Bitcoin Tests the Bullish Trendline for Next Moves

Bitcoin's price dipped to as low as $65,796 in today's trading session against the U.S. dollar. As of this writing, the pair is testing the ascending trendline highlighted in red. The technical indicators are not providing valuable information now, so we focus on price action analysis.

From a technical perspective, the trend remains bullish as long as the price stays above the red trendline. However, if bears push and maintain the BTC/USD price below this trendline, the dip could extend further, with the next bearish target potentially being the $68,000 resistance level.

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- Market Update by Solidecn.com

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,147

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,147

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

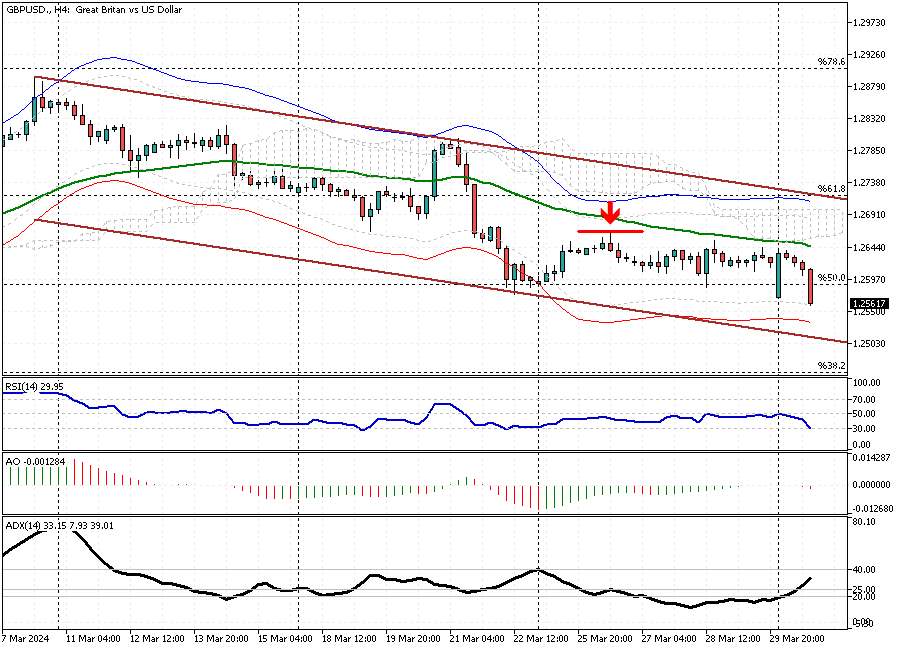

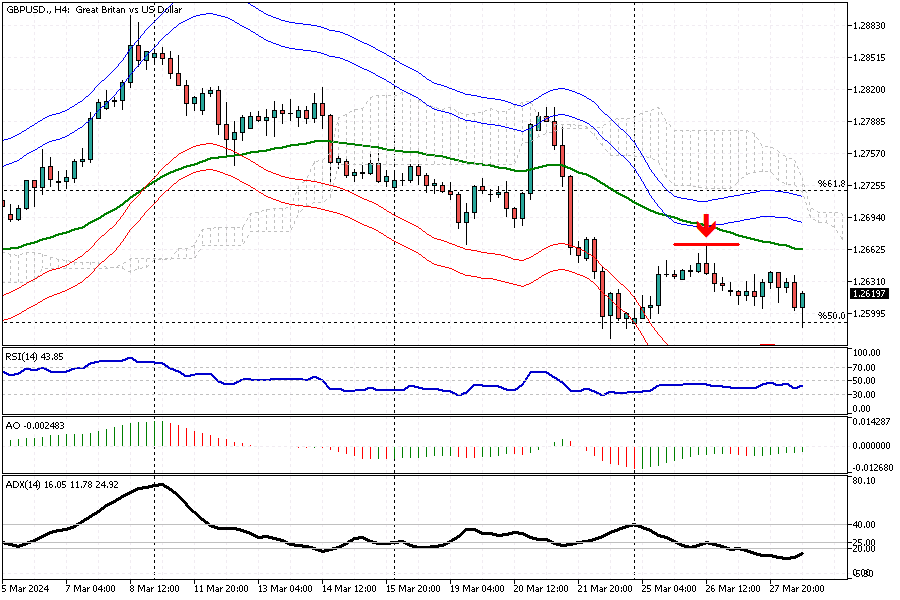

GBPUSD: New Trends and Bearish Targets Unveiled

Solid ECN — The GBPUSD traded within a narrow range last week. The ADX indicator, hovering above the 25 level, suggests a new trend is likely on the horizon. Since the U.S. Dollar broke through the 50% Fibonacci resistance level, it appears that the downtrend that began in early March is set to continue.

