Oil Prices Surge Amid Bullish Signals

Solid ECN—Oil price returned from the $74.2 low when the stochastic oscillator signaled an oversold market. As of this writing, the pair trades at about $76.7, above the immediate support at $75.7. The technical indicators suggest the current uptick momentum should resume. Interestingly, the awesome oscillator adds to this bullish speculation.

From a technical standpoint, if the oil price holds above $75.7, the price will likely rise to the key resistance area at $78.1, backed by the 75-period simple moving average.

Conversely, if the bears (sellers) drive the price below $75.7, the $74.2 key resistance will likely be initially tested. Furthermore, if the selling pressure exceeds $74.2, the next support area will be the $71 mark.

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- Market Update by Solidecn.com

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,049 Times in 638 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 6 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (6)

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,049 Times in 638 Posts

Bearish Momentum Expected Below 50 SMA

Solid ECN—The NZD/USD pair is consolidating near the 50-period simple moving average. Meanwhile, the stochastic oscillator stepped into the overbought territory, signaling a sell.

Furthermore, the bearish momentum will likely resume if the price remains below the 50 SMA.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 7 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (7)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,049 Times in 638 Posts

Silver Price Eyeing $28.5 Resistance

Solid ECN—Silver price bounced from $27.3 as expected. The stochastic oscillator signaled oversold conditions, warning traders about this pullback. Currently, the XAG/USD bulls are testing the 100-period simple moving average as resistance. Meanwhile, the technical indicators suggest the primary trend is bearish, but the price might consolidate to upper resistance levels.

If the bulls surpass the immediate resistance at $28.5, the pullback will likely target the next demand area at approximately $29.4.

Conversely, if the silver price dips below the immediate support at $28.1, the current uptick trend should be invalidated, and the bears will likely test the recent lower low at $27.3.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 7 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (7)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,049 Times in 638 Posts

Litecoin Price Tests $71.8 Resistance

Solid ECN—Litecoin dipped from $76.2, the June 29 high. Currently, the price is testing the $71.8 resistance, while the technical indicators suggest the bearish momentum could extend to lower resistance levels.

Bulls must first maintain the price above the $71.8 resistance for the uptrend to resume. In this scenario, the $76.2 level could be retested. Furthermore, if the buying pressure exceeds the July 29 high, the next ceiling will likely be the $80 psychological level.

On the flip side, if the LTC/USD price closes and stabilizes below the immediate resistance at $71.8, the next bearish target could be $69.7.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 6 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (6)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,049 Times in 638 Posts

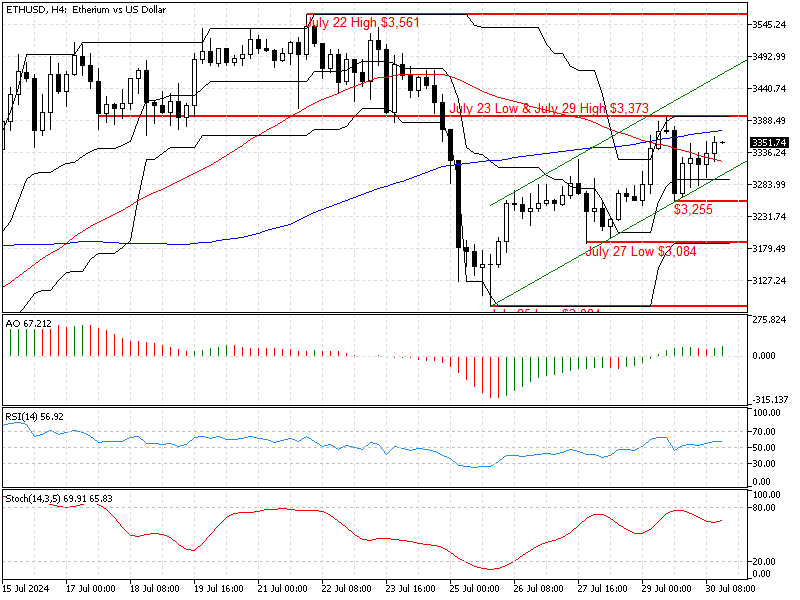

Ethereum Bullish Momentum Slows at Critical Resistance

Solid ECN—Ethereum's bullish momentum eased near the July 23 low of $3,373, encountering active resistance. Technical indicators suggest a sideways market with a mildly bullish bias.

