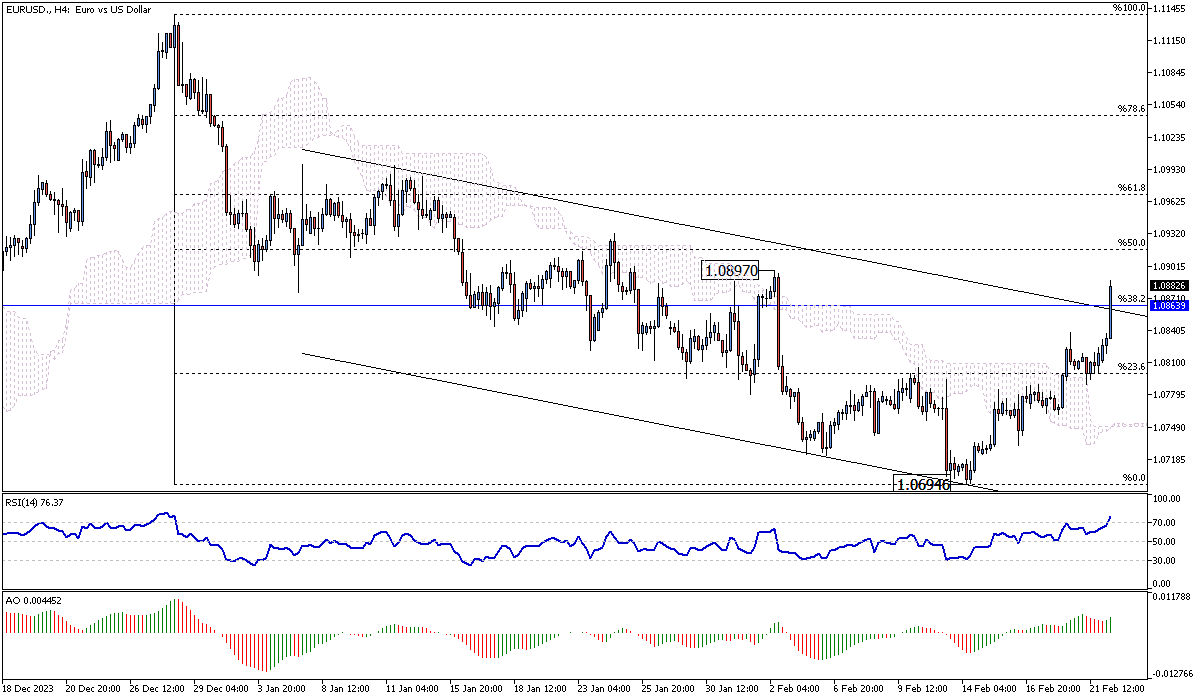

Euro’s Struggle Against the U.S. Dollar Amid Fibonacci Resistance

Solid ECN – The Euro is trading above the 38.2% Fibonacci resistance against the U.S. Dollar, which stands at 1.085. This level is clinging to the upper band of the bearish flag. Interestingly, the RSI indicator has stepped into the overbought zone. This could be interpreted as a sign that the uptick in momentum, which began on February 12, might ease near this level.

From a technical standpoint, the primary trend is bearish. However, this could be invalidated if the bulls manage to cross and stabilize the price above the 1.08639 ceiling.

On the other hand, if the 1.08639 level holds, the EURUSD pair will likely turn downward again. In this scenario, the 23.6% Fibonacci support would be tested once more.

Happy trading!

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- Market Update by Solidecn.com