The next bearish target is expected to be the flag's lower band, followed by the 38.2% Fibonacci support level.

Please note that the bear market will be invalidated if the price rises above the Ichimoku Cloud.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,147

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

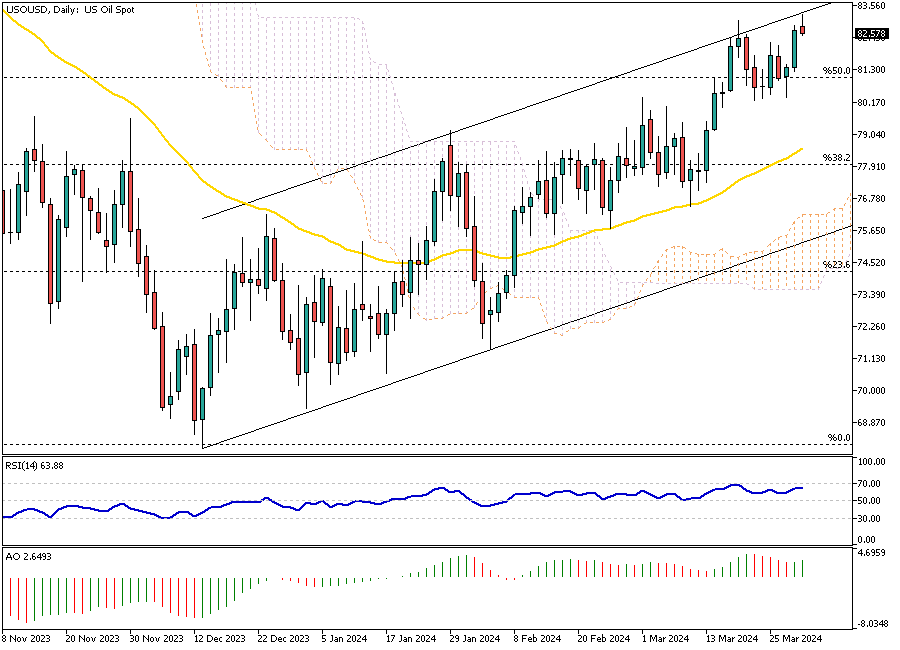

Oil Prices Peak Ahead of OPEC+ Meeting

Solid ECN – On Monday, WTI crude oil prices climbed to about $83.5 a barrel, reaching their highest point in five months. This surge comes as investors eagerly await the upcoming joint ministerial OPEC+ meeting this week. At this meeting, the group plans to examine the current state of the market and how well members are sticking to their production goals.

They are expected to decide to keep their current production levels the same. The Russian Deputy Prime Minister Alexander Novak mentioned last Friday that Russian oil companies should focus more on reducing their oil production than their exports during the second quarter. This is part of Russia's efforts to align with OPEC+'s production targets.

In addition, the market is also paying close attention to how Ukrainian drone attacks on Russian oil facilities and the peace negotiations in Gaza might affect the oil supply.

