Euro Rises as Central Banks Discuss Future Rate Cuts

Solid ECN – On Wednesday, the euro climbed to $1.09, bouncing back from its lowest point in two weeks after the Federal Reserve decided not to change its plans for interest rate reductions in 2024. The Fed did not alter interest rates in March, meeting expectations, and hinted at three possible decreases later in the year. Also, the ECB's President Lagarde emphasized in an earlier meeting that they would look at reducing rates in June.

She added a note of caution, stating that the European Central Bank wouldn't lock itself into a set number of cuts, as future decisions will be based on the latest data. Central bank leaders from five countries—Spain, the Netherlands, Ireland, Greece, and Slovakia—have expressed their support for action in June.

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- Market Update by Solidecn.com

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,181

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,181

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Recent Trends in NZDUSD

Solid ECN – The New Zealand dollar fell below $0.605, reaching close to its four-month low following the Australian dollar's downturn. This happened after the Reserve Bank of Australia decided not to change interest rates, a decision many anticipated. They also removed their previous caution against ruling out future rate hikes. Meanwhile, the Kiwi dollar faced additional pressure due to the upcoming policy meeting of the US Federal Reserve. There's the worry that persistently high inflation in the US might postpone any cuts in Fed rates.

Furthermore, within New Zealand, the expectation is growing that the Reserve Bank of New Zealand may reduce its policy rates starting in August as the rise in prices begins to slow down. As investors wait, they are particularly interested in the upcoming report on the country's economic growth, hoping it will offer more clarity.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,181

