Rising Aussie Dollar: A Five-Month High

Solid ECN – The Australian dollar has maintained a strong position, staying around $0.675, which is its highest level in nearly five months. This strength is largely due to the dovish (less aggressive) monetary policies of the US Federal Reserve and the Bank of Japan. These policies have put pressure on the US dollar and the yen, in turn boosting other major currencies, including the Australian dollar, commonly referred to as the Aussie.

Furthermore, the Aussie has been positively influenced by an increase in commodity prices. This rise in prices can be attributed to supply disruptions caused by attacks in the Red Sea. Additionally, the possibility of lower interest rates has also played a role in enhancing the overall demand outlook, thus supporting the Australian dollar's value.

Domestically, the situation is also noteworthy. The latest meeting minutes from the Reserve Bank of Australia (RBA) revealed that the central bank had contemplated raising interest rates for a second consecutive month in December. However, the RBA opted to wait for more data before making such a decision, as there were promising signs regarding inflation.

The RBA has also observed that aggregate demand within Australia has slowed more rapidly than they had anticipated. This slowing of demand is coupled with an observation of an accelerating pace of disinflation (a slowing down in the rate of inflation) in other parts of the world. These factors together contribute to the complex economic landscape that the RBA and the Australian dollar are currently navigating.

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- Market Update by Solidecn.com

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Solid ECN: Guard Against Negative Balances

Solid ECN ensures peace of mind for its traders, especially during market volatility. Committed to maintaining high standards, Solid ECN introduces the Solid-Shield feature. This innovative tool safeguards traders from the risk of a negative balance. Essentially, even in extremely volatile market conditions where margin calls and stop-outs might fail, Solid ECN traders are not liable for any negative balance.

The Solid-Shield feature is designed to automatically reset the balance to zero if it turns negative following a stop-out. This reset process is completely automated, offering an additional layer of financial security to Solid ECN traders.

%15 Bonus | Swap Free | Raw Spread | RegulatedThough trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 4 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (4)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Gold's Rise and Resistance: Fibonacci Analysis

FxNews – In the daily XAUUSD chart, gold recently rebounded from the 50% Fibonacci support level. Now, the metal is trading over the 38.2% Fibonacci support, approaching the resistance zone between $2,047 and $2,057.

Delving deeper with the 4-hour chart, we get a clearer picture of gold's market movements. Here, buyers are striving to keep the price over the 38.2% Fibonacci mark. This bullish trend is backed by various technical indicators. For instance, the RSI indicator is consistently above 50, a good sign for buyers. Moreover, the Awesome Oscillator shows green bars, signaling upward momentum. If this trend continues and the current level holds, we anticipate gold might reach the 61.8% Fibonacci resistance.

Conversely, if gold's price falls beneath its current support, this would challenge the current bullish perspective, potentially leading to a decline in its value.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 6 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (6)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

BoJ's Steady Policy Boosts Tokyo Stocks

Solid ECN – On Tuesday, the Nikkei 225 index rose by 1.4%, reaching 33,219, its highest point in two weeks. The broader TOPIX index also saw an increase, finishing 0.7% higher at 2,334. These gains followed the Bank of Japan's decision to maintain its ultra-easy monetary policy, with a commitment to keeping interest rates low. The bank, however, did not provide any clues about potential changes to this policy in the next year. Most sectors ended the day lower, except for basic materials, which remained relatively unchanged. Real estate emerged as the standout sector, leading the gains, followed by technology and non-cyclical industries. Among individual companies, Tokyo Electron saw a significant increase of 3.7%, with Fast Retailing and Recruit Holdings both gaining 2.2%.

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

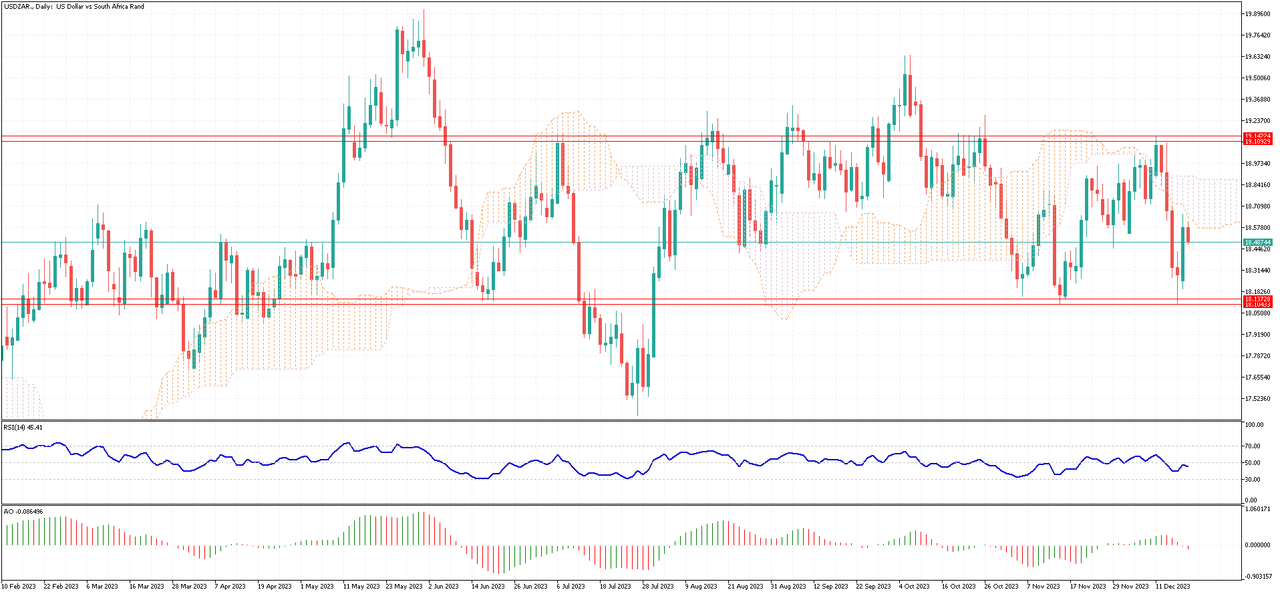

Rand Dips as Dollar Stabilizes

The South African rand is currently trading at about 18.6 against the US dollar, a slight decline from its recent one-month peak of 18.3. This change comes as the dollar finds stability, influenced by several Federal Reserve policymakers who expressed hawkish views. These officials are challenging the extent of the interest rate cuts that the markets were expecting for next year.