> If the price closes above $3,373, it could allow bulls to reach the July 22 high of $3,561.

> The July 27 low of $3,084 serves as the key support level for the current bull market.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 6 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (6)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,049 Times in 638 Posts

Oversold AUD/USD: Key Levels and Potential Breakout

Solid ECN—The AUD/USD pair is consolidating within a narrow range between the immediate support at 0.651 and the immediate resistance at 0.656.

The stochastic oscillator has been deep in the oversold territory for four consecutive days, indicating a potential for the price to fill the 'fair value gap' around the $0.661 resistance. For this scenario to unfold, the price must close and stabilize above the $0.656 resistance.

Conversely, if the price dips below the $0.651 support, the downtrend will likely resume, with the next supply zone at the $0.646 mark.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 6 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (6)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,049 Times in 638 Posts

GBP/USD: Golden Cross Signals Potential Trend Reversal

Solid ECN—The 50 and 100-period moving averages form a golden cross in the GBP/USD currency pair, suggesting a potential reversal from a bull market to a bear market. Additionally, the pair trades within a bearish channel, with bullish candlesticks appearing weaker and smaller than their bearish counterparts.

However, the Awesome Oscillator indicates divergence, which may signal that the pair could consolidate before resuming its downtrend. In this scenario, the GBP/USD price might rise to test the 100-simple moving average, approximately at 1.291. Traders and investors should closely monitor the 1.2911 resistance area for bearish signals.

Conversely, the bear market outlook would be invalidated if the GBP/USD price breaks above the key resistance level at 1.2941.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 6 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (6)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,049 Times in 638 Posts

Key Indicators Suggest EUR/USD Consolidation

Solid ECN—The EUR/USD downtrend cooled near the 1.080 resistance, while the awesome oscillator signals divergence. This development in the technical indicators means the market might step into a consolidation phase, or the trend might reverse from this point.

Additionally, the market is not oversold, as the stochastic and RSI hover above 30 and 20, respectively.

Therefore, we suggest retail traders wait patiently for the EUR/USD price to consolidate near the 50-period simple moving average. They should also monitor the 1.086 resistance area for bearish candlestick patterns or use a breakout strategy if the price exceeds 1.086.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 6 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (6)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,049 Times in 638 Posts

Gold Prices Poised for a Breakout: Key Levels to Watch

Gold trends are currently testing the 50-simple moving average at approximately $2,408, which also serves as the immediate resistance level. Technical indicators suggest that the uptrend may resume, and XAU/USD is not overvalued.

From a technical perspective, if the price of gold climbs above $2,408, the next bullish target will likely be $2,431.

Conversely, if sellers stabilize the price below the immediate support level of $2,353, the decline could extend to $2,339.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 6 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (6)

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,334

- Thanks

- 1

- Thanked 2,049 Times in 638 Posts

USD/JPY: Bearish Flag and Candlestick Patterns Signal Trend Resumption

Solid ECN—The USD/JPY pair is consolidating inside the bearish flag, trading at approximately 153.6. The primary trend is bearish, and the price below the 50 SMA is proof of that. Although the technical indicators give mixed signals, the 4-hour chart has formed bearish candlestick patterns.

From a technical standpoint, the downtrend will likely resume if the price remains below the 155.3 key resistance. In this scenario, the 151.9 support could be tested. If the selling pressure dips the price below this immediate support, the 150.0 supply area will likely be targeted.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 6 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (6)

Thread: Market Update by Solidecn.com

Thread: Market Update by Solidecn.com

Subscribe to this thread: 1

Open

Copyright © 2025 vBulletin Solutions, Inc. All rights reserved.

Reply With Quote

Reply With Quote