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

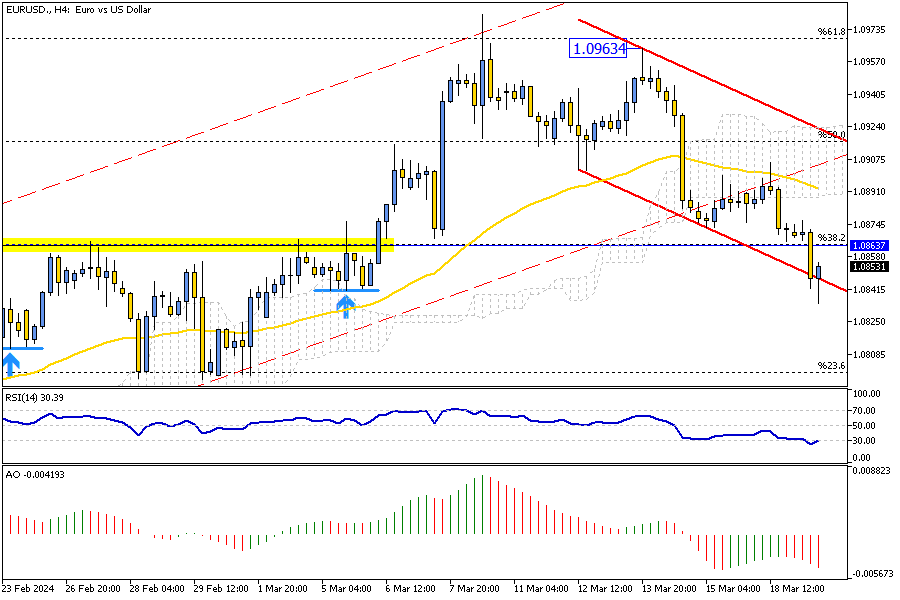

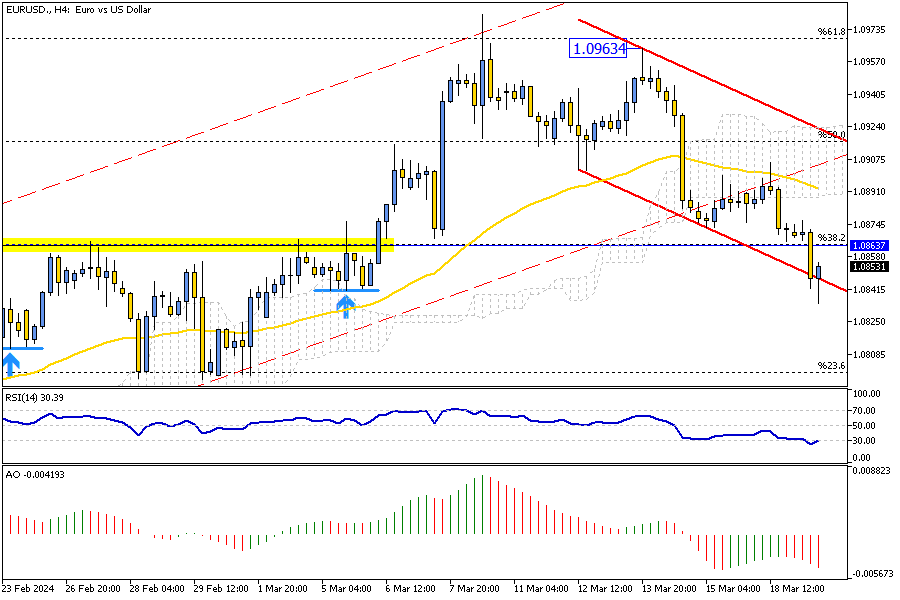

EURUSD Hits New Low: Analyzing the Latest Bearish Wave

Solid ECN – In today's trading session, the European currency dipped toward the 1.08 mark, its lowest since March 1st, against the U.S. Dollar. The drop was expected from a technical perspective because the bears formed an inverted hammer clinging to the EMA 50 yesterday. The failed attempt to cross above the moving average has led the EURUSD price to experience a new bearish wave.

As of this writing, the pair is testing the lower band of the bearish flag. The RSI indicator hovers in the oversold area; therefore, the market might make corrections below the EMA 50 before a new wave emerges.

From a technical standpoint, the primary market is dominated by bears if the price is kept below the cloud. Due to the RSI being in the oversold zone, we suggest waiting for the price to show some correction before joining the bear market. With the price below the mentioned resistance areas, the 23.6% Fibonacci support could be the next target.

The price must flip and stabilize itself above the cloud for the bear market to be deemed invalid.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,181

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Euro Drops as ECB Considers June Rate Cut Amid Slow Growth

Solid ECN – The euro fell toward the $1.08 mark, its lowest since March 1st, as investors processed reports of slower wage increases and cautious remarks from some European Central Bank (ECB) officials. They also looked forward to the Federal Reserve's policy meeting on Wednesday. ECB Vice President Luis de Guindos stated on Tuesday that the bank might consider lowering interest rates in June, highlighting the need for more information before changing policies.

ECB President Christine Lagarde mentioned possibly lowering rates earlier in the month due to falling inflation. The ECB's chief economist, Philip Lane, suggested a rate cut could come in the second quarter. Significantly, central bank leaders from Spain, the Netherlands, Ireland, Greece, and Slovakia, among the ECB's 26 Governing Council members, supported a decision in June.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,181

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

BTCUSD Hits April Low: What's Next for Bitcoin Prices?

Solid ECN – Bitcoin flipped below the Ichimoku cloud in last week's trading session. The decline continued this week, and today BTCUSD hit a new low for April, trading below the $64,400 mark. Interestingly, the RSI and the Awesome Oscillator also point to a bear market. In addition to RSI and Ao, the ADX climbs to 40, signifying that the downtrend is strengthening.

From a technical standpoint, the EMA 50 and the upper band of the bearish channel, marked in red, act as resistance levels. If Bitcoin's price remains below $67,000, the next target is likely the $60,000 mark.

Conversely, for the uptrend to resume, the price must cross above the EMA 50 and maintain its position above it.