In South Africa, the Reserve Bank decided to maintain its main lending rate at 8.25% for the third consecutive meeting on November 23rd, a rate that hasn't been this high in 14 years. The bank continues to highlight ongoing inflationary risks. Notably, the annual inflation rate in South Africa decreased to 5.5% in November 2023. This is a drop from the five-month peak of 5.9% seen in October and brings it nearer to the central bank's target range of 3% to 6%.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 4 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (4)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Swiss Franc Climbs High, Supported by SNB

Solid ECN – The Swiss franc has risen past 0.87 against the USD, reaching its highest level since the end of July. This surge is partly due to a temporary dip in the dollar's strength and ongoing support from the Swiss National Bank. Recent dovish comments from Federal Reserve officials hinting at potential rate cuts next year have put pressure on the US dollar.

Meanwhile, the Swiss National Bank has been actively supporting the franc by selling off its foreign currency reserves. This strategy helps to mitigate the impact of fluctuating commodity prices and keeps import inflation in check, a crucial tool in combating high price growth in Europe. Latest reports show that the Swiss National Bank's foreign exchange reserves have decreased for the sixth consecutive month, hitting a seven-year low in November. On the policy side, the central bank maintained its key interest rate last week and indicated that, despite a slowdown in the country's Consumer Price Index (CPI), inflation risks are still present.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 4 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (4)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

BoJ Holds Rates Steady in Year-End Meeting

The Bank of Japan (BoJ) concluded its final meeting of the year with a unanimous decision to keep its key short-term interest rate at -0.1% and the 10-year bond yields close to 0%, as anticipated. The central bank also decided to maintain the flexible upper limit for long-term government bond yields at 1.0%.

Amidst significant uncertainties both domestically and internationally, the BoJ committed to persist with its monetary easing policy. The board emphasized its readiness to adjust to changes in economic conditions, prices, and financial stability. The ultimate goal of the BoJ is to sustainably reach a 2% price stability target, ideally alongside rising wages. The committee also expressed its willingness to implement additional easing measures if necessary. Recently, the central bank governor, Kazuo Ueda, acknowledged that wage growth is trailing behind the increase in prices, casting doubt on the sustainability of the inflation target level.

Source.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 3 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (3)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Explore Solid ECN's Diverse Account Types

Solid ECN presents a variety of account options on the MetaTrader 5 platform, catering to both individual and corporate clients interested in Forex and Derivatives trading.

Clients, including Retail, partners, and White-Label customers, can access diverse spreads and liquidity through advanced automated trading platforms. Solid ECN offers unique account choices, allowing clients to select the one that best suits their trading preferences. Featuring superior trading conditions and rapid execution speeds, Solid ECN equips traders at all levels with the necessary resources to achieve their trading objectives.

Solid ECN caters to every type of trader, from beginners to seasoned investors, offering a wide array of account types. Our genuine ECN accounts provide ultra-tight spreads starting from 0 pips and swift execution, ensuring clients get the best bid and ask prices, complemented by top-notch customer support.

%15 Bonus | Swap Free | Raw Spread | RegulatedThough trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Dollar Climbs Back, Awaits Inflation Data

Solid ECN – The value of the dollar has seen an uptick, currently hovering around 102.5 this Tuesday. This rise comes after a dip below 102 just last week. The shift in momentum is partly due to comments from officials at the US Federal Reserve, who have been hinting that expectations for a decrease in interest rates might be a bit hasty.

Among the voices urging caution were Chicago's Austan Goolsbee and Cleveland's Loretta Mester, adding to similar sentiments previously expressed by John Williams from New York. Across the Atlantic, the European Central Bank and the Bank of England have held their rates steady, committing to higher rates in the fight against inflation. Market participants are now keenly awaiting the US PCE inflation figures, hoping for a clearer picture of inflation trends.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 3 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (3)

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

USDJPY Forecast: A Turnaround Imminent?

Solid ECN – Since mid-November, the USDJPY currency pair has demonstrated a bearish trend, effectively establishing its position beneath the Ichimoku Cloud. Presently, it's encountering the 38.2% Fibonacci resistance, while simultaneously, the RSI indicator is exiting the oversold zone. Adding to this analysis, the Awesome Oscillator is signaling a divergence, hinting at either a consolidation phase or an imminent trend reversal for the pair.

Given these technical indicators and the current market movements, a consolidation phase seems likely for USDJPY. This could lead to a rise in its value, potentially surpassing the 38.2% Fibonacci level. Bolstering this analysis is the 50% Fibonacci support level. However, should the price fall below the critical support at 140.76, this bullish scenario would be effectively invalidated.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 3 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (3)

Thread: Market Update by Solidecn.com

Thread: Market Update by Solidecn.com

Subscribe to this thread: 1

Open

Copyright © 2026 vBulletin Solutions, Inc. All rights reserved.

Reply With Quote

Reply With Quote