On the demand side, there's some positive news: recent data revealed that China's manufacturing sector grew in March for the first time in six months, a development that could mean stronger demand for oil from the world's largest importer of crude oil.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,147

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

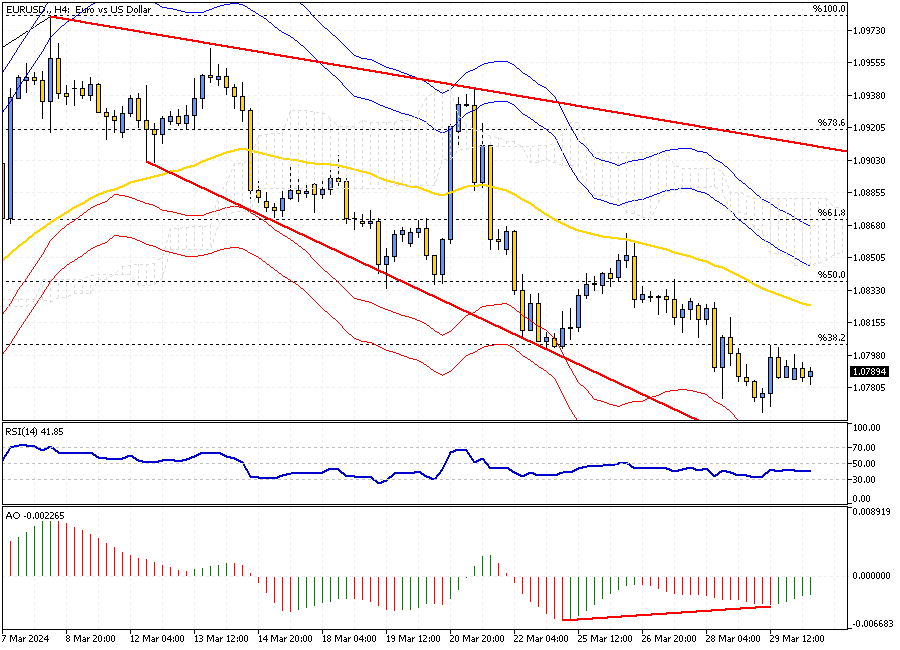

Navigating the Bear Market: Entry Points for EUR/USD Traders

Solid ECN – The U.S. Dollar is stabilizing below the 38.2% Fibonacci level against the European currency today, Monday, April 1st, 2024.

The divergence signaled by the Awesome Oscillator could indicate a potential consolidation phase on the horizon.

From a technical perspective, the primary trend for EUR/USD is bearish. The pair will likely regain some of its losses from last week by rising to the 50% Fibonacci level, which coincides with the EMA 50. This resistance level could provide a suitable entry point for retail traders looking to join the bear market.

Conversely, the bear market should be invalidated if the pair stabilizes above the Ichimoku Cloud.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,147

