Solid ECN Solution to Combat Inflation

At Solid ECN Securities, we understand the challenges posed by inflation. To address this, we've developed a robust solution: offering our customers the convenience of multiple wallets. This allows them to safeguard their assets, investments, and earnings in a variety of highly sought-after currencies and cryptocurrencies.

Available Wallet Options:

> Euro Wallet

> US Dollar Wallet

> Pound Sterling Wallet

Solid ECN proudly offers the opportunity to trade in over 250 products through a Bitcoin-based account, all within a genuine ECN environment. You're invited to open an account with Solid ECN, your premier destination for trading Forex, Commodities, Indices, and cryptocurrencies. Discover the difference with us!

%15 Bonus | Swap Free | Raw Spread | Regulated

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- Market Update by Solidecn.com

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to Solid ECN For This Useful Post:

Unregistered (1)

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

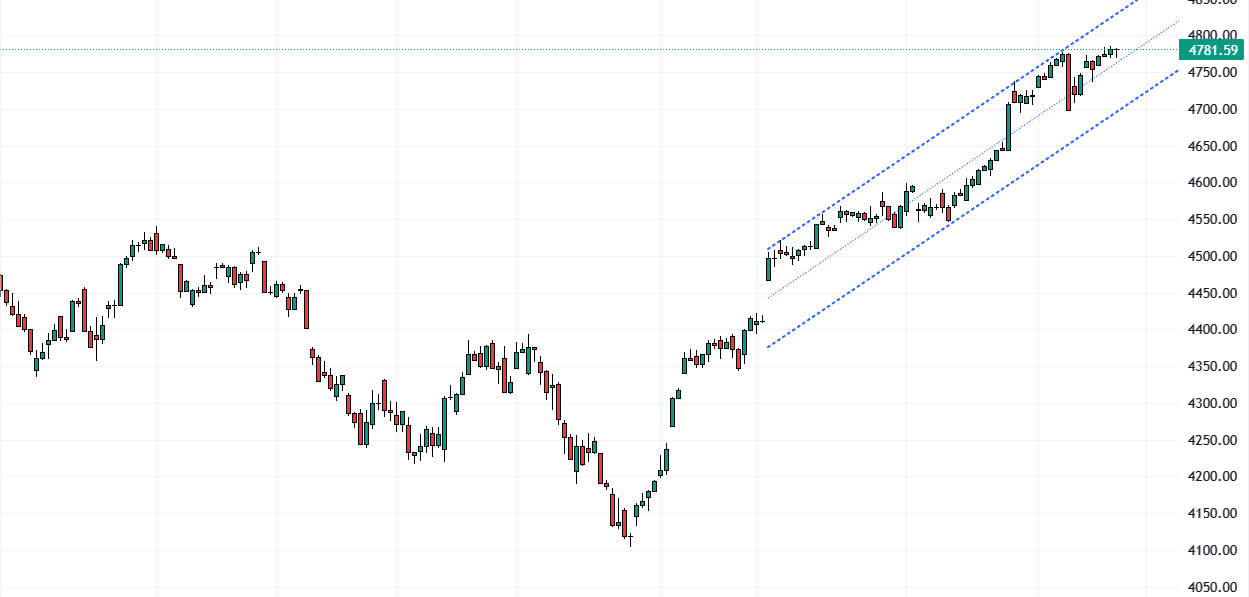

US Stock Futures Analysis: Steady End to Strong Year

Solid ECN – US stock futures remained stable on Thursday, as investors reflected on a year marked by robust gains in equities. The previous trading day saw the Dow increase by 0.3%, while the Nasdaq Composite rose slightly by 0.16%. The S&P 500 also saw a modest gain of 0.14%, approaching record levels. In this upward trend, eight out of the 11 S&P sectors closed higher, with real estate, healthcare, and consumer staples leading the charge.

The market's upward momentum is largely driven by the anticipation that the Federal Reserve will reduce interest rates next year. Bit Digital, an American bitcoin mining company, experienced an 18.6% surge in its shares. This followed its announcement to double its mining operations by 2024. Coherus BioSciences also enjoyed a significant 23.4% jump in its stock value after receiving US FDA approval for its new drug delivery device to fight infections.

Looking forward, both the Dow and S&P 500 are set to conclude the year with substantial gains, over 13% and 24% respectively. Meanwhile, the Nasdaq Composite has impressively rallied by 44.3% this year. This steady performance in US stock futures analysis reflects a year of consistent growth in the stock market.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to Solid ECN For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

NZX 50’s Remarkable Climb: A Four-Month High

Solid ECN –The NZX 50, New Zealand’s benchmark index, experienced a significant surge, gaining 90.25 points or 0.77% to close at 11,768.68 last Thursday. This marked the fourth consecutive session of growth, pushing the index to its highest point in over four months. This upward trend was observed amidst a relatively calm trading environment as the holiday season approached, with most sectors witnessing gains.

The positive sentiment was largely driven by the recent global stock market rally, with expectations of interest rate cuts in 2024 by major central banks, including the US Federal Reserve. Additionally, there is growing optimism that the Reserve Bank of New Zealand (RBNZ), known for its hawkish stance, might adopt a more dovish approach in the coming year. This could potentially involve a significant rate cut aimed at stimulating the sluggish economy, a move that could occur earlier than the central bank’s late 2025 projection.

