Dollar Index: A Holiday Trading Tale

On Tuesday, amidst holiday trading, the dollar index lingered around 101.6. This was near its five-month low, due to signs of slowing US inflation. This has led to predictions that the Federal Reserve will begin to lower interest rates next year. Data from Friday revealed that the core PCE index, the Federal Reserve’s favored inflation measure, dropped to 3.2% in November from 3.4% in October.

This was lower than the projected 3.3%. Furthermore, figures from Thursday showed a weaker than expected US economic growth in Q3 and a minor rise in unemployment benefit claims recently. The dollar was trading near multi-month lows against other major currencies. It is at risk of further depreciation against the yen, as BOJ Governor Kazuo Ueda stated on Monday that the chances of reaching the 2% inflation target were “gradually rising.”

- Forum

- Forum

- Forex Charts

- Portal FX.co

- Monitoring

- Forex TV

- Forum

- Trading Discussion Area

- Trading Strategies

- Market Update by Solidecn.com

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,245

- Thanks

- 1

- Thanked 1,810 Times in 585 Posts

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,245

- Thanks

- 1

- Thanked 1,810 Times in 585 Posts

A Simple Guide to the Nikkei 225’s Recent Rise

Solid ECN – On Monday, the Nikkei 225 index rose by 85.05 points or 0.26%, ending at 33,254.03. This continued the gains from the previous session. Investors were encouraged by Wall Street’s year-end rally on Friday, especially after the US Federal Reserve’s preferred inflation measure for November was lower than expected and closer to the central bank’s 2% target.

Meanwhile, both overall and core inflation in Japan dropped to a 16-month low last month. On a quiet Christmas day, investors paid attention to a speech by Kazuo Ueda, the governor of the Bank of Japan. He suggested that the central bank might change its monetary policy if wages and prices start moving in the right direction. He also repeated that the board was keeping its very supportive monetary policy to protect the delicate economic recovery.

The healthcare sector led the increase, followed by property, tech, and consumer sectors. The top performers of the day included Nexon Co. (5.4%), NTT Data Group (4.5%), Lasertec Co. (2.8%), NH Foods (2.5%), and Takashimaya Co. (2.4%).Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 7 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (7)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,245

- Thanks

- 1

- Thanked 1,810 Times in 585 Posts

Japan's Economic Index: A Fragile Uptick in 2023

Solid ECN – In October 2023, Japan's main economic forecast tool (the Leading Economic Index), saw a slight increase to 108.9 from an initial 108.7. However, this was still not as high as the previous month's 109.3, showing that Japan's economic recovery is still weak.

The country is dealing with rising prices and lots of outside uncertainties. During the third quarter of 2023, Japan's economy went down by 0.7%, marking its first drop in a year. This downturn was caused by reduced spending by both people and businesses, and trade issues also played a part in lowering the country's overall economic performance. Additionally, people's confidence in the economy in October was almost at its lowest in six months.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 8 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (8)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,245

- Thanks

- 1

- Thanked 1,810 Times in 585 Posts

USDJPY's Sharp Decline

Solid ECN – The USDJPY pair saw a sharp drop after hitting the Ichimoku cloud. It's now trading below a resistance level formed by the cloud. A closer look at the USDJPY 4-hour chart shows the price falling within a channel. The pair is currently at the 78.6% Fibonacci support level.

Given the technical indicators, it seems this support might break, continuing the bearish trend.