Noteworthy

It's important to note that the primary market is bullish, and the current downward momentum is considered a consolidation phase. During this phase, major players collect profits by sweeping the floor from retail traders.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,181

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

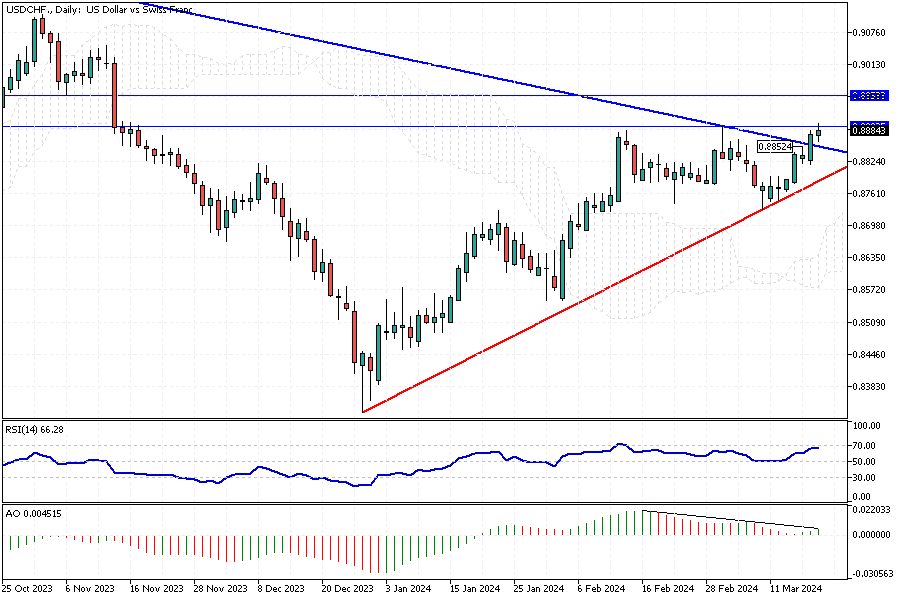

USDCHF Hits New Heights Post-Wedge Breakout

Solid ECN – The U.S. Dollar broke out from the wedge pattern in today's trading session against the Swiss franc and is testing the 0.889 barrier as of writing.

The Awesome Oscillator signals divergence, which could be interpreted as a sign that a consolidation phase is likely on the way. Therefore, the price might dip to 0.885 before a new bullish wave begins. Interestingly, the RSI indicator is nearing the overbought zone, signaling the same as the AO.

From a technical standpoint, the ascending trendline in red supports the bull market. As long as the pair trades above this level, the primary trend will remain an uptrend. In this scenario, the market will likely surpass the 0.889 resistance and aim for the next target, the 0.895 mark.

P.S. For the uptrend to resume, the market must pass and stabilize the price above the 0.889 mark.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,181

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

Diversify with Solid ECN's Global Marketplace

Solid ECN – Discover the simple way to secure your assets: diverse trading with Solid ECN! Market leaders and top investors never stick to just one or two instruments. They spread their bets across a range of commodities, indices, and currencies to increase their chances of success. And now, you can too!

With Solid ECN, you're not just trading; you're embarking on a global adventure with the freedom of high leverage and the benefit of minimal spreads. Craft your unique trading portfolio and dive into a world of opportunities. Our mission is to bring you the hottest and most sought-after products in the trading space.

Join us today and gain access to an extensive selection of over 250 trading products including:

- Forex (Majors, Crosses, Minors)

- Precious Metals (Gold, Silver, Palladium, Platinum)

- Energy sources (Brent, WTI)

- Global Indices and Nasdaq

- Big names like Adidas, British American Tobacco, BMW, Airbus, and more

- Trending Cryptocurrencies (Cardano, Algorand, BNB, Dogecoin, Ripple, and more)

Start your diverse trading journey with Solid ECN and unlock the potential for success.

https://solidecn.com >>> %15 Bonus | Swap Free | Raw Spread | RegulatedThough trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,181

