reduce income and profitability, possibly leading to challenges in the agricultural sector. Overall, the impact on the economy would depend on the balance between these consumer and producer effects.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to Solid ECN For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Bitcoin's Steady Rise: December 9th Update

On Saturday, December 9th, the value of Bitcoin in US Dollars was 44,193, showing a small rise of 33 or 0.07% from the last trading session. Over the past month, Bitcoin's value increased by 18.51%. If we look at the past year, it went up by 157.98%.

Predictions suggest that by the end of this quarter, the price of Bitcoin in US Dollars might decrease to 37,157 and further drop to 30,991 in a year, as per projections from global macro models and what experts anticipate.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 2 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (2)

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

GBPUSD Sees Slight Decline, Predicted to Lower Further

Solid ECN - On Friday, December 8, the GBPUSD experienced a modest decrease, dropping 0.0046 or 0.37% to close at 1.2544, down from 1.2590 in the previous trading session. This shift reflects a slight downward trend in the currency pair.

It is anticipated that the British Pound will trade around the 1.25 mark by the end of the current quarter. Extending the outlook further, over the next 12 months, the Pound is estimated to potentially trade at around 1.20.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to Solid ECN For This Useful Post:

Unregistered (1)

Thread: Market Update by Solidecn.com

Thread: Market Update by Solidecn.com

Subscribe to this thread: 1

Open

Copyright © 2026 vBulletin Solutions, Inc. All rights reserved.

Reply With Quote

Reply With Quote