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,245

- Thanks

- 1

- Thanked 1,810 Times in 585 Posts

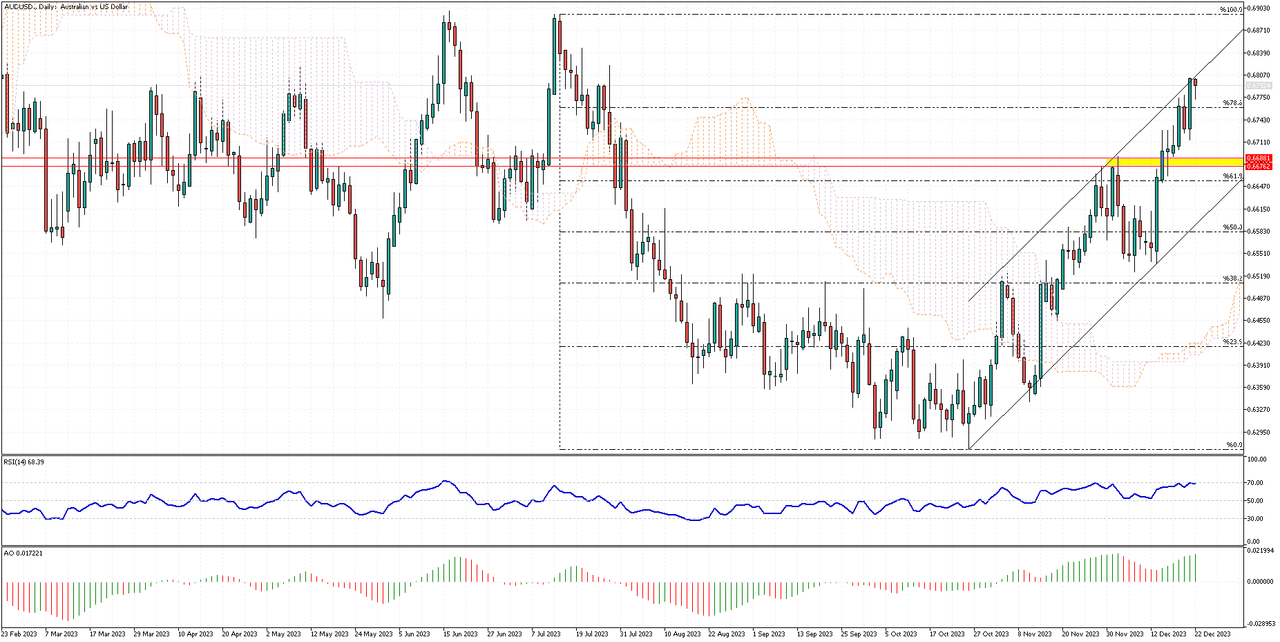

AUDUSD: Buy or Wait?

The AUDUSD's rise is still going strong, moving near the top of its bullish trend. Yet, in today's market, the pair approached the 78.6% Fibonacci level, with the RSI near 70. This means the pair isn't overvalued despite the ongoing uptrend.

For those with smaller budgets, buying now may not be the best move. It's better to wait for a slight price drop. If the price dips below 78.6%, it could fall to the support zone between 0.6681 and 0.6676, a better buy-in point for those bullish on AUDUSD.

However, buying the Australian dollar now isn't advisable, strong trend or not. The market looks overbought, and AUDUSD is likely to lose some value. A smarter strategy is to wait for a drop before joining the upward trend.

With its upward momentum, the pair might reach its June 2023 high.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 8 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (8)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,245

- Thanks

- 1

- Thanked 1,810 Times in 585 Posts

UK Pound Rises Amid Economic Shifts

Solid ECN – The UK pound recently surged past $1.27, driven by investor reactions to fresh economic data and predictions about future monetary policies. Recent reports have painted a mixed picture of the UK's economic health. The third quarter showed a shrinkage in the economy, a downturn further emphasized by revised figures from the second quarter, signaling a looming recession risk. On a brighter note, retail sales in November surpassed expectations.

Inflation trends are also shifting. The latest Consumer Price Index (CPI) report indicates a drop in UK inflation to 3.8%, significantly lower than the anticipated 4.4%. Additionally, core inflation has fallen to 5.1%, which is below the forecasted 5.6%. These changes have led traders to strongly anticipate interest rate cuts by the Bank of England (BOE) in the coming year. Market expectations suggest a total decrease of 143 basis points, translating to five quarter-point reductions and a 70% likelihood of a sixth cut. However, this contrasts with BOE Governor Andrew Bailey's insistence on keeping rates higher for a longer duration.

Despite the recent slowdown, inflation in the UK remains nearly double the BOE’s 2% target and is the highest among the Group of Seven nations. This situation poses a delicate balance for policymakers, who must navigate between supporting growth and controlling inflation.

Economic Implication

In a fundamental analysis, the future of the UK economy hinges on several factors. The anticipated interest rate cuts could stimulate spending and investments, potentially aiding in recession recovery. However, persistent high inflation remains a challenge. If inflation continues to outpace targets, the BOE may need to reconsider its stance on rate cuts to prevent further devaluation of the pound and manage cost-of-living increases. The economic outlook will largely depend on the BOE’s ability to balance these competing priorities and the government's measures to support economic growth.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,245

- Thanks

- 1

- Thanked 1,810 Times in 585 Posts

Yen Holds Firm as Japan Sees Inflation Ease

Solid ECN – In a recent update, the value of the Japanese yen remained stable at approximately 142.2 against the US dollar. This steadiness occurred despite new data indicating a decrease in Japan's inflation rates. November saw both the main and core inflation rates drop to the lowest they've been in 16 months, recording figures of 2.8% and 2.5%, respectively. Notably, the core inflation rate has been over the Bank of Japan's target of 2% for twenty consecutive months.