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

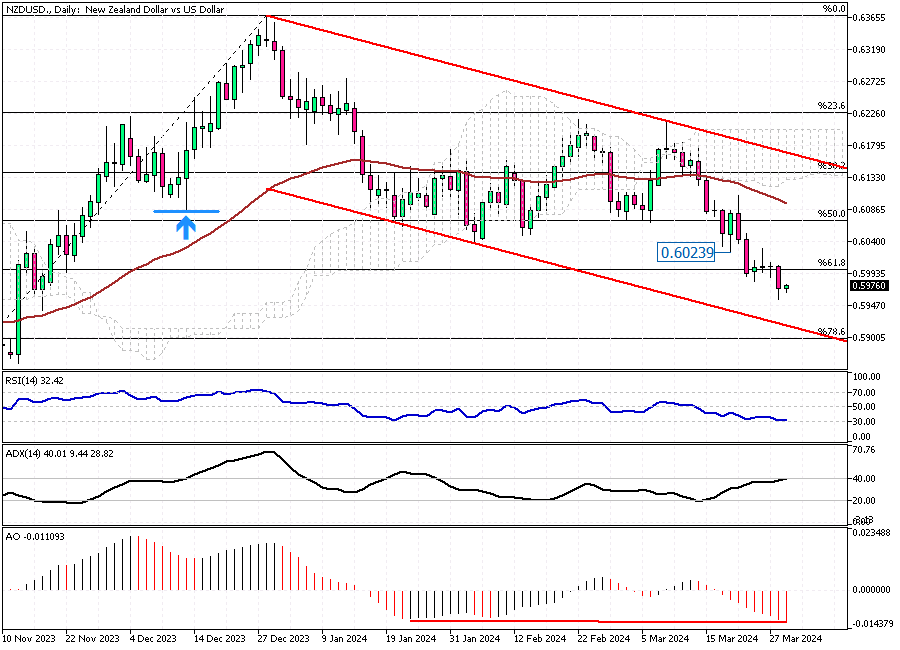

How to Trade the NZD/USD Pullback: Insights from the Awesome Oscillator

The NZD/USD currency pair is currently in a bear market, trading below the 61.8% Fibonacci resistance level. The ADX indicator signifies that the trend is strong on the daily chart, as it nears the 40 level. However, the Awesome Oscillator indicates divergence, suggesting that the New Zealand dollar is likely to experience a pullback to the 0.602 resistance area.

Technically speaking, the next bearish target could be the 78.2% Fibonacci level, but the decline may continue after a consolidation phase. Therefore, the 0.602 level can provide a decent entry point for joining the sellers in the NZD/USD market.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,147

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

AUDUSD's Technical Outlook: Pullback Opportunities in Sight

In today's market, the Australian dollar is losing value compared to the U.S. Dollar. The exchange rate fell below the 0.6503 support level, and it’s currently trading around 0.6493 after a slight recovery from 0.6475.

Despite the bearish trend, the Awesome Oscillator indicates a divergence, suggesting we might soon enter a consolidation phase. This means the AUD/USD pair could temporarily rise, possibly retesting the 0.6503 level and then the 50 EMA, before continuing its downward trajectory.

Technically speaking, the AUD/USD is experiencing a bear market, but there's a chance for a short-term pullback because the Awesome Oscillator is showing divergence. The levels around 0.6503 and 0.6504 could offer good opportunities for those looking to enter the market with this bearish trend in mind.

However, should the pair close above and find stability over the Ichimoku cloud, it would challenge the current bearish outlook and potentially shift the market sentiment.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,147

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

GBPUSD Drops, Awaiting Bank Decisions

Solid ECN – In late March, the British pound fell to just above $1.26, its weakest since February 19, and was on track to lose almost 1% over the quarter compared to the US dollar. This happened as investors paid careful attention to cautious words from bank officials. Fed Governor Waller mentioned that the latest inflation figures back the idea that the US Federal Reserve might not soon lower its short-term interest rate goal, though he didn't rule out cuts later in the year.

In Britain, Bank of England's Haskel stated that it's too soon to consider rate cuts, and his colleague Mann warned against expecting too many rate reductions this year. She suggested it's unlikely the UK would reduce rates before the US.

During its March session, the Bank of England kept its interest rates the same. Two members, who had earlier supported increasing rates, now preferred to wait, leading to a softer approach than many had predicted.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,147

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

Silver Prices Hold Steady as Investors Eye Fed Moves

Solid ECN—Silver prices have stabilized above $24.5 per ounce after hitting almost a one-year high on March 20th. This happens while investors wait for speeches from the Federal Reserve's officials and the key PCE inflation data this week. These events will help them predict if the U.S. will start easing its monetary policy soon. Before this, the U.S.'s main financial authority decided not to change its plan for three interest rate decreases in 2024.