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,146

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,146

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

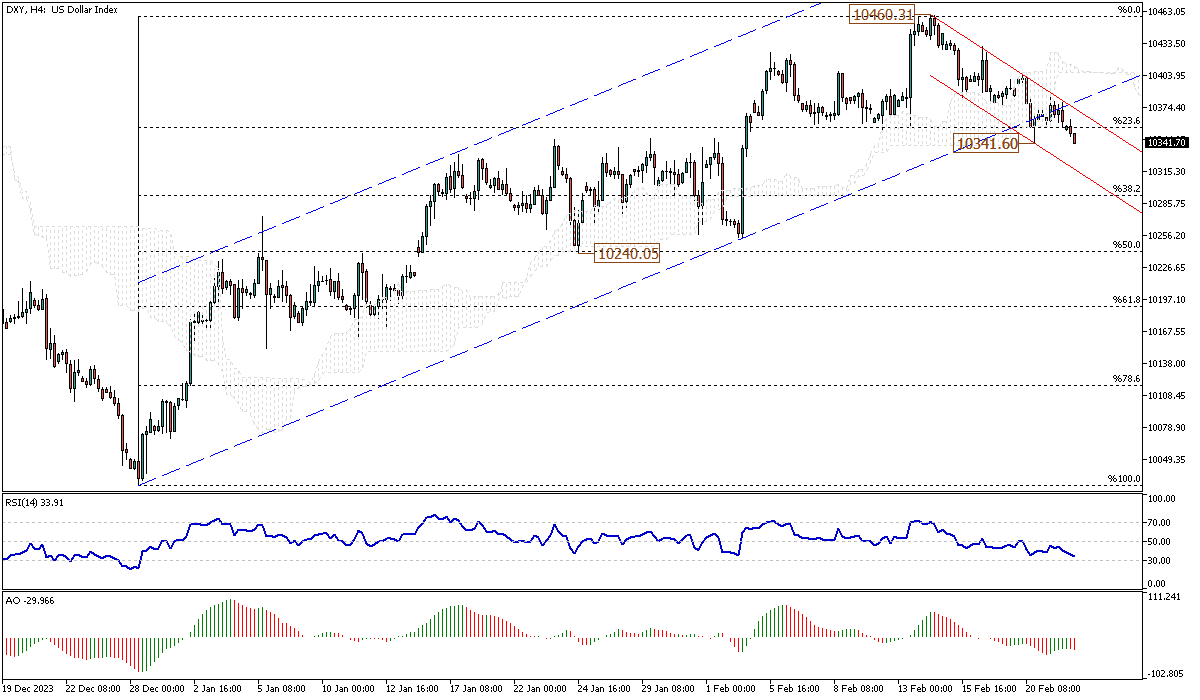

U.S. Dollar Index Tests Fibonacci Support: A Technical Analysis

Solid ECN – The U.S. Dollar index is testing the $10,341 mark, below the 23.6% Fibonacci support level. Subsequently, the DXY index is experiencing a decline within the bearish flag following its breakdown from the bullish channel, as depicted in the 4-hour chart. The technical indicators also show similar patterns in alignment with this new trend. Specifically, the RSI indicator is floating below 50, and the bars of the awesome oscillator are in red.

Therefore, from a technical standpoint, the trend is downward as long as the index trades below the Ichimoku cloud. If the bears maintain their positions, the next target could be the 38.2% Fibonacci support level, followed by the $10,240 mark.

On the flip side, if the bulls push the price above the Ichimoku cloud, the bearish scenario mentioned earlier would be invalidated. In such a scenario, the index would likely test the February 14th higher high at the $10,460 mark.