Earlier in the week, the yen faced some downward pressure. This was largely due to the Bank of Japan's decision to continue its very accommodative monetary policy. The bank did not hint at any potential shifts towards more standard policies in the upcoming year. The Bank's Governor, Kazuo Ueda, emphasized in a press conference that the bank is prepared to implement further easing measures if they become necessary.

In contrast, recent economic data from the United States has led to speculation that the Federal Reserve might begin to reduce interest rates next year. This expectation has lent some support to the yen.

Economic Implication

From an analytical perspective, the economic future appears to hinge on several factors. Japan's persistent core inflation above the target suggests an underlying economic resilience, possibly influencing the Bank of Japan's monetary policy decisions in the future. However, the bank's readiness to introduce further easing measures could signal a cautious approach towards economic uncertainties. Internationally, the US Federal Reserve's potential interest rate adjustments could impact the yen, either stabilizing or fluctuating its value against the dollar.

Overall, careful monitoring of these domestic and international economic indicators will be crucial in forecasting the yen's trajectory and Japan's economic health.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,245

- Thanks

- 1

- Thanked 1,810 Times in 585 Posts

Ibovespa Hits Record High

Solid ECN – On Thursday, the Ibovespa index climbed 0.8%. It reached over 131,800, a new high. This rise followed a loss in the previous session. The upbeat mood in Wall Street influenced this. Investors think the Federal Reserve will soon lower interest rates. This hope caused a drop in future interest rate expectations in Brazil. It also supports a positive view of Brazil's central bank. This mood is good for stocks in emerging markets.

Vale, a big company, saw its shares rise almost 3%. This was due to higher iron ore prices. In other news, Braskem, despite a police probe into its mining in Maceio, saw its shares go up.Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

-

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,245

- Thanks

- 1

- Thanked 1,810 Times in 585 Posts

Gold Nears $2,040 Amid Rate Cut Hopes

Solid ECN – Gold climbed to near $2,040 per ounce on Thursday. It recovered from earlier losses, driven by strong beliefs that the US Federal Reserve will reduce interest rates next year. Also, a big drop in stocks created a demand for safe investments like gold.

Even though Federal Reserve officials opposed the idea of many rate cuts next year, the market still thinks there's a 70% chance of a rate cut in March. Investors are now waiting for US economic growth data on Thursday and the core personal consumption expenditures (PCE) index on Friday for more clues. In the UK, inflation in November fell to its lowest in over two years, suggesting a possible worldwide trend of rate cuts. In other news, the Bank of Japan kept its very relaxed monetary policy, and the People’s Bank of China did not change its main lending rates.

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

<a href="https://www.instaforex.com/ms/?x=msforum">InstaForex</a> -

Senior Member

- Join Date

- Oct 2022

- Posts

- 1,245

- Thanks

- 1

- Thanked 1,810 Times in 585 Posts

Offshore Yuan Slips to 7.15

Solid ECN – The offshore yuan dropped to around 7.15 per dollar, moving down from its six-month high. This happened because China's central bank did not change its main lending rates, even though there was pressure to loosen monetary policy due to a weak economic recovery.

The People’s Bank of China kept its one-year rate at 3.45% and its five-year rate at 4.2%, as many had expected. Now, markets are looking forward to possible rate cuts next year and maybe a lower reserve requirement ratio to keep enough money in circulation. Experts believe that China’s low inflation and slow economic growth justify this expectation. However, the yuan is still strong because the US Federal Reserve might start to cut interest rates next year. Also, the Bank of Japan has not said anything about changing its policies in 2024.

Though trading on financial markets involves high risk, it can still generate extra income in case you apply the right approach. By choosing a reliable broker such as InstaForex you get access to the international financial markets and open your way towards financial independence. You can sign up here.

-

The Following 5 Users Say Thank You to Solid ECN For This Useful Post:

Unregistered (5)

Thread: Market Update by Solidecn.com

Thread: Market Update by Solidecn.com

Copyright © 2024 vBulletin Solutions, Inc. All rights reserved.

Reply With Quote

Reply With Quote