This decision made silver and similar assets without yield more attractive. Since their last meeting, the likelihood of reducing interest rates in June has increased to about 70% from the previous 55%. Meanwhile, the Swiss National Bank was among the first big banks to begin reducing its policies in Europe. Silver continues to be supported as a safeguard against global political tensions, mainly due to ongoing conflicts in Ukraine and the Middle East. Recently, Russia has significantly attacked Ukraine's energy infrastructure.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,147

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

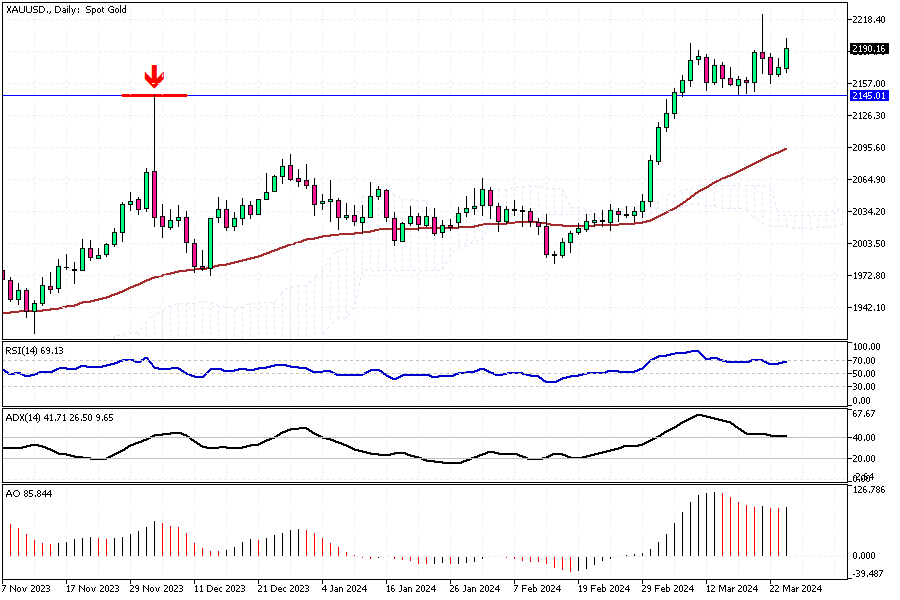

Gold Prices Surge Amid Global Tensions

Solid ECN – On Tuesday, the price of gold climbed to a new peak, approximately $2,190 per ounce. This increase was mainly due to the weakening of the US dollar. Investors are anticipating rate cuts, especially with the upcoming US PCE price index report expected this Friday. Following last week's announcement by the Federal Reserve, which kept its prediction of three interest rate cuts for the year, gold became more attractive.

However, February saw better-than-expected US durable goods orders, and various Federal Reserve officials have voiced concerns regarding persistent inflation and a strong economy. Currently, there's a roughly 70% expectation among markets that the Federal Reserve will begin to lower rates in June, a notable increase from the 55% likelihood anticipated before their last meeting.

Additionally, gold's status as a secure asset is bolstered by rising geopolitical tensions in the Middle East and Eastern Europe, underscored by the UN Security Council's call for an immediate ceasefire in Gaza.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,147

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

Gold Prices Near Record Highs Amid Rate Cut Expectations

Solid ECN – On Monday, the price of gold remained steady around $2,175, nearing its record high of $2,185 set on March 20th. This stability comes amid increasing bets on the Federal Reserve reducing interest rates.

Recently, the Fed kept its forecast, expecting to lower rates three times in 2024, making gold more attractive. Moreover, investors now believe there's over a 70% likelihood that the Fed will cut rates in June, a jump from the 55% probability anticipated before their latest meeting.

This week, all eyes are on important U.S. inflation data and speeches from several Federal Reserve officials for further indications of future monetary policies. Additionally, ongoing conflicts in Russia and the Middle East support gold's status as a reliable safe-haven asset.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Thread: Market Update by Solidecn.com

Thread: Market Update by Solidecn.com

Copyright © 2024 vBulletin Solutions, Inc. All rights reserved.

Reply With Quote

Reply With Quote