Happy trading!Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,146

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

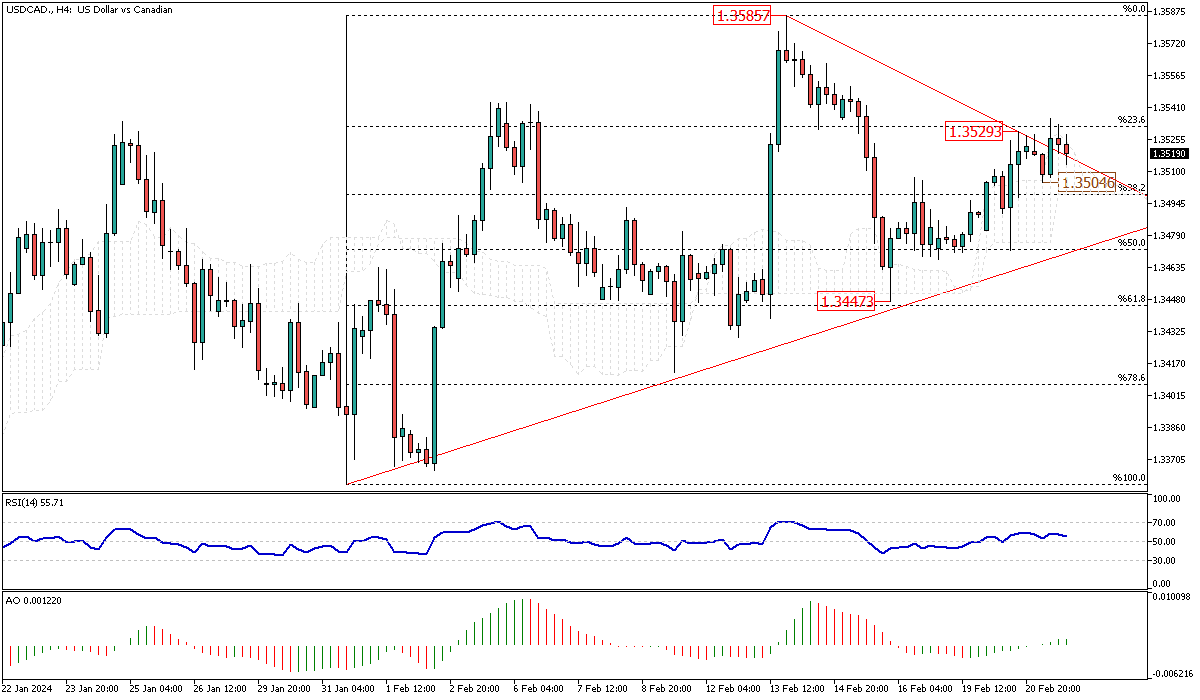

USDCAD Price Analysis: Testing 23.6% Fibonacci Resistance

When writing, the USDCAD price is 1.352, slightly below the 23.6% Fibonacci resistance currently under test. The technical indicators are bullish, with the RSI floating above 50, and the AO bars are green beyond the signal line.

From a technical standpoint, the bulls must break the 1.3529 resistance for the primary uptrend to continue. If this scenario unfolds, the next bullish target will be the February higher high at 1.3585.

On the flip side, if the USDCAD price falls below the 1.3504 mark, the decline would extend to the 50% Fibonacci resistance. This is where the ascending trendline supports the trend. It’s worth noting that as long as this trendline remains unbroken, the primary USDCAD trend should be considered bullish.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,146

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

USDJPY Trades in Ascending Channel Amid Bullish Indications

Solid ECN – The USDJPY pair trades within an ascending channel, indicating that traders should seek extended opportunities rather than short ones. However, the price has been fluctuating within a bearish flag, depicted in red, since February 13th. Meanwhile, the technical indicators don't provide valuable data on the next market move. The RSI indicator is clinging to the middle line, while the AO bars are small, with a slight increase in the green bars.

From a technical standpoint, the lower band of the bullish flag, depicted in blue, serves as support for the primary trend, which is bullish. As long as the USDJPY price remains within the flag, the ultimate forecast is an increase in the value of the U.S. dollar against the Japanese yen. In this scenario, the bulls must close above the 159.4 resistance for the uptrend to resume. Otherwise, the weak bearish momentum seen on the chart might extend to the lower band of the flag. It's worth noting that the 148.9 resistance area offers a better entry point than the current market value, which is 150 at the time of writing.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,146

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

USDCAD Tests Fibonacci Resistance Amid Bullish Wave

Solid ECN – The USDCAD pair is testing the 23.6% Fibonacci resistance at the 1.3529 mark, following the bullish wave that began on February 15th from the 1.3447 mark, the 61.8% Fibonacci support level. The 4-hour chart shows that the bulls have crossed above the bearish trendline with a long-bodied candlestick. This could be interpreted as a continuation of the uptrend momentum. Interestingly, the technical indicators back up this momentum, with the relative strength index pointing upwards and the awesome oscillator flipping above the signal line.

From a technical standpoint, the U.S. dollar is likely to gain more against the Canadian dollar, and the next target for the buyers could be the 1.3585 resistance.

On the flip side, the bullish trendline is the primary support for the uptrend. The uptrend scenario outlined above should be invalidated if the price falls below this level corresponding to the 50% Fibonacci level or the 1.3471 mark.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,146

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

USDCHF Bullish Trend Supported by Ichimoku Cloud

Solid ECN - The USDCHF currency pair trades sideways above the 0.8782 resistance level inside the Ichimoku cloud. It's worth mentioning that the Ichimoku cloud adds an extra layer of support to the bullish trend that began on February 2 from the 0.8852 mark. The technical indicators on the 4-hour chart don't provide significant data, so we should rely on the horizontal channel depicted in blue on the 4-hour chart.