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

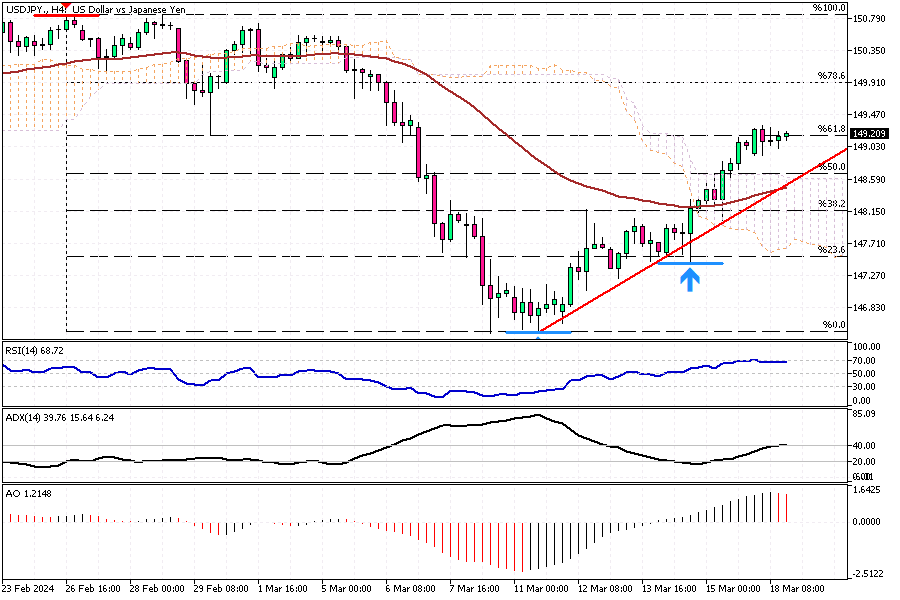

USDJPY at the Crossroads of Overbought Conditions

Solid ECN – The Japanese currency has again become bearish against the U.S. Dollar. As shown on the USDJPY 4-hour chart, the American currency has risen above the Ichimoku cloud and is trading at about 149.1 as of this writing.

Currently, the pair is testing the 61.8% Fibonacci support while the RSI indicator is about to enter the overbought area. Therefore, it is not recommended to go long on the U.S. currency in a saturated market; it is better to wait for the pair to form new higher lows and lower highs.

That said, with the Awesome Oscillator's red bars, there is a high chance for the market to drop to the ascending trendline in red. This level of support can provide a decent entry point to join the bull market.

Conversely, the bull market should be invalidated if the price falls below the 148.8 mark.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,181