In China, New Zealand’s primary trading partner, the two largest cities, Beijing and Shanghai, have recently lowered downpayment ratios and relaxed some housing qualifications for lower mortgages. This move has had a positive impact on the NZX 50.

Among the companies listed on the NZX 50, Restaurant Brands NZ saw a substantial increase of 5.3%, while Seeka Ltd. rose by 3.7%. Other notable performers included Delegat Group Ltd., Gentrack Group Ltd., and Winton Land Ltd., which gained 3.2%, 2.6%, and 1.9% respectively.

SourceThough trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to Solid ECN For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

US Oil Trades Near $80.5, Bulls Eye 50% Fibonacci

Solid ECN – US oil is currently trading at around $80.5 per barrel. The upward momentum has eased near the 38.2% Fibonacci level, yet the bulls have successfully maintained the oil price above the simple moving average. Notably, there is one bearish signal: the divergence in the Awesome Oscillator. Consequently, we can anticipate the price potentially dipping to the lower band of the bullish flag, with the 38.2% level acting as resistance.

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to Solid ECN For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Silver Price Dips, Trend Reversal Looming?

In today’s trading, the price of Silver dipped to the Ichimoku cloud. The divergence in the awesome oscillator hints at a possible trend reversal or the start of price consolidation. The current bullish trend is supported by the 38.2% Fibonacci retracement level. If the bears push the price below this level, we could see the Silver price decline extend to 23.6%.

On the other hand, if the awesome oscillator bars gain momentum above the signal level and the RSI indicator moves above the median line, we might see the bullish wave continue. In this scenario, the price could rise to test the 61.8% support level again. Keep an eye on these indicators for potential market movements!

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to Solid ECN For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

USDCNH RSI Uncertainty, Bullish Outlook Remains

Solid ECN – The USDCNH currency pair is currently hovering near the Ichimoku Kinko Hyo, while the RSI indicator presents a level of uncertainty. Despite mixed signals from technical indicators, the market is trending upwards. The bullish channel, which began in mid-November 2023, supports this current trend. The bulls are now eyeing the 7.1577 to 7.1637 resistance zone. If USDCNH can demonstrate strength above the cloud, the price is expected to rise to the upper band of the bullish flag.

On the other hand, the lower band of the flag underpins the bullish scenario. However, if this level is breached downwards, the above scenario should be accordingly invalidated. In such a case, the price could drop to 7.1117, and potentially even to 7.09669.

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following User Says Thank You to Solid ECN For This Useful Post:

Unregistered (1)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Bitcoin Tests Ichimoku Cloud: Price Trend Alert

Solid ECN – Bitcoin has a shift below the Ichimoku cloud. The price is currently testing the cloud as resistance. The price is ranging inside the bearish channel. The RSI indicator hovers below the median line. We expect the bitcoin price decline to $40,600 area if the market ranges inside the flag.

Bitcoin is experiencing a notable shift, now positioned below the Ichimoku cloud. Presently, its price is testing the cloud, facing it as a resistance level. In the midst of this, we're seeing the price moving within a bearish channel. Concurrently, the RSI indicator remains below the median line, signaling a cautious market sentiment.

Should the market continue to range within this flag pattern, we anticipate a potential decline in Bitcoin's price towards the $40,600 area.

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Euro Strengthens Against Dollar: A 5-Month Analysis

The Euro has risen to $1.1, a five-month high. This is due to the weakening of the dollar. The latest PCE inflation data from the US suggests that the Fed may reduce interest rates next year. The first cut could be in March. Traders expect the ECB to also cut borrowing costs next year. They may follow the Fed’s pace. However, most policymakers are against this idea. Over the year, the Euro has gained about 3%.

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Decoding Divergence: A Deep Dive into Gold Chart Patterns

Solid ECN – Upon first glance at the Gold chart, we notice the awesome oscillator bars signaling divergence. However, it appears that the divergence signal led to the consolidation phase. As a result, the XAUUSD price is currently ranging above $2,045. The ADX’s style line in black is retreating below the 40 level, indicating that the market’s momentum may slow down. Consequently, the gold price might remain within a narrow range until the holidays end.

The lower line of the bullish flag serves as support. If the bottom line is breached, the gold price could dip to the resistance area of the Ichimoku cloud. However, as long as the price continues to range inside the channel, the market maintains its bullish stance. In this scenario, the next target could be the 61.8% Fibonacci resistance, followed by the $2,090 mark.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 8 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (8)

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,413 Times in 751 Posts

Understanding EURJPY’s Movement in the Ichimoku Cloud

Solid ECN – The EURJPY currency pair is presently undergoing a test of the Ichimoku cloud. Last week, the pair managed to cross above the cloud successfully. The subsequent decline post-breakout could potentially be viewed as a consolidation phase.

However, should the pair’s decline persist below the cloud, the bullish bias would be rendered invalid, indicating a false Ichimoku signal.

From a technical perspective, as long as the pair remains within the channel and above the 50% Fibonacci support level, the short-term trend is bullish. In this scenario, the target could be the upper band of the flag channel.

This analysis is subject to market conditions and should be used in conjunction with other indicators.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 7 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (7)

Thread: Market Update by Solidecn.com

Thread: Market Update by Solidecn.com

Subscribe to this thread: 1

Open

Copyright © 2026 vBulletin Solutions, Inc. All rights reserved.

Reply With Quote

Reply With Quote