From a technical standpoint, the upward trend on the 4-hour chart should continue if the bulls cross above the 0.8839 level. This scenario is likely due to the primary USDCHF trend and the awesome oscillator bar turning green in the current trading session.

Conversely, the bears need to stabilize the price below the 0.8782 support to target the 38.2% Fibonacci level. If this scenario comes into play, the high of February 12 can be considered the new higher high, and the price might experience a further decline to the 50% Fibonacci retracement level.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,146

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

Saudi Arabia's Dec 2023 Trade Surplus Dips Amid Lower Sales

Solid ECN - In December 2023, Saudi Arabia's trade surplus shrank to SAR 38.2 billion from SAR 44.2 billion the year before. The country's exports dropped by 9.7% to SAR 98.5 billion, mainly due to a 15.8% decrease in oil product sales, which make up 73.1% of total exports. Also, non-oil product exports decreased by 3% to SAR 19.15 billion, with a significant fall in plastics and rubber goods sales by 7.6%.

The main export destinations were China (14.8%), Japan (11%), and India (8.8%). On the other hand, imports decreased by 7.1% to SAR 60.4 billion, though there was a rise in the intake of machinery, appliances, and electrical gear by 21.5% and transportation equipment by 20%. China was the largest source of imports, accounting for 21%, followed by the US (8.1%) and UAE (7.8%).Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,146

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

GBPJPY Crosses Minor Resistance

Solid ECN – The GBPJPY currency pair has crossed above the 189.5 minor resistance in the 4-hour chart and is currently testing the broken resistance. The GBPJPY chart above shows that the bulls have successfully stabilized the price above the 23.6% Fibonacci support. Furthermore, the technical indicators are supporting the current bullish trend. The RSI indicator hovers above 50, while the AO (Awesome Oscillator) bars are green and positioned above the signal line.

From a technical standpoint, as long as the GBPJPY trades above the ascending trendline, depicted in blue, the trend will remain bullish and likely aim to break the 190.0 ceilings.

On the flip side, if the price falls and stabilizes below the 23.6% Fibonacci support, the decline from February 12 from the 190.0 mark would extend to the 38.2% Fibonacci retracement level, followed by the 50% level.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,146

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

Australian Dollar Stabilizes Above Fibonacci Support Against U.S. Dollar

Solid ECN - The Australian dollar stabilizes the price above the 23.6% Fibonacci support level against the U.S. Dollar. Currently, the AUDUSD pair is trading around 0.655. The technical indicators signal a continuation of the bullish bias that began on February 13th. The RSI indicator floats above 50, and the awesome oscillator bar in the 4-hour chart turned green. Meanwhile, 0.6497 serves to support the upward trend. The next likely bullish target will be the 38.2% Fibonacci retracement level, corresponding to the 0.662 resistance area.

On the other hand, if the AUDUSD price falls below the ascending trendline, depicted in red, the bullish scenario could be invalidated. In this case, the U.S. Dollar would likely test the 0.6442 support.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,146

- Thanks

- 1

- Thanked 1,377 Times in 448 Posts

GBPUSD Price Decline: Ichimoku Cloud and Channel Analysis

Solid ECN - The GBPUSD price has declined from 1.2629, which aligns with the Ichimoku cloud and the descending trendline, depicted in red. The pair is currently testing the 23.6% Fibonacci support level, which appears weak and may not keep the price from falling. Moreover, the technical indicators support the bearish market, with the RSI indicator hovering below the middle line and the Awesome Oscillator flipping below the signal line.

From a technical standpoint, the downtrend will likely continue as long as the GBPUSD price maintains a position below the 1.2629 resistance. The next target could be 1.2550, followed by 1.2517, the lower low of February 5th.

On the flip side, to invalidate the bearish scenario, the bulls must close and stabilize the price above 1.2629.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Thread: Market Update by Solidecn.com

Thread: Market Update by Solidecn.com

Copyright © 2024 vBulletin Solutions, Inc. All rights reserved.

Reply With Quote

Reply With Quote