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

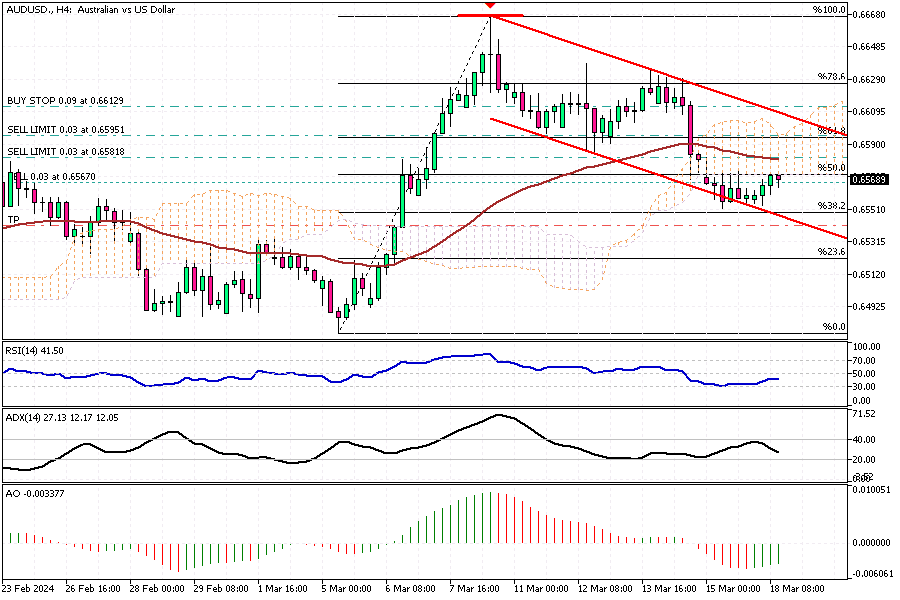

AUDUSD's Resilience: A Test Against Ichimoku Cloud Resistance

Solid ECN – The Australian dollar rebounded from the 38.2% Fibonacci support level against the U.S. dollar in today's trading session. The pair is now testing the Ichimoku cloud as resistance, close to the EMA 50. The Awesome Oscillator bars are green, while the RSI remains below 50, giving mixed signals. Meanwhile, the ADX indicator has dropped to level 20, which can be interpreted as a slowdown in the trend.

From a technical standpoint, the bounce could extend to the upper band of the bearish flag depicted in red. However, as long as the AUDUSD price remains within the flag, the 23.6% Fibonacci level will likely be the next target.

The bear market should be invalidated if the price stabilizes itself above the cloud.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,181

- Thanks

- 1

- Thanked 1,564 Times in 522 Posts

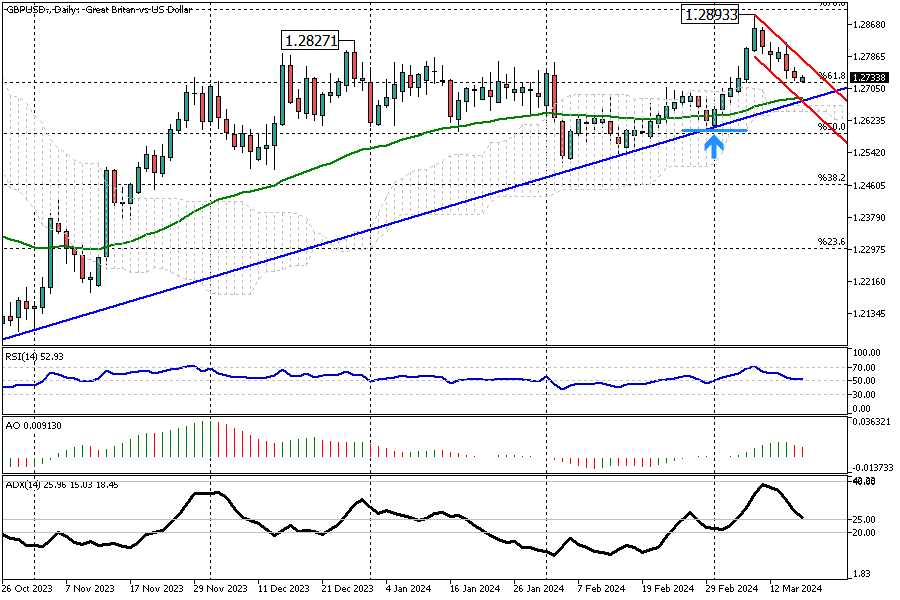

Analyzing GBPUSD's Bullish Sentiments Amid Recent Downtrend

Solid ECN – Pound Sterling demonstrated its resilience at the start of the Monday trading session. It opened with a slight gap against the U.S. Dollar but quickly recovered. It is currently holding strong at around 1.273.

The pair trades above the bullish trend line, as indicated in blue on the GBPUSD chart. Therefore, the primary trend remains bullish. However, the price has fallen from the 1.289 high and is now experiencing a downtrend within the bearish channel, marked in red.

The data from the chart suggests that the current downward momentum may represent a consolidation phase, setting the stage for a potential bullish comeback. The EMA 50, aligning with the trend line and the resistance level supported by the Ichimoku cloud, could provide a solid support for buyers to initiate this optimistic turn of events.

Please note that the price must break out of the bearish channel for the uptrend to resume. In this scenario, the rise could continue and target the high from February as its first significant milestone.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

Thread: Market Update by Solidecn.com

Thread: Market Update by Solidecn.com

Copyright © 2024 vBulletin Solutions, Inc. All rights reserved.

Reply With Quote

